This report is an updated version of the report published on the 15 December 2023 at 3:07 PM AEDT.

HomeCo Daily Needs REIT (ASX: HDN)

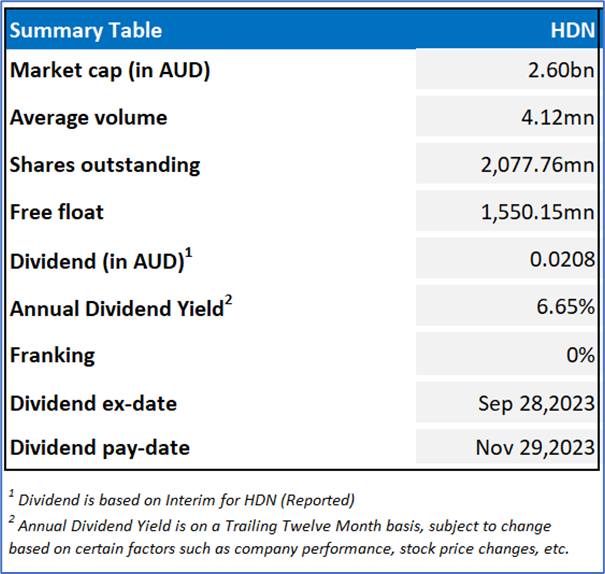

HDN is an Australian Real Estate Investment Trust, which invests in convenience-based assets throughout the target sub-sectors of Neighbourhood Retail, Large Format Retail, and Health & Services.

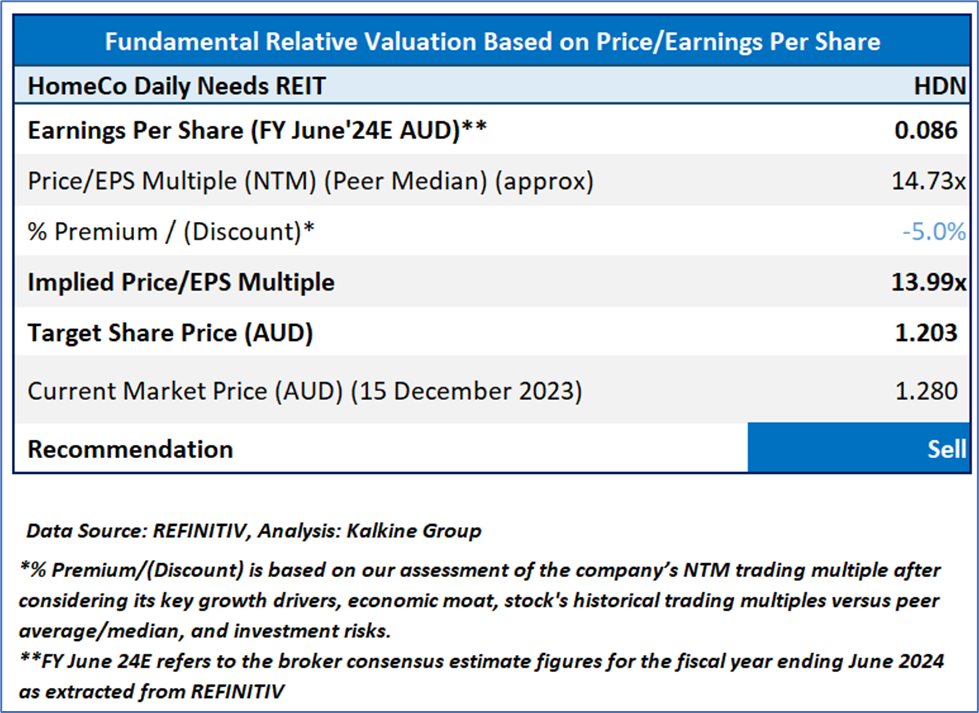

Recommendation Rationale – SELL at AUD 1.280

- Financial Performance: In FY23, the company’s revenue went up by ~77% YoY. During the period, the company’s leasing spreads stood at +6.0% across 174 leasing deals, with the portfolio delivering more than 99% cash rent collections in FY23. The company’s AUD 600mn development pipeline remains a key pillar of its growth strategy.

- Outlook: The company has a healthy balance sheet as of 30 June 2023, with net assets of AUD 3.1bn and gearing of 33.8%. This combined with resilient portfolio valuations provides a platform to continue to undertake asset recycling and organic growth opportunities. In FY24, FFO is expected to be 8.6 cents per unit, whereas distribution forecast is expected to be around 8.3 cents per share.

- Emerging Risks: Considering the market volatility, its properties prices are dependent on the external demand and supply of the raw material, it’s sourcing, and properties’ valuations etc.

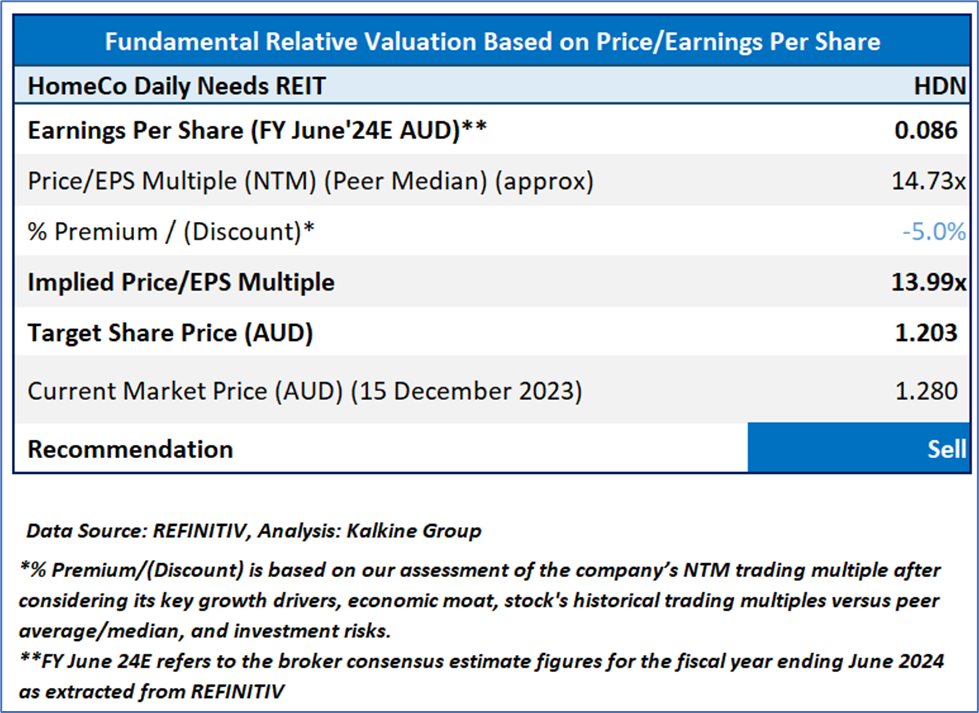

- Overvalued Multiples: On a forward 12-month basis, key valuation multiples (EV/EBITDA, and Price/Book) are higher than the median of the Residential & Commercial REITs’ industry.

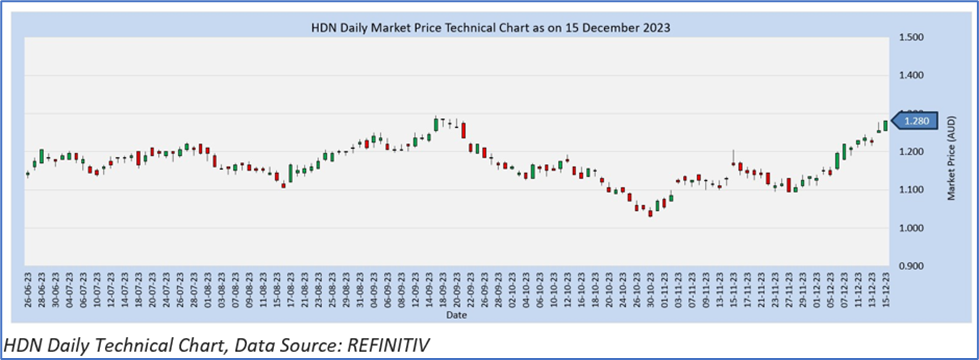

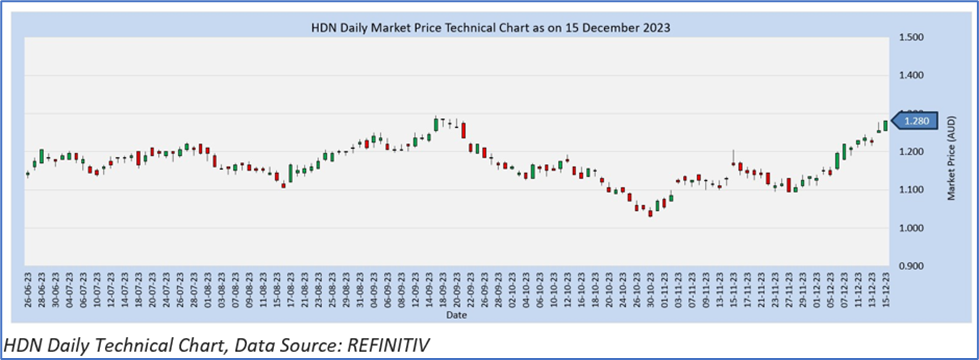

HDN Daily Chart

Valuation Methodology: Price/Earnings Approach (FY December'24E) (Illustrative)

Given the macroeconomic factors, volatility in commodity prices and other material business risks, etc, the company might trade at some discount to its peers. For valuation, few peers like Charter Hall Long WALE REIT (ASX: CLW), Vicinity Centres (ASX: VCX), and Charter Hall Group (ASX: CHC) has been considered. Considering that the stock has surpassed it R2 level, volatility in share price movement, current trading levels and risks associated, it is prudent to book profits at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current market price of AUD 1.28, at 1:25 PM, AEDT, as of December 15, 2023.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 15 December 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

AU

Please wait processing your request...

Please wait processing your request...