This report is an updated version of the report published on 29 January 2024 at 3:24 PM AEDT.

Super Retail Group Limited (ASX: SUL)

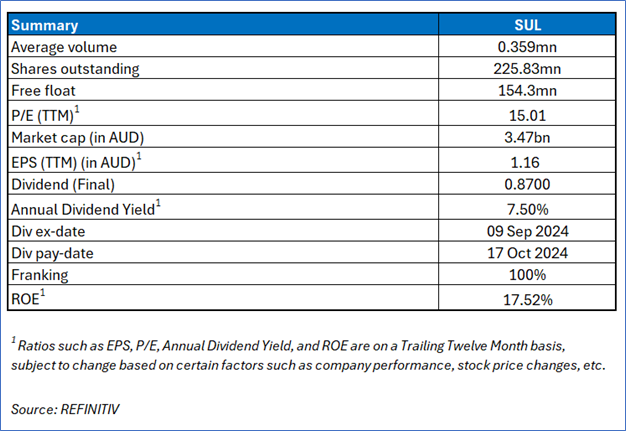

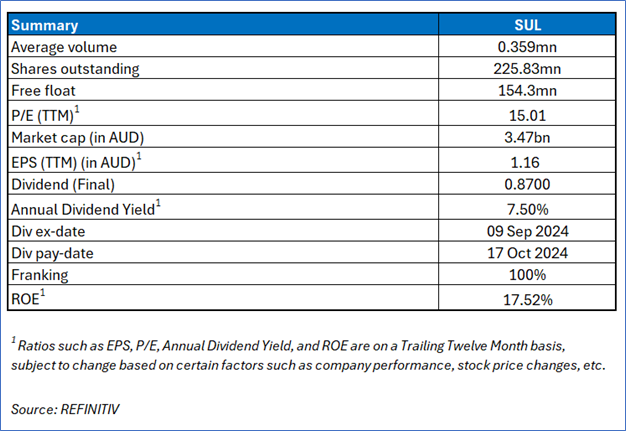

Super Retail Group Limited (ASX: SUL) is an Australia-based retailer. Its principal activities include retailing of auto parts and accessories, tools and equipment, retailing of boating, camping, outdoor equipment, fishing equipment and apparel, and retailing of sporting equipment and apparel.

Recommendation Rationale - SELL at AUD 15.870

- FY24 Profit Decline: Despite revenue growth, the Group's segment profit before tax decreased by 12% YoY, and the statutory net profit after tax dropped by 9% YoY. Normalised net profit also saw an 11% YoY decrease, signaling weaker profitability.

- Safety Performance Decline: The company reported a significant 31.6% YoY increase in the Total Recordable Injury Frequency Rate (TRIFR), mostly due to manual handling injuries. This performance was described as unacceptable, and the company acknowledged that more work needs to be done in this area to improve safety standards.

- Uncertain Economic Outlook: The company described the outlook for FY25 as "uncertain," mainly due to continuing cost-of-living pressures, inflation, and global economic and geopolitical instability, which are affecting consumer behaviour.

- Allegations in Federal Court: The company referenced workplace proceedings in the Federal Court of Australia, although it stressed that none of the allegations had been substantiated. The issue could have reputational implications, even though it is being vigorously defended.

Daily Price Chart

Daily Technical Chart, Data Source: REFINITIV

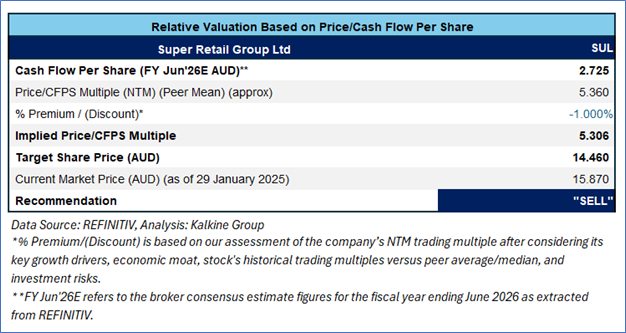

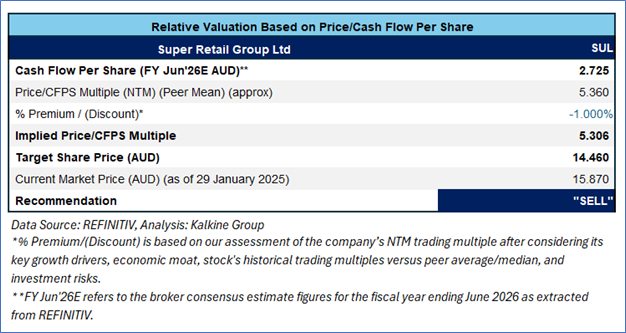

Valuation Methodology: Price/Cash Flow Approach (FY Jun'26E) (Illustrative)

SUL is expected to trade at a discount compared to its peers considering the 9% and 12% YoY decline in Segment EBIT and PBT in FY24, respectively. For conducting the valuation, the following peers have been considered: Baby Bunting Group Ltd (ASX: BBN), Lynch Group Holdings Ltd (ASX: LGL), and Shaver Shop Group Ltd (ASX: SSG).

Considering the rally in share price movement, current trading level, and risks associated, the share price can witness resistance at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current market price of AUD 15.870, as of 29 January 2025, at 2:05 PM AEDT.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 29 January 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Kalkine reports are prepared based on the stock prices captured either from REFINITIV or Trading View. Typically, REFINITIV or Trading View may reflect stock prices with a delay which could be a lag of 25-30 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

AU

Please wait processing your request...

Please wait processing your request...