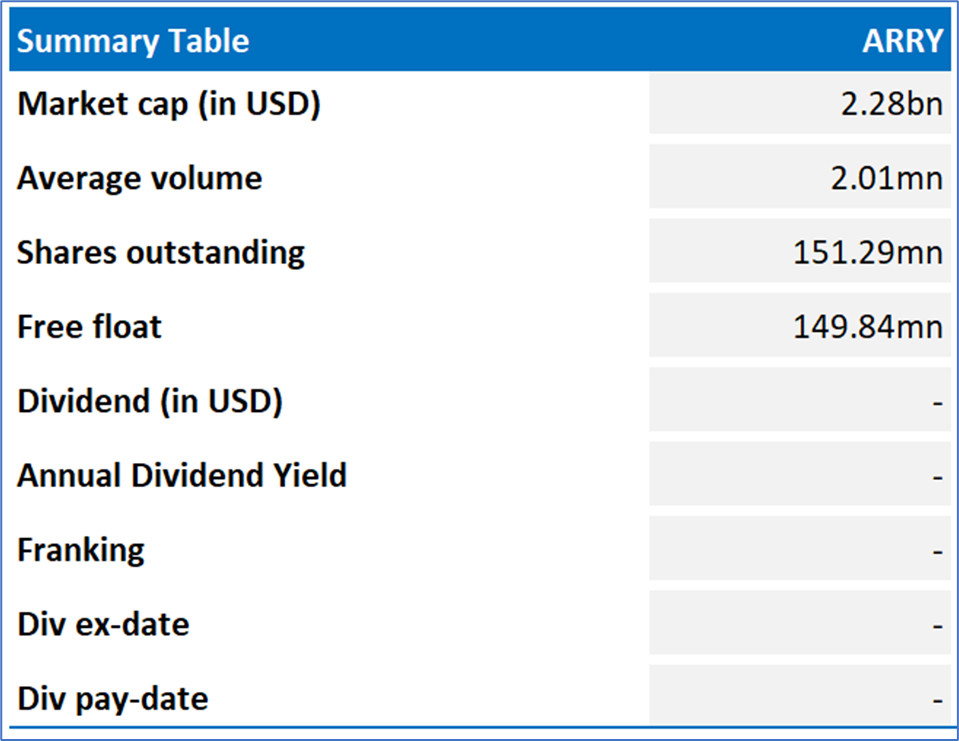

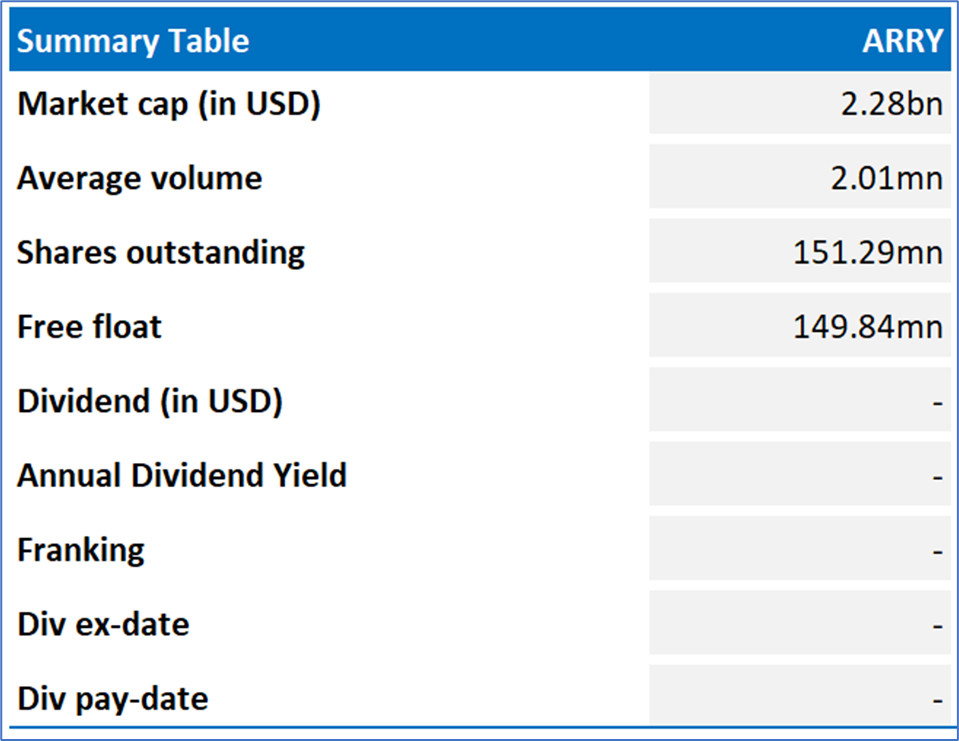

Array Technologies Inc. (NASDAQ: ARRY)

Array Technologies Inc. (NASDAQ: ARRY) is a manufacturer of solar energy ground-mounting systems. The company’s production is a single-axis tracker, an integrated system of steel supports, electric motors gearboxes, and electric controllers that move solar panels throughout the day maintain an optimal alignment to the sun, increasing energy production.

Recommendation Rationale – SELL at USD 15.10

- Financial Performance: In FY23 ended 31 December 2023, ARRY registered revenue of USD 1,576.6mn and achieved net income of USD 85.5mn. Furthermore, the company saw its adjusted EBITDA more than double to USD 288.1mn and a free cash flow of USD 215mn during the year.

- Outlook: ARRY anticipates revenue to fall within the range of USD 1,250mn to USD 1,400mn, adjusted EBITDA of USD 285-315mn, and adjusted net income per share of USD 1-1.15 for the fiscal year ending 31 December 2024.

- Emerging Risks: ARRY is exposed to risks arising from the lower demand for solar energy projects, loss of customers, changes in electric utility industry policies and regulations, etc.

- Overvalued Multiples: On a forward 12-month basis, key valuation multiples (EV/EBITDA, PE, Price/Cash Flow, and Price/Book) are higher than the median of the Energy industry.

ARRY Daily Chart

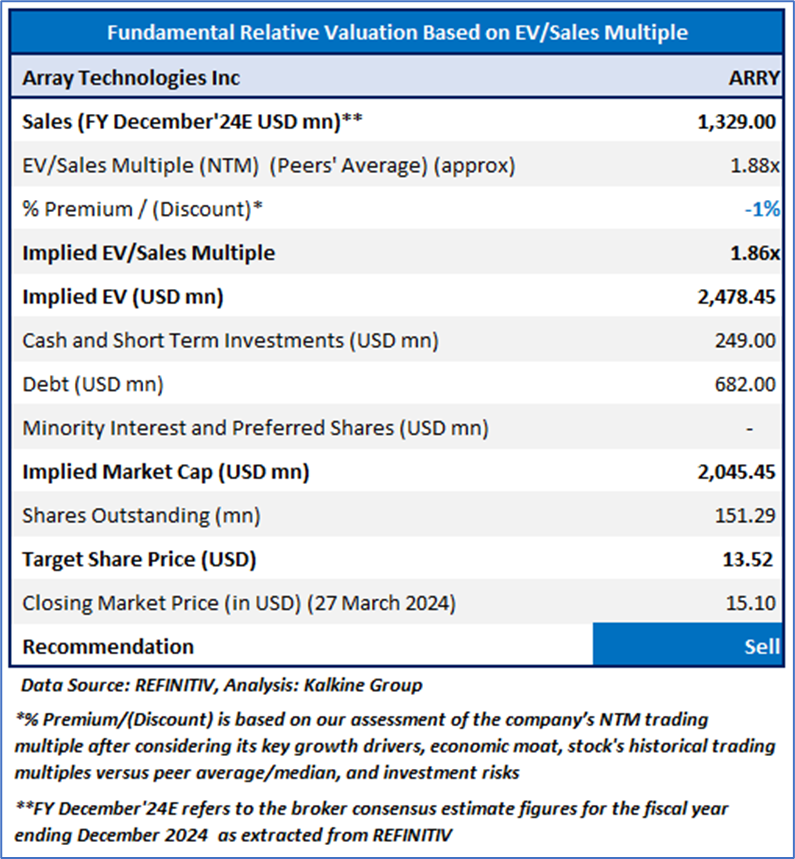

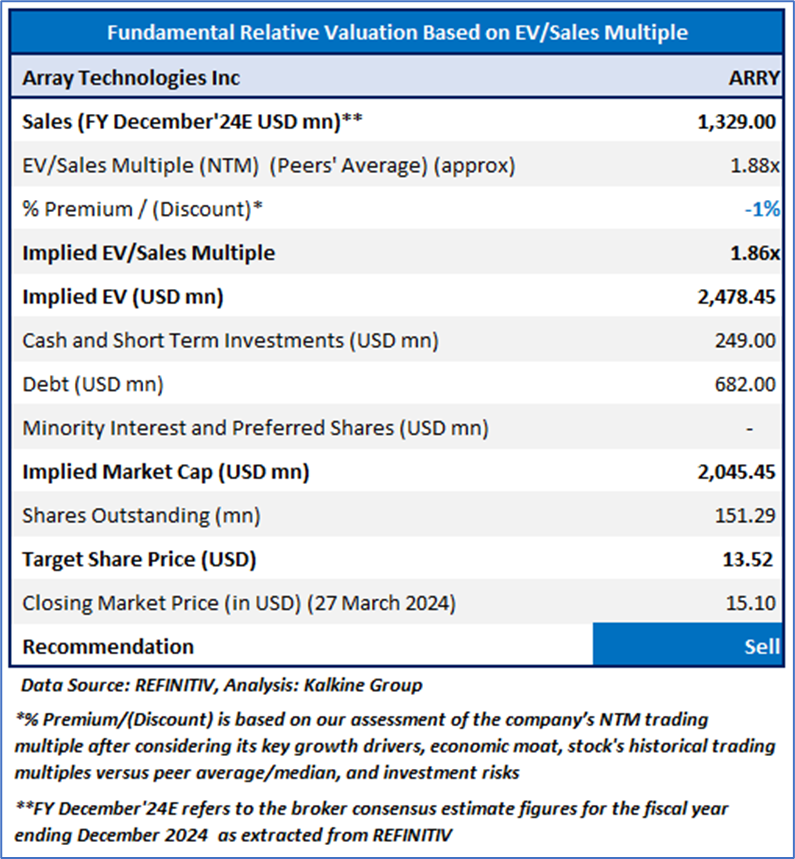

Valuation Methodology: EV/Sales Approach (FY December'24E) (Illustrative)

For valuation, few peers such as Itron Inc (NASDAQ: ITRI), SunPower Corporation (NASDAQ: SPWR), FTC Solar Inc (FTCI: DHG), and others have been considered.

Given its current trading levels, recent rally in the share price, and other factors associated, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the closing market price of USD 15.10, up by 6.94%, as of 27 March 2024.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Array Technologies is a part of Global Fully Charged Portfolio

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 27 March 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

AU

Please wait processing your request...

Please wait processing your request...