Wipro Limited (NYSE: WIT)

Wipro Limited (NYSE: WIT) is a consulting and technology services firm. It operates in two main segments: Information Technology (IT) Services and IT Products.

As per our US Diversified Opportunities Report published on ‘WIT’ on 25th July 2024, Kalkine provided an ‘Buy’ stance on the stock at USD 5.87 based on fundamental analysis and the stock price has now moved by ~12.27% since then and is trading above resistance 1.

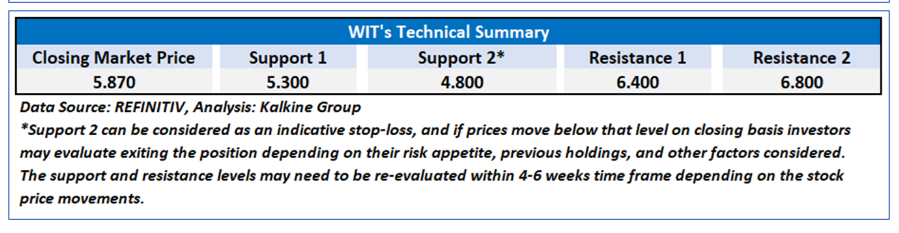

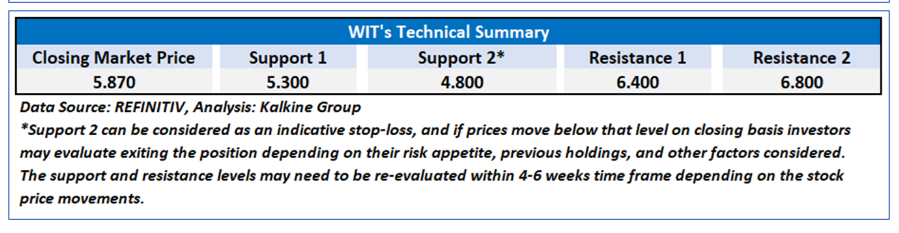

Noted below are the details of support and resistance levels provided in our previous report:

Key Recommendation Rationale – Sell at USD 6.59

- Year-over-Year Revenue Decline: Wipro's gross revenue decreased by 1.0% year-over-year, signaling potential challenges in maintaining growth amidst a competitive market. The IT services segment also experienced a 2.0% decline compared to the same quarter last year, raising concerns about long-term revenue sustainability.

- Weak Outlook for IT Services: The guidance for the IT Services business segment for the upcoming quarter indicates a projected decline of up to 2.0% in constant currency terms. This cautious outlook reflects uncertainties in demand and market conditions, which could impact investor confidence.

- Subpar Performance in Key Markets: While Wipro grew in three out of four markets, the fact that growth did not extend across all markets suggests vulnerabilities in specific areas. This uneven performance may indicate operational or strategic weaknesses that need addressing to ensure balanced growth.

- High Voluntary Attrition Rate: A voluntary attrition rate of 14.5% on a trailing 12-month basis raises concerns about employee retention and potential disruptions in service delivery. High attrition can lead to increased recruitment costs and loss of valuable expertise, affecting overall performance.

- Struggles in IT Products Segment: The IT Products segment reported revenue of only USD 7.9 million and incurred a loss of USD 2.2 million for the quarter. This underperformance highlights challenges in this segment, which could detract from the company's overall financial health and growth strategy.

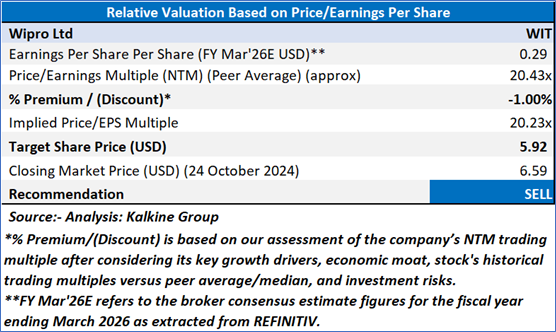

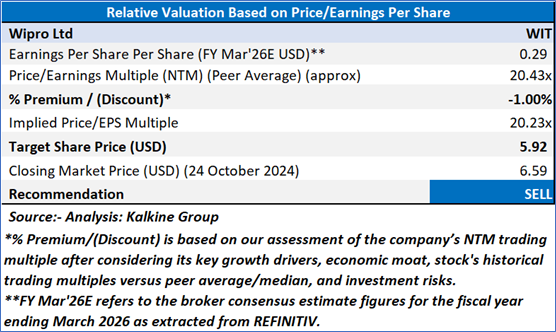

Valuation Methodology: Price/ Earnings Approach

WIT’s Daily Chart

Considering the target level attainment, above-mentioned reasons, declining profit margins, lower liquidity, and increasing volatility over global equity market an ‘Sell’ rating is assigned to the ‘WIT’ at the closing market price of USD 6.59 as of 24 October 2024.

Note: This report may be updated with details around fundamental and technical analysis, price chart in due course, as appropriate.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is 24 October 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...