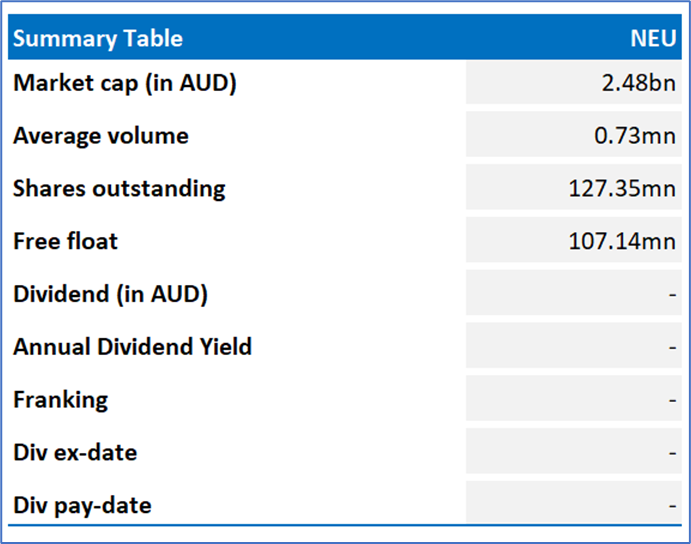

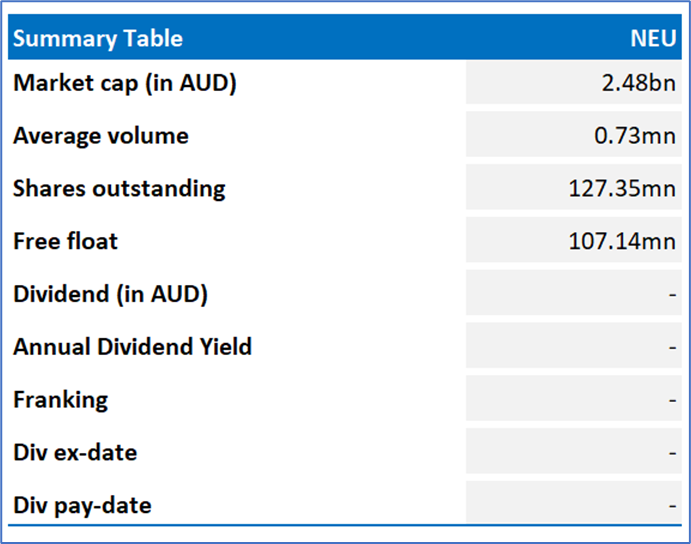

Neuren Pharmaceuticals Limited (ASX: NEU)

Neuren Pharmaceuticals Limited (ASX: NEU) is engaged in the development of new drug therapies targeting the treatment of neurological disorders. Approved by the US FDA, the company’s product DAYBUE™ (trofinetide) is designed for treat Rett syndrome in adult and pediatric patients two years of age and older. Another drug candidate, NNZ-2591, is undergoing Phase 2 trials.

Recommendation Rationale – SELL at AUD 21.26

- Financial Performance: NEU registered total income of AUD 64.4mn and profit after tax of AUD 47.8mn in 1HFY23. NEU earned AUD 10.4mn from DAYBUE™ royalties in 3QFY23..

- Outlook: NEU expects to earn DAYBUE™ royalties of AUD 12.8mn for 4QFY23 and AUD 26.8mn for FY23. Focus is on advancing clinical studies on NNZ-2591, being designed for four serious neurodevelopmental disorders.

- Emerging Risks: A failure to achieve desired outcomes from clinical trials may impact the company’s operations and pathway to developments.

- Overvalued Multiples: On a forward 12-month basis, key valuation multiples (EV/Sales, Price/Earnings, EV/EBITDA, Price/Book Value, and Price/Cash Flow) are higher than the median of Healthcare Industry.

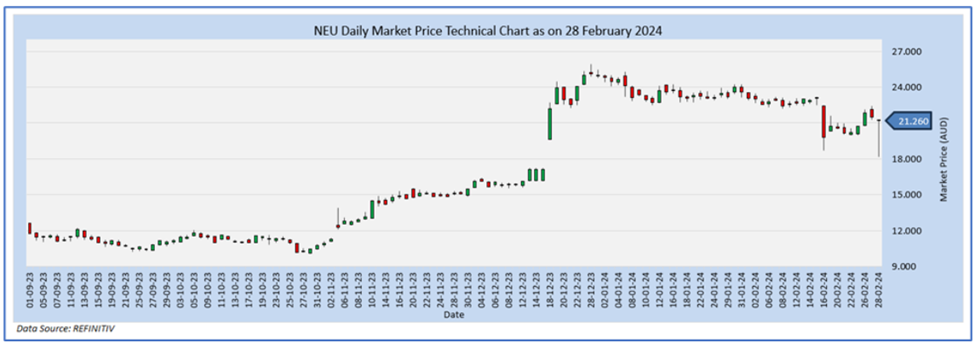

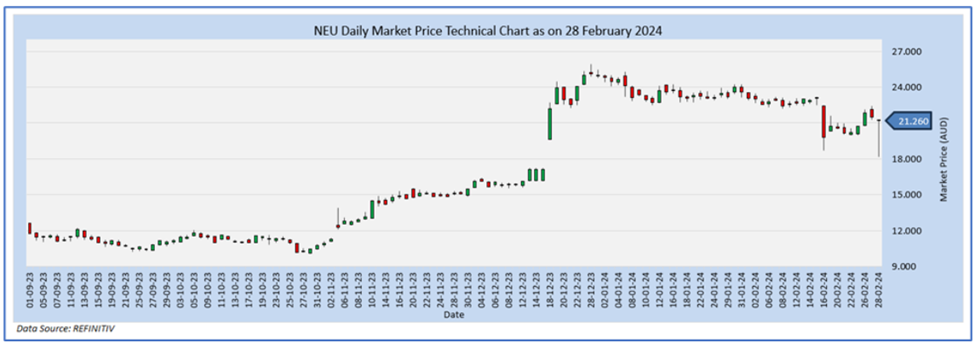

NEU Daily Chart

Considering the resistance, current trading levels and risks associated, it is prudent to book profits at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 21.26 (as of February 28, 2024, at 10:15 AM AEDT).

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 28 February 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

AU

Please wait processing your request...

Please wait processing your request...