Australian Unity Office Property Fund

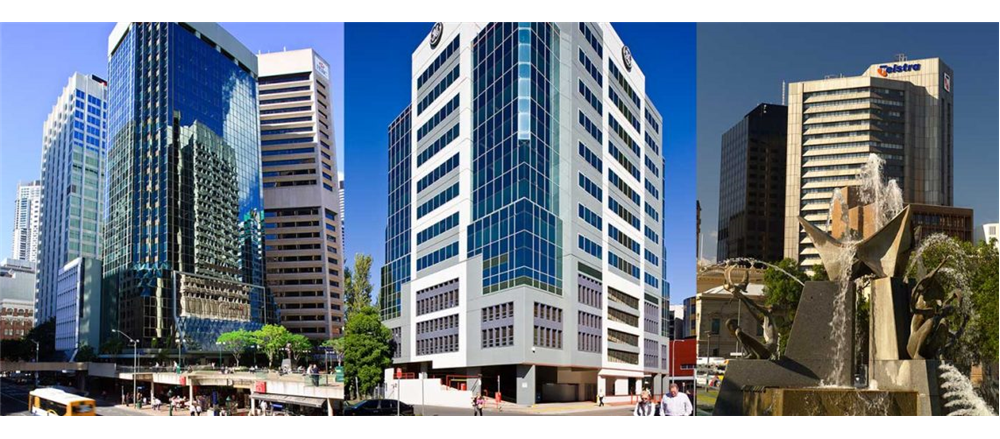

Exposure to quality asset portfolio: Australian Unity Office Property Fund (ASX code: AOF) came with an estimated IPO size of $155 million and the offer opened at May 31, 2016 and ended on June 16, 2016 with the unit price valued at $2. The fund has been set to offer exposure to Australian office assets with a portfolio consisting of eight properties across Sydney, Adelaide, Melbourne, Brisbane and Canberra. The fund is owned by the Australian Unity Group, which has $2 billion funds under management.

The occupancy rate across the portfolio is 96.5% while the fund is expected to deliver a distribution yield in the range of 7.8% - 8.3% for full year to March 2017 (Source: Fund update dated March 31, 2016). The half of its portfolio is leased to Telstra, the NSW Government and GE Capital Finance, hence assured the income return. Post IPO, the gearing ratio stands reduced to 30%, however, this might constrain the fund’s capacity to expand its portfolio through acquisition.

Fund metrics (Source: Company reports)

The company reported total income of $21.92 million for nine months ended December 2015 and profit before financial costs is $6.45 million. As on April 30, 2016, its property portfolio is valued at $391.05 million. On the other hand, the group also has certain risks wherein the fund carries a client concentration risk, as 30% of the income is derived from single largest tenant, Telstra. Also, the net tangible asset is currently at $1.96 while the unit is priced $2, which indicates the capital growth in short-term may be limited as there is no discount. But, the yield income, tenant profile and occupancy rates indicate comfort for fund’s future performance. Prior to the listing, the company reported that 99% of investors voted in favor of the company listing. The Australian Unity Office Fund was expected to trade on the ASX on a conditional and deferred settlement basis from 12 noon on 20 June 2016. The security is as of now trading on a conditional basis pursuant to ASX Business Rule.

AOF Daily Chart (Source: Thomson Reuters)

ChimpChange Limited

Competitive advantage of low cost to transaction: ChimpChange Ltd (proposed ASX code: CCA) is operational in the United States and entering the Australian market with initial public offer of 18.75 million shares at $0.80 each to raise $15 million. The stock is expected to trade on the ASX on a deferred settlement basis on June 30, 2016. The shares are offered to people located in Australia, New Zealand and certain qualified persons in the Hong Kong, Singapore and the United Kingdom. The core of this Australian digital bank start-up in the US is to tap the US P2P market by allowing people through its app to make free, instant, person-to-person transfer using mobile phone numbers and the master card network. The key reason to have operation in the US is that the fees charged in the US for such transaction is considerably higher due to a cap imposed by the Reserve Bank while the same is not the case in Australia. ChimpChange, after having a base in the US, is also looking to tap a number of smaller lenders and payment firms in Australia to act as its partners. The company believes the ASX listing will be used for marketing and technology development as well as the credibility would grow in Asia. The plan of the company is to replicate the business model of Moven and Simple to offer other products from its bank partner, like loans or deposits. The company has tapped over 80,000 customers and growing its customer base and transaction volumes, which would be the primary drivers in the short-term. Moreover, the added advantage of ChimpChange is the track record of management in the industry as company benefits from the expertise of its CEO Peter Clarewho was formerly the CEO of Westpac, New Zealand.

Meanwhile, the major concern for the group is that 47% of the equity capital is with Ian Trahar, the Chiarman of CO2 Group, the earlier company of Founder and managing director Ash Shikin. Secondly, there are factors such as reliance on external capital, regulation issues and the competition which may weigh over the company. Thirdly, the near-term revenue outlook is not reported to be promising and the demand may be uncertain for its product. Although the addressable US market has big potential to grow in long-term, short-term outlook is very speculative.

CoAssets Limited

Access to various markets including P2P lending market: CoAssets Ltd (proposed ASX code: CA8), a Singapore based crowdfunding platform company is kicking off its Australian operations through its Australian subsidiary, business crowdfunding in addition to the real estate crowdfunding. The company is entering Australian stock market with 25 million shares at an issue price of $0.40 per share to raise $10 million. Having base in Singapore, the company was addressing financial needs of Australian businesses through Singapore platform while the new platform would allow Australian businesses to turn to Australian investors for their funding needs. The start of Australian operations would provide CoAssets with exposure to five key markets: Singapore, China, Indonesia, Australia and Malaysia targeting 1.5 billion customers. The estimated crowdfunding market size addressed by CoAssets is expected to exceed US$90 billion in next 10 years while P2P (peer to peer) business lending is estimated to hit US$ 20 billion in 2020 (Source: Prospectus). Moreover, the Australian Government has a big focus on innovation with crowdfunding and P2P lending as part of it. CoAssets with its accomplishment in different countries is looking to leverage its proven model, track record via expansion in Australian operations as a key future growth driver. The group further wants to establish itself as an alternative source of capital for Australian property developers and SMEs and is even facilitating them with a competitively priced capital in a timely fashion.

On the other side, CoAssets already seems to face competition in the P2P lending market in Singapore and would take time to catch up. Though the entry is late but the potential is still huge with expansion probability for other markets like Indonesia, Australia and China. Also, the fair value of the business may be difficult to arrive at, as the company is in expansionary phase. The stock is expected to trade on the ASX on July 05, 2016.

Group structure for CoAssets Pte Ltd (Source: Company Reports)

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation. Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product. The link to our Terms & Conditions has been provided please go through them and also have a read of the Financial Services Guide. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine Pty Ltd currently hold positions in: BHP, BKY, KCN, PDN, and RIO. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations.

AU

Please wait processing your request...

Please wait processing your request...