Semtech Corporation

SMTC Details

Semtech Corporation (NASDAQ: SMTC) provides analog as well as mixed-signal semiconductor products to original equipment manufacturers and distributors.

Financial Results

- SMTC announced Q4 and FY 2024 results. In Q4, its net sales stood at $192.9 Mn, above the midpoint of guidance. Its GAAP gross margin of was (0.2)% as well as Non-GAAP gross margin was 48.9%, above the midpoint of guidance.

- The company mentioned that end market demand for the semiconductor business has progressed from stable to growing.

- The working capital improvements contributed to positive operating as well as free cash flows for Q4.

Outlook

For Q1 FY 2025, SMTC is expecting net sales of ~$200 Mn (+/- $5 Mn) and gross margin of 49.5% (+/- 100 bps). It is expecting operating income of $20.5 Mn (+/- $3.0 Mn).

Key Risks

The cyclical nature of the industry, Risks relating to production operations and services, etc. are some of the risks SMTC is exposed to.

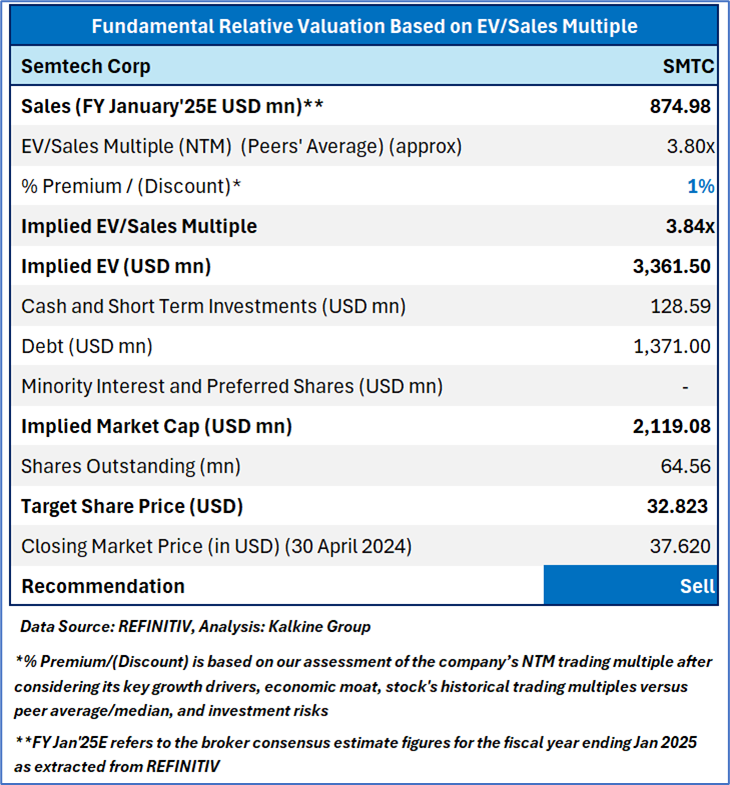

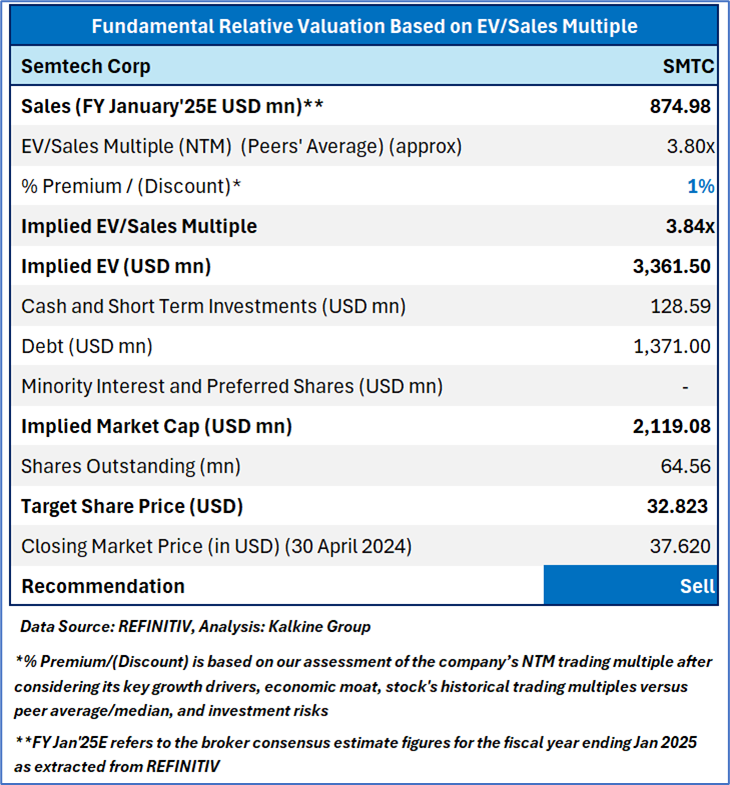

Fundamental Valuation

EV/Sales Based Relative Valuation

Stock Recommendation

Over the last one month, the stock has given a return of 36.4%. The stock has made a 52-week low and high of USD 37.08 and USD 13.13, respectively. The company’s performance is exposed to the risks related to the global slowdown as well as geopolitical tensions.

Also, unfavorable or uncertain conditions in the 5G infrastructure market could result in fluctuations in the rate of revenue growth or financial results. The company is subject to export restrictions as well as laws affecting trade and investments. This could limit the ability to sell to certain customers.

Hence, a ‘Sell’ rating has been provided on the stock at the closing price of $37.62 per share, up by 1.54% as on 30th April 2024

Technical Overview:

SMTC Daily Technical Chart, Data Source: REFINITIV

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for share price chart and stock valuation is based on April 30, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

AU

Please wait processing your request...

Please wait processing your request...