Sony Group Corporation

Sony Group Corporation (NYSE: SONY) is a diverse conglomerate with operations spanning Games & Network Services (G&NS), Music, Movies, Electronics Products & Solutions (EP&S), Imaging & Sensing Solutions (I&SS), Finance, and miscellaneous activities. In G&NS, the focus is on network services and the production and sale of home video game consoles and software. The Music segment includes music production and publishing, along with video media platform businesses. Movies involve film and television program production and media network activities. EP&S covers a wide range, from TV and audio to video, still image, video camera, smartphone, and Internet-related services. I&SS centers around the image sensor business. Financial activities include insurance services, primarily personal life and non-life insurance, as well as banking. Sony is also engaged in various other endeavors, such as the disc manufacturing business.

Recent Financial and Business Updates:

- Quarterly Financial Performance: A Surge in Consolidated Sales Amidst Challenges: In the reported quarter, Sony Group Corporation experienced an 8% increase in consolidated sales, reaching 2 trillion 828.6 billion yen compared to the same period in the previous fiscal year. However, consolidated operating income saw a significant decrease of 106.4-billion-yen year-on-year, primarily attributed to a 64.3 billion yen decline in the Financial Services segment's operating income. Adjusted EBITDA also decreased by 60.8-billion-yen year-on-year to 426.4 billion yen. Income before income taxes decreased by 113.5 billion yen to 257.6 billion yen, while net income attributable to Sony Group Corporations stockholders decreased by 81.6 billion yen to 200.1 billion yen.

- FY23 Outlook: Upward Revisions in Sales and Net Income: Moving forward, the company presented the full-year consolidated results forecast for FY23, anticipating sales to be 12 trillion 400 billion yen, a 200 billion yen increase from the previous forecast. Operating income is expected to remain unchanged at 1 trillion 170 billion yen, while net income attributable to Sony Group Corporationʼs stockholders is forecasted to be 880 billion yen, a 20 billion yen increase from the previous forecast. Adjusted EBITDA is expected to reach 1 trillion 785 billion yen, marking a 35 billion yen increase from the previous forecast. However, the consolidated operating cash flow forecast, excluding the Financial Services segment, is expected to decrease to 1 trillion 160 billion yen, mainly due to foreign currency conversion adjustments and increased working capital in the G&NS segment.

- Strategic Vision: Cumulative Adjusted EBITDA Surpasses Mid-Range Plan Targets: The three-year cumulative adjusted EBITDA, a key performance indicator (KPI) for the current mid-range plan, is projected to be approximately 5.1 trillion yen, surpassing the target of 4.3 trillion yen by 19%. This translates to an average annual growth rate of approximately 9% compared to the fiscal year ended March 31, 2021, the final year of the previous mid-range plan.

- Global Business Environment: Sony's Prudent Approach Amid Uncertainties: Despite positive projections, Sony acknowledges the need to monitor the global business environment, considering factors such as worldwide economic slowdown, geopolitical risks, and the division of the global economy. In response, the company plans to focus on key priorities, including increasing market penetration and expanding the user base for PS5 in the G&NS segment. Efforts will also be directed towards improving operational efficiency and profitability in the I&SS segment. Sony aims to finalize the current mid-range plan, addressing any potential challenges before the start of the next fiscal year.

- February 14, 2024, Wednesday, 16:00 (Japan Standard Time) - Live Webcast of Presentation Slides and Verbal Explanation. A Q&A session will be conducted to discuss the results for the third quarter of the fiscal year 2023.

Technical Observation (on the daily chart)

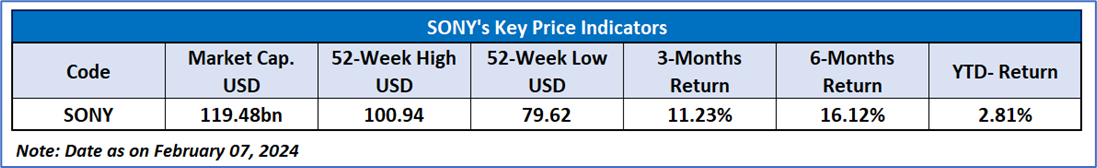

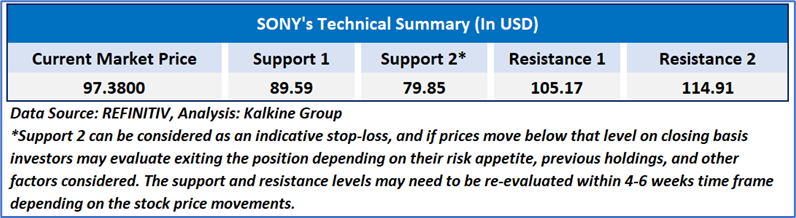

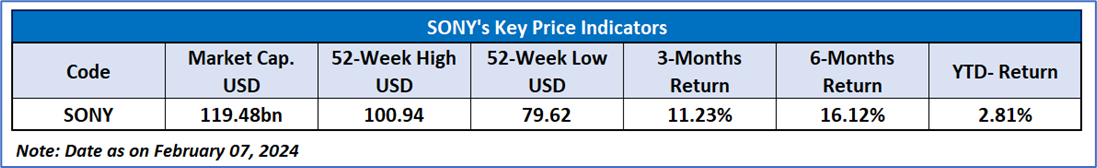

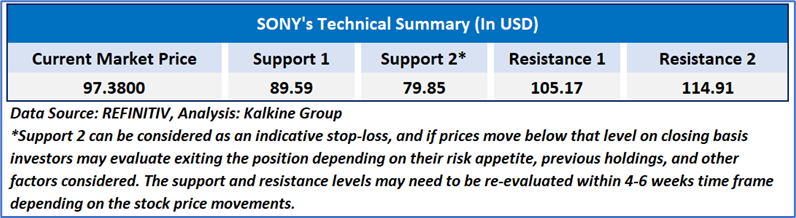

The Relative Strength Index (RSI), calculated over a 14-day span, stands at 54.84, currently recovered from overbought zone, signifying the likelihood of either more consolidation or a brief surge. Adding to this, the stock presently finds itself positioned between both the 21-day and 50-day Simple Moving Averages (SMA), which could function as a dynamic short-term resistance and support levels respectively. Now, the stock's price hovers around a crucial support range of USD 92.00 to USD 95.00, with an anticipation of an impending upward shift originating in case of a support from these support levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Sony Group Corporation (NYSE: SONY) at the current market price of USD 97.38, as of February 07, 2024, at 07:25 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is February 07, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

AU

Please wait processing your request...

Please wait processing your request...