Hannon Armstrong Sustainable Infrastructure Capital, Inc.

HASI Details

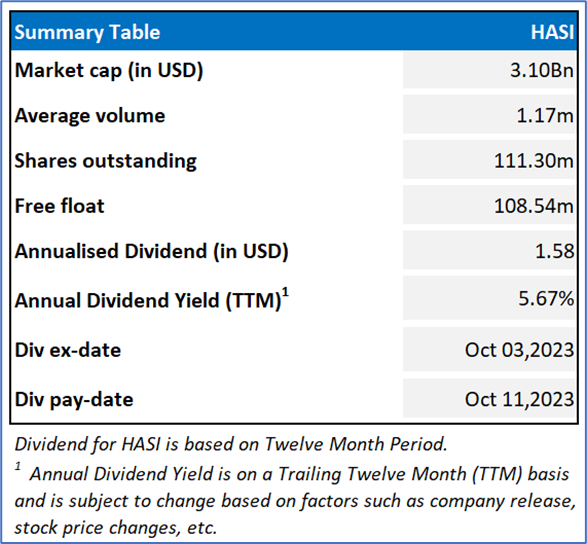

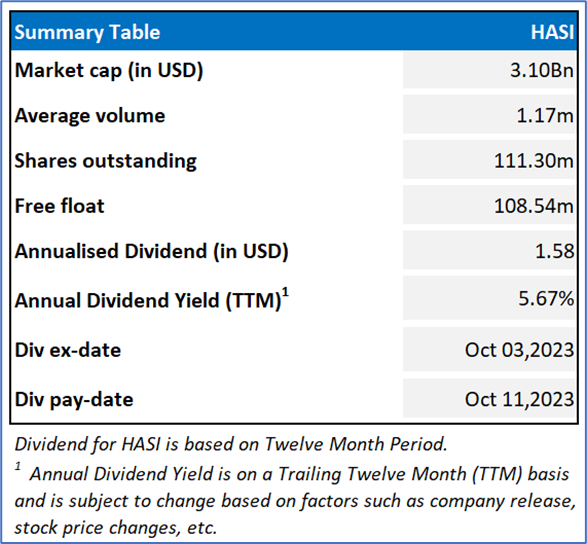

Hannon Armstrong Sustainable Infrastructure Capital Inc (NYSE: HASI) provides debt and equity financing to the energy markets in the United States.

Financial Results for Q3 FY 2023

- The company reported results for the third quarter of 2023 in which it witnessed YTD 2023 volume of $1.8 Bn as well as portfolio growth of $1.2 Bn. Its portfolio yield increased to 7.9%. The company closed $973 Mn of investments in the third quarter of 2023.

- Its total revenue rose $30 Mn, driven by the $21 Mn in increased interest as well as securitization income from the larger portfolio and the higher average rate, and an increase in managed assets balance.

Key Update

HASI announced that it has upsized as well as priced the private offering of $550 Mn in aggregate principal amount of 8% green senior unsecured notes due 2027 by the indirect subsidiaries, HAT Holdings I LLC and HAT Holdings II LLC.

Outlook

HASI is expecting that annual distributable earnings per share would grow at the compounded annual rate of 10% - 13% from 2021 to 2024, relative to the 2020 baseline of $1.55 per share, which is equivalent to 2024 midpoint of $2.40 per share.

Key Risks

Decline in the level of government support, higher competition, etc. are some of the risks HASI is exposed to.

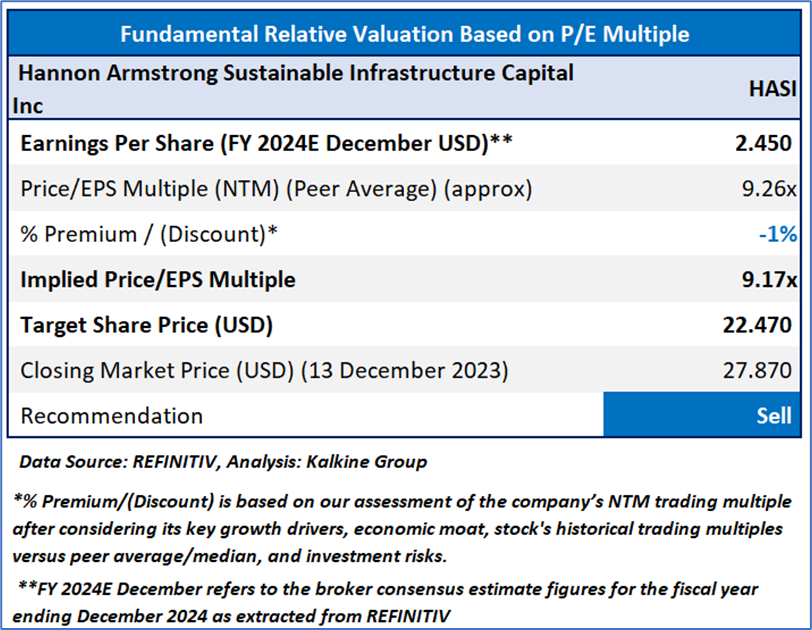

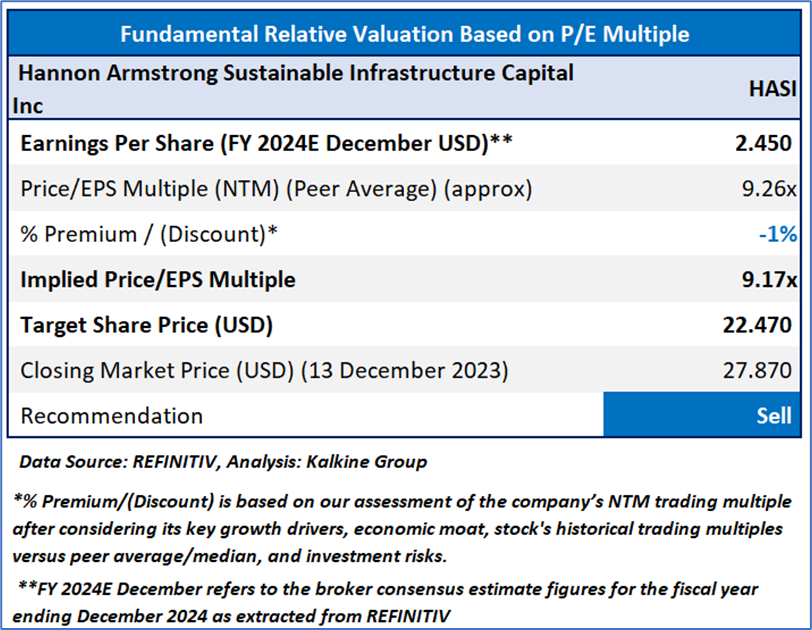

Fundamental Valuation

Stock Recommendation

Considering the risks associated, the company might trade at some discount to its peers’ P/E multiple average. The company’s performance is exposed to the risks related to the global slowdown as well as geopolitical tensions. Therefore, investors should exit the stock.

Hence, a ‘Sell’ rating has been provided on the stock at the closing price of USD 27.87 per share, up by 8.28% as on 13th December 2023.

Technical Overview:

Daily Price Chart

HASI Daily Technical Chart, Data Source: REFINITIV

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for share price chart and stock valuation is based on December 13, 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

AU

Please wait processing your request...

Please wait processing your request...