Stock of the Day - QBE (SELL)

As part of its half year 2014 updates, QBE Insurance (QBE) conveyed its focus on underwriting excellence, evidenced by reducing attritional claims ratio while aiming to achieve improved margin. The Company witnessed strong performances in Australia & New Zealand (COR 86.9%), Equator Re (COR 89.9%), Asia Pacific (COR 91.7%) and Europe (COR 95.6%) with North America returning to profitability. Latin America has been impacted by $169M of prior accident year development. QBE’s debt to equity improved through 1H14. Key financial strength ratings have also remain unchanged following 29 July market update. On operational front, QBE established GSSC in Manila for developing a scalable cost base. The Company reported that progress to deliver $250M expense savings and $90M procurement savings is as per expectation. The Company’s Asia Pacific growth strategy is rolling-out well in view of doubling the business in 5 years.

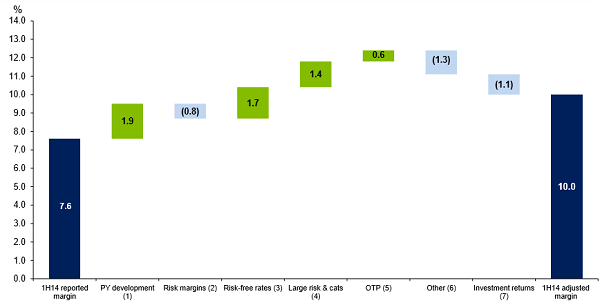

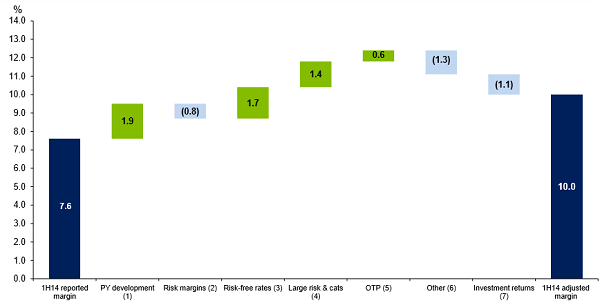

1H14 Insurance Profit Margin Analysis (Source – Company Reports)

The highlights for the 1H14 results illustrate that for premium income, Gross written premium is down 10% to $8,491M (down 7% constant currency) with premium rate increase around 1% overall and Net earned premium reduction of 5% to $6,947M (down 2% constant currency). The underlying insurance business indicated adjusted 1H14 combined operating ratio of around 93% with attritional claims ratio 46.6% (1H13 - 47.9%) with large individual risk and catastrophe claims 9.9% and commission & expense ratio of 33.4%. The Company reported for an insurance profit of $530M (1H13 $790M) and insurance profit margin of 7.6% (1H13 10.8%). Interim dividend of 15.0 Australian cents per share, fully franked was announced. The cash payout ratio was observed to be 42%. Further, the 2014 interim results included NPAT of $392 million (1H13 - $477 million); cash profit of $416 million (1H13 - $590 million); cash earnings per share of 33.2 US cents (1H13 - 49.3 US cents); and combined operating ratio of 96.5% (1H13 - 92.8%). The Company planned for non-core asset sales for2H14 entailing partial sale of Australian agencies and sale of North American agencies, complete sales of CEE businesses while the North American middle market business to be retained. The IPO (of minority stake) of LMI has been targeted for completion in 2015 with tangible book value around $1.2Bn.

Specialty Product Launch Timeline_North America Operations (Source – Company Reports)

In terms of capital raising to repurchase and cancel convertible, the Company reported for $600M (A$650M) institutional placement plus $150M (A$160M) Share Purchase Plan with proceeds used to repurchase and cancel remaining $500M convertible. Further, we made a note of the debt restructuring planned for 2H14 with $700M qualifying Tier 2 subordinated debt issue to retire $400M senior debt. Consistent with capital plan announced in August 2014, QBE successfully priced US$700 million of subordinated debt in November 2014.

Investments and Cash at 30 June: $31.4Bn (Source – Company Reports)

QBE believes to grow free cash flow over medium terms, and conveyed targeting PCA multiple of 1.7x-1.9x. Solid returns on current investment portfolio which is conservatively positioned as compared to peers, were witnessed by the Company. The in-house managed investment portfolio increased 2% to $31.4 billion from $30.6 billion.

Capital Plan (Source – Company Reports)

As per August updates, QBE’s portfolio includes 94% in cash, money markets and bonds, and 63% of fixed income invested in AAA or AA Future portfolio. The Company aims to have a future portfolio with diversified fixed income implementing strategic asset allocation up to 15% and lengthening duration on fixed income portfolio when markets permit. Other August highlights included effective reinsurance of Italian/Spanish medical malpractice claims reserves; reduction of 2014 NEP by $390M due to the one-off impact, and so forth.

QBE Daily Chart (Source - Thomson Reuters)

QBE also released its revised outlook for 2014 including premium targets with GWP in the range of $16.6Bn - $17.0Bn, NEP in the range of $13.9Bn - $14.2Bn and $390M one-off impact of medical malpractice reinsurance on NEP. Further, net claims ratio of 62.0% - 63.0%, 2H14 large individual risk and catastrophe allowance of 13.2%, commission and expense ratio of around 33% and combined operating ratio of 95.0% - 96.0% have been anticipated. The net investment yield of 2.4% - 2.7% and net investment contribution of 3.5% - 4.0% with insurance profit margin of 8.0% - 9.0% have been stated. Dividend payout of up to 50% of annual cash profit with dividend seasonality target of 40:60 interim: final payout ratio was another highlight. Results announcement for the full year ended 31 December 2014 is expected in February 2015.

Nonetheless, given the challenging market conditions, a little unstable position in view of performance of a few businesses, declining North American contributions to QBE’s gross earned premiums, fall in crop prices in some jurisdictions, and efforts towards creation of emerging markets division across Asia Pacific and Latin America; we put a SELLrecommendation for this stock at the current price of $11.25.

Disclaimer

The advice given by Kalkine Pty Ltd and provided on this website is general information only and it does not take into account your investment objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people.

Kalkine.com.au and associated pages are published by Kalkine Pty Ltd ABN 34 154 808 312 (Australian Financial Services License Number 425376).

The information on this website has been prepared from a wide variety of sources, which Kalkine Pty Ltd, to the best of its knowledge and belief, considers accurate. You should make your own enquiries about any investments and we strongly suggest you seek advice before acting upon any recommendation.

Kalkine Pty Ltd has made every effort to ensure the reliability of information contained in its newsletters and websites. All information represents our views at the date of publication and may change without notice. To the extent permitted by law, Kalkine Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine Pty Ltd hereby limits its liability, to the extent permitted by law to the resupply of services. There may be a product disclosure statement or other offer document for the securities and financial products we write about in Kalkine Reports. You should obtain a copy of the product disclosure statement or offer document before making any decision about whether to acquire the security or product.

The link to our

Terms & Conditions has been provided please go through them and also have a read of the

Financial Services Guide.

AU

Please wait processing your request...

Please wait processing your request...