Qantas Airways Ltd (ASX: QAN)

Qantas Airways Ltd is engaged in the operation of international and domestic air transportation services.

Recommendation Rationale – SELL at AUD 5.510

- Technical Indicator: The momentum oscillator 14-Day RSI (~62.96) is approaching the overbought zone; and thus, price can face correction in the short term.

- Higher Leverage: The debt/equity ratio of QAN was significantly higher than the industry median in FY23. Moreover, the Company expects that its Net Debt is expected to increase further in FY24.

- Key Operating Metric: QAN’s revenue passenger kilometers increased by 184% YoY in FY23, while it remained 23% lower than the pre-Covid FY19 period.

- Key Risks: QAN’s performance is exposed to geopolitical instability, changes in government regulations, volatility in foreign exchange rates, fuel prices, international conflicts on epidemic, among others.

QAN’s Daily Chart

(Source: REFINITIV, Analysis by Kalkine Group)

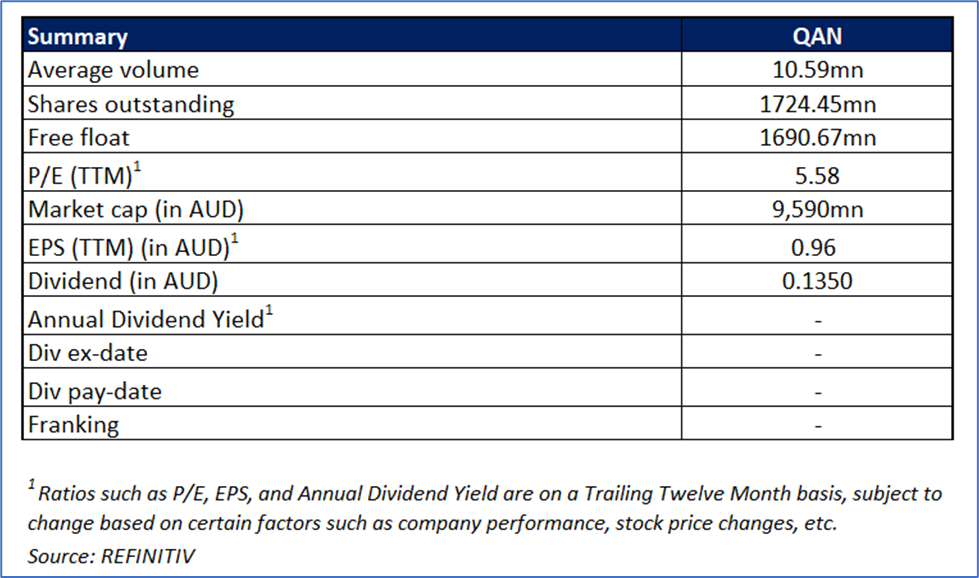

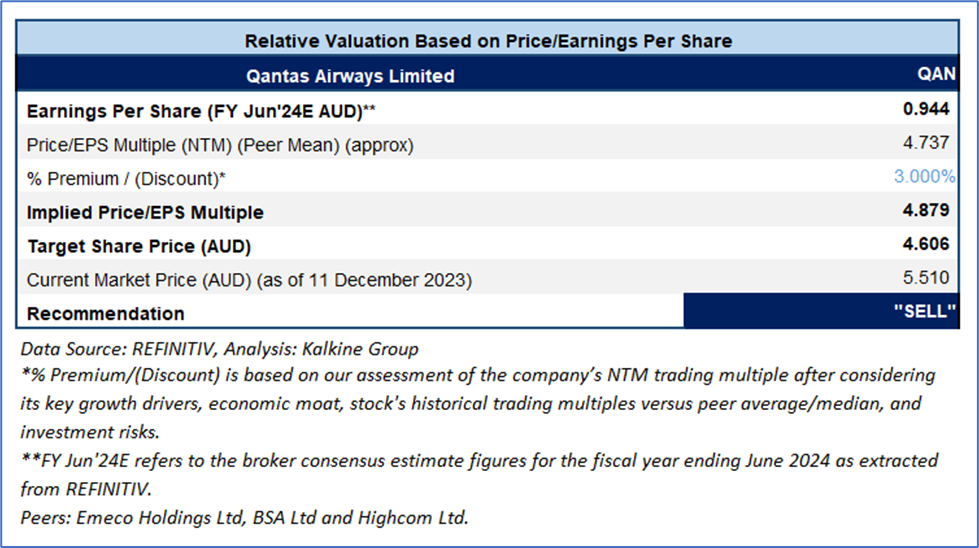

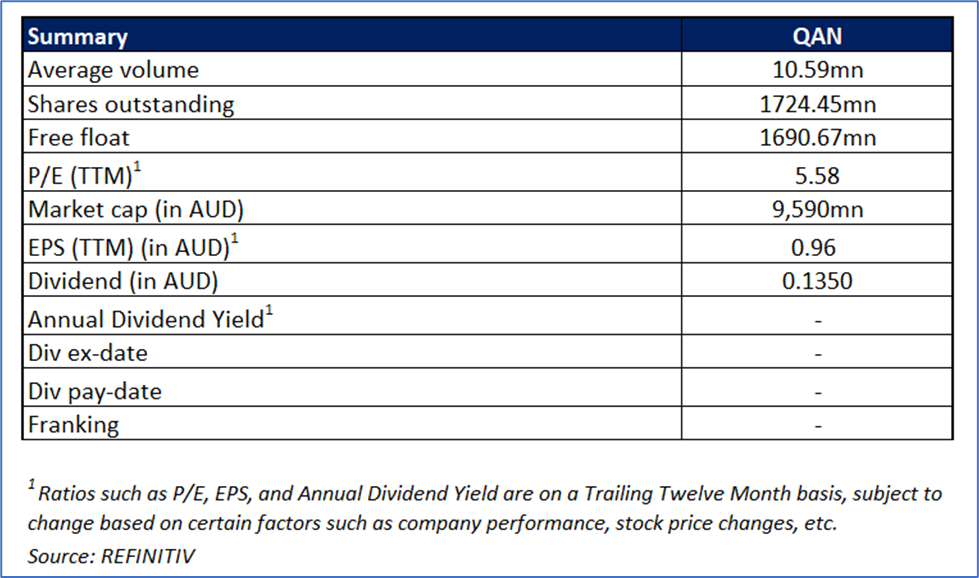

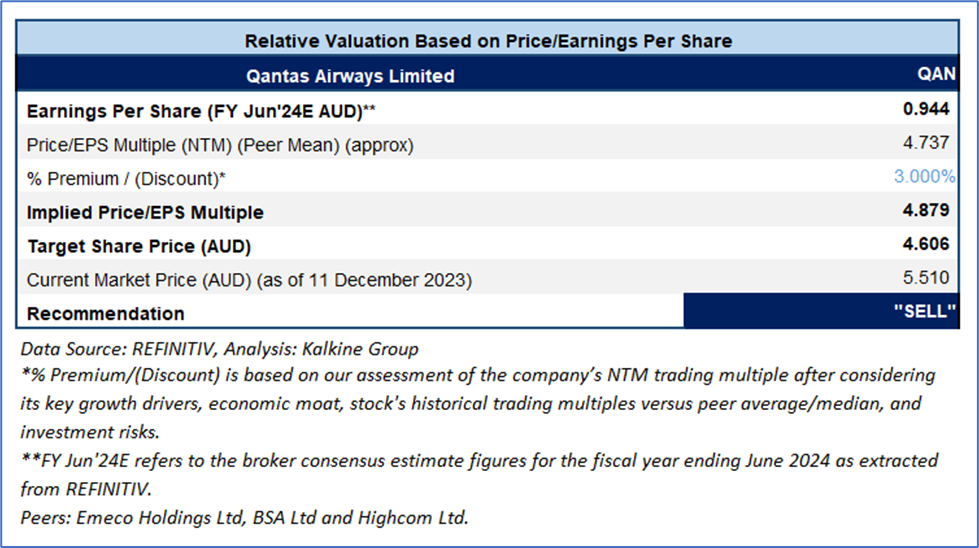

Valuation Methodology: Price/Earnings Approach (FY24E) (Illustrative)

Considering that the resistance level, and risks associated, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 5.510 (as of 11 December 2023, at 12:50 PM AEDT).

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 11 December 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

AU

Please wait processing your request...

Please wait processing your request...