Realty Income Corporation

O Details

Realty Income Corporation (NYSE: O) is a REIT which invests in people and places to deliver dependable monthly dividends.

Financial Results

- The company announced the operating results for 3 and 9 months ended September 30, 2023. For the quarter, net income available to common stockholders stood at $233.5 Mn, or $0.33 per share and AFFO available to common stockholders was $721.4 Mn, or $1.02 per share.

- O’s Q3 results demonstrated the consistency of the earnings profile as well as the attractive internal growth of the high-quality real estate portfolio while highlighting the capabilities of One Team and platform.

- The company closed its third quarter in the solid financial position, with $3.4 Bn of unused capacity on the $4.25 Bn multi-currency revolving credit facility after giving effect to commercial paper borrowings, which are fully backstopped by the facility.

Key Updates

The company announced it has declared an increase in its common stock monthly cash dividend to $0.2565 per share from $0.2560 per share. The dividend is payable on January 12, 2024.

Outlook

For FY 2023, the company is expecting net income per share in the range of $1.25 to $1.32 and AFFO per share of between $3.98 to $4.01.

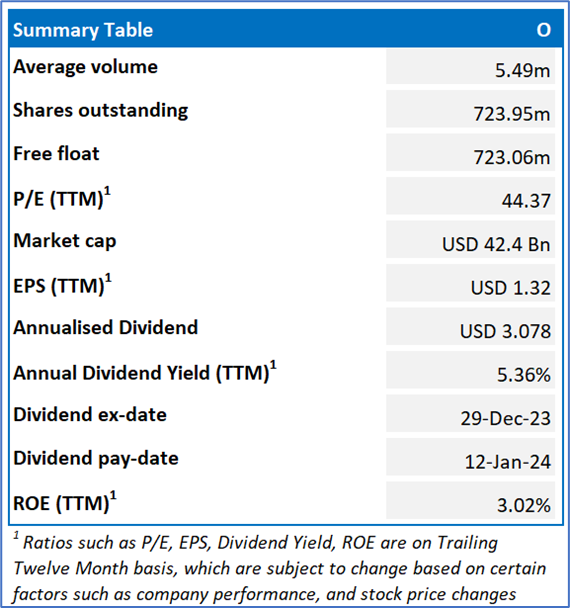

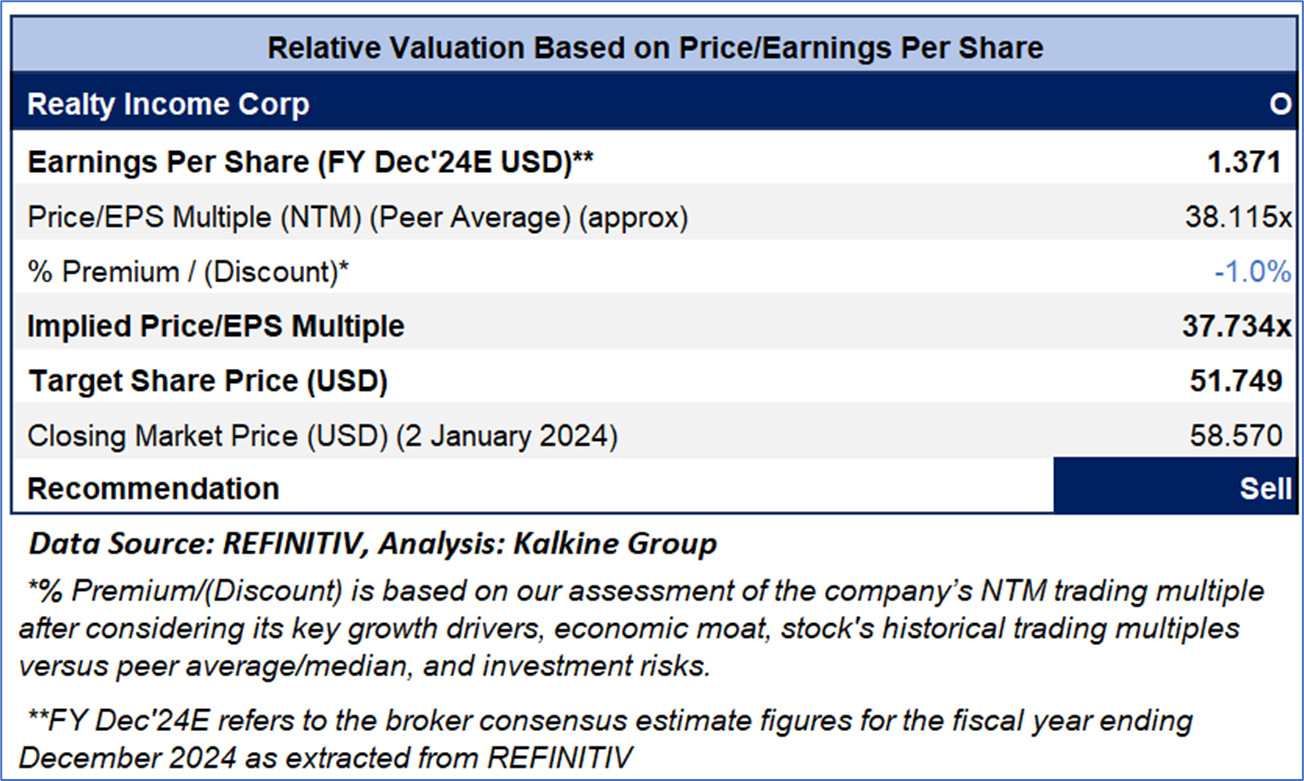

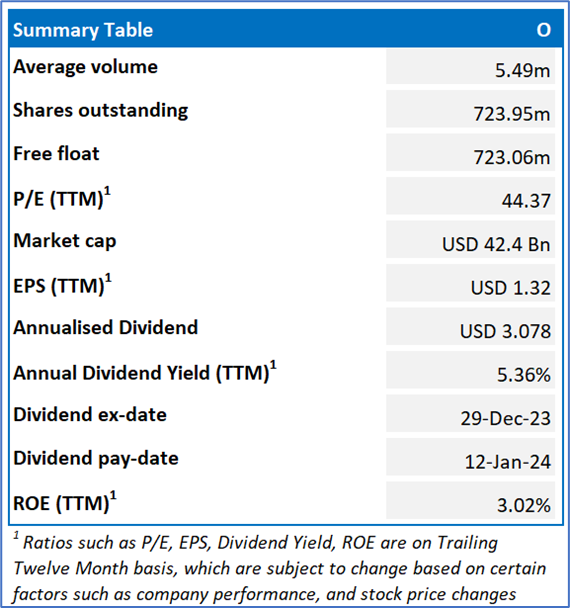

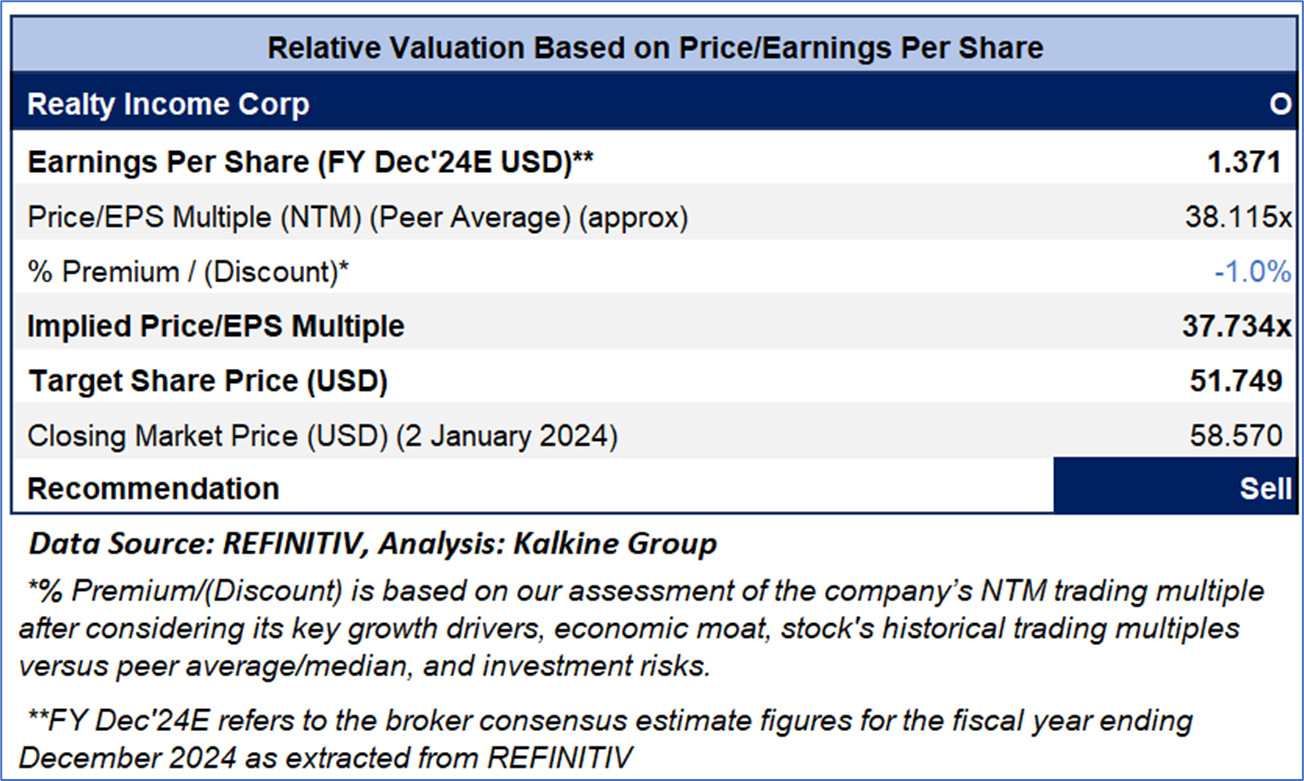

Fundamental Valuation

P/E Based Relative Valuation (Illustrative)

Key Risks

Weak global growth, Volatility in the market, general domestic and foreign business, economic, or financial conditions are some of the risks the company is exposed to.

Stock Recommendation

The stock has made a 52-week low and high of US$45.035 and US$68.85, respectively. The company’s performance is exposed to the risks related to the global slowdown as well as geopolitical tensions. Therefore, investors should exit the stock.

Hence, a ‘Sell’ rating has been provided on the stock at the closing price of USD 58.57 per share, up by 2% as on 2 January 2024.

Technical Overview:

Daily Price Chart

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for share price chart and stock valuation is based on January 2, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

AU

Please wait processing your request...

Please wait processing your request...