Santos Limited (ASX: STO)

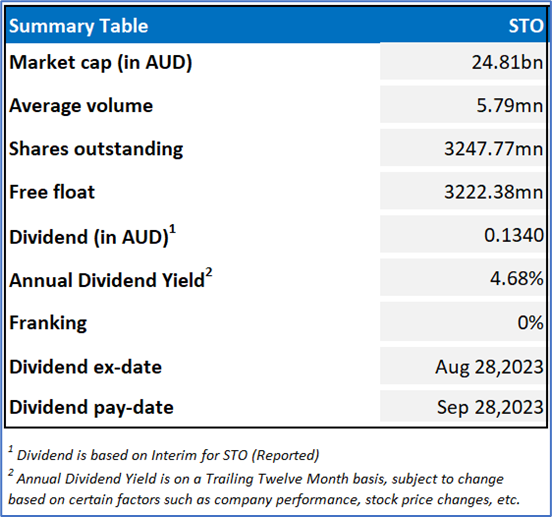

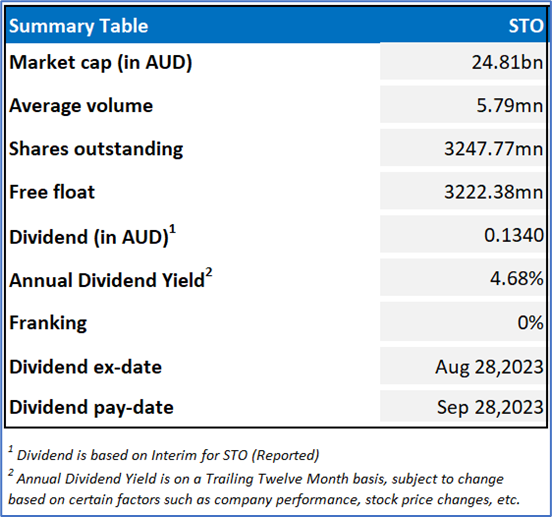

STO is a domestic gas supplier with a portfolio of high-quality liquified natural gas (LNG), pipeline gas, and oil assets STO is largely involved in the production of natural gas (LPG, ethane, methane, CSG, LNG shale gas, condensate), and oil.

Recommendation Rationale – SELL at AUD 7.66

- Financial Performance: The top-line growth increased by more than USD 1.4mn on QoQ, and stood at USD 1,436mn in Q3FY23 as compared to USD 1,336mn Q3FY22. STO witnessed growth in production of 23.3 mmboe, driven by an increase in crude oil production in PNG. The company reduced debt by USD 1.4bn in 3QFY23.

- Outlook: The STO management focused on increasing production by 6% CAGR from 2024 to 2028, and targeted free cash flow to USD 14bn from 2024 to 2028. STO aims to net zero scope 1 to 2 emissions by 2040 and reduction by 30% in scope 1 and 2 emissions by 2030.

- Emerging Risks: The company is exposed to changes in prices of commodities. Further, an ongoing shortage of skilled labour could affect the operational and financial performance of the business.

- Overvalued Multiples: On a forward 12-month basis, key valuation multiples (EV/EBITDA, EV/Sales, and Price/Earnings) are higher than the median of the Oil & Gas’ industry.

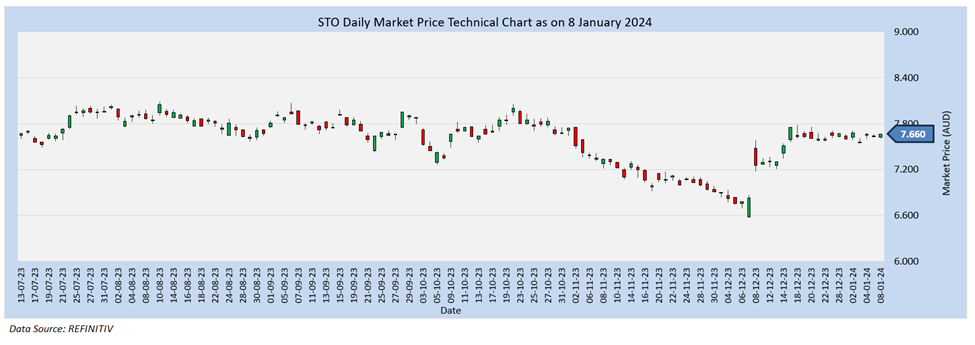

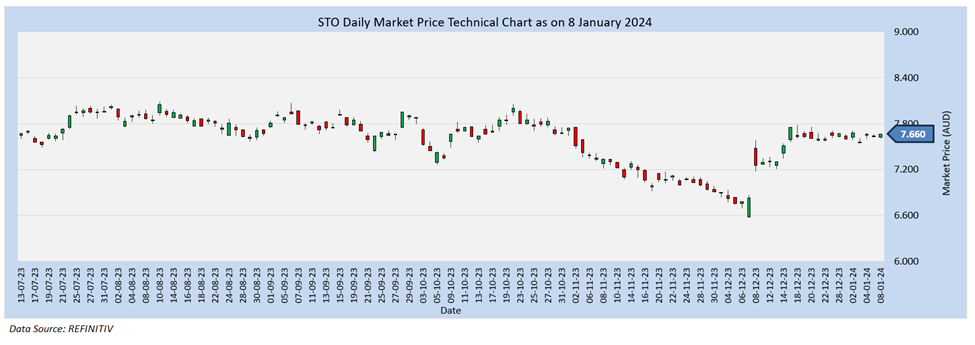

STO Daily Chart

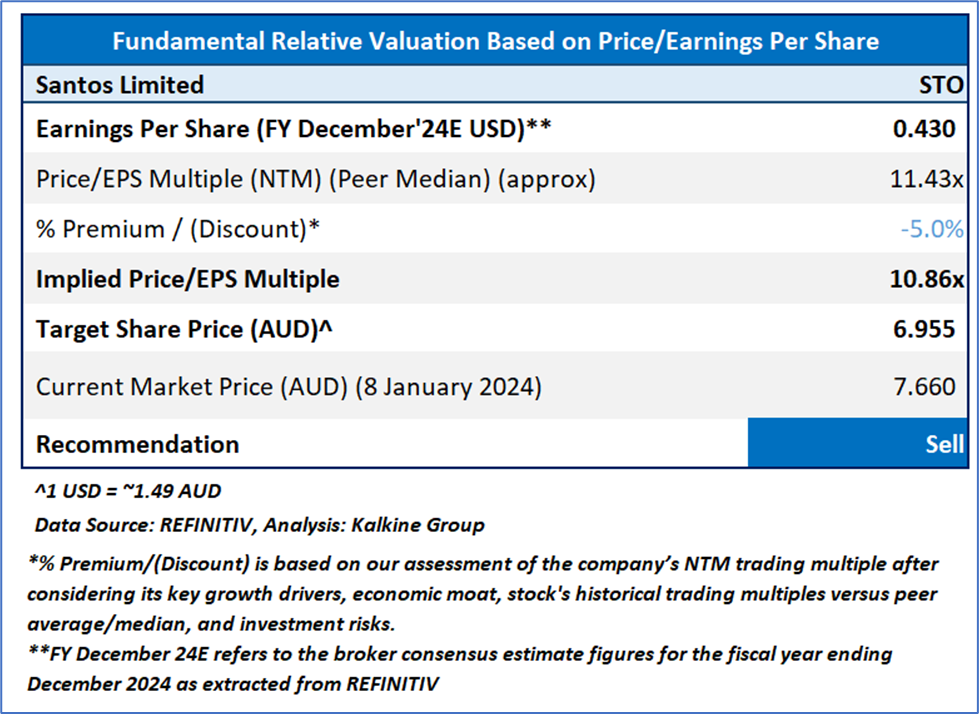

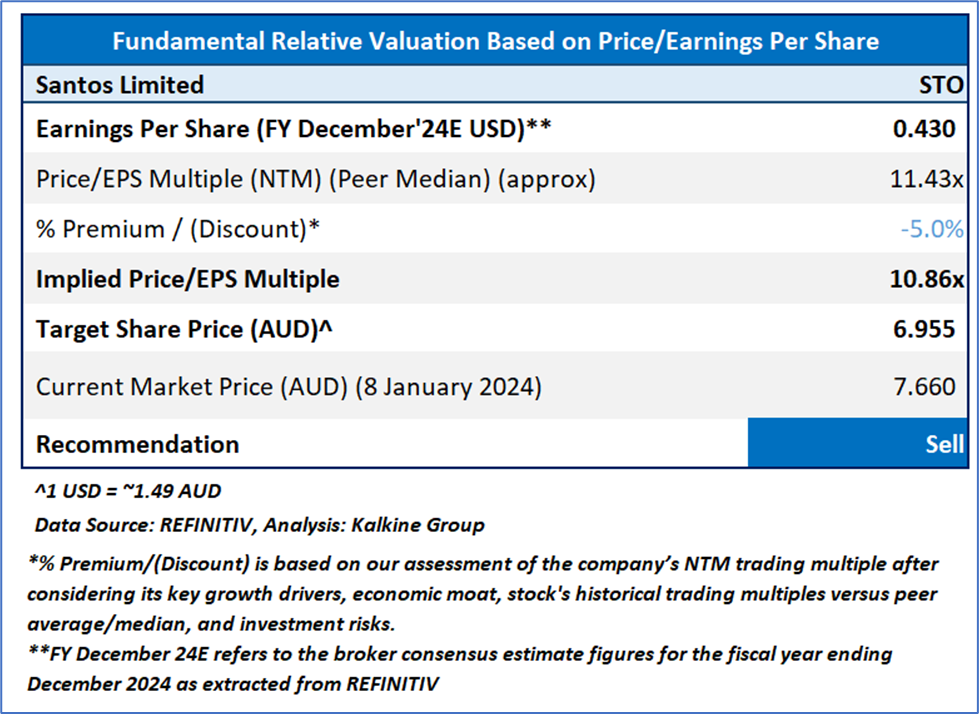

Valuation Methodology: Price/Earnings Approach (FY December'23E) (Illustrative)

Given the macroeconomic factors, volatility in commodity prices and other material business risks, etc, the company might trade at a slight discount to its peers. For valuation, few peers like Beach Energy Ltd (ASX: BPT), Karoon Energy Ltd (ASX: KAR), Viva Energy Group Ltd (ASX: VEA), and others have been considered. Considering the current trading levels and risks associated, downside indicated by the valuation, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 7.66, as of January 8, 2024, at 10:55 AM AEDT.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 8 January 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

AU

Please wait processing your request...

Please wait processing your request...