Alibaba Group Holding Ltd

Alibaba Group Holding Ltd (NYSE: BABA) provides technology infrastructure and marketing platforms. The Company operates through seven segments. China Commerce segment includes China retail commerce businesses such as Taobao, Tmall and Freshippo, among others, and wholesale business.

Recent Business and Financial Updates

- Business Highlights

- Revenue and Profitability: For the quarter ended September 30, 2024, Alibaba Group reported revenue of RMB236,503 million (USD33,701 million), reflecting a year-over-year growth of 5%. Income from operations amounted to RMB35,246 million (USD5,023 million), a 5% increase compared to the same period in the prior year. This growth was primarily driven by a reduction in non-cash share-based compensation expenses, partially offset by a decline in adjusted EBITA. Adjusted EBITA, a non-GAAP metric, decreased by 5% year-over-year to RMB40,561 million (USD5,780 million), attributable to increased investments in e-commerce businesses despite revenue growth and enhanced operating efficiency.

- Net Income and Earnings Per Share: Net income attributable to ordinary shareholders stood at RMB43,874 million (USD6,252 million), with overall net income reaching RMB43,547 million (USD6,205 million), marking a significant 63% year-over-year increase. This improvement was largely due to mark-to-market gains on equity investments, reduced impairment of investments, and higher income from operations. Non-GAAP net income decreased by 9% year-over-year to RMB36,518 million (USD5,204 million). Diluted earnings per ADS were RMB18.17 (USD2.59), while non-GAAP diluted earnings per ADS decreased by 4% year-over-year to RMB15.06 (USD2.15).

- Cash Flow: Net cash provided by operating activities amounted to RMB31,438 million (USD4,480 million), a 36% decline compared to RMB49,231 million in the prior year. Free cash flow, a non-GAAP measure, dropped 70% year-over-year to RMB13,735 million (USD1,957 million). This decline was attributed to investments in Alibaba Cloud infrastructure, refunds to Tmall merchants following the cancellation of annual service fees, and changes in working capital linked to the downsizing of certain direct sales businesses.

- Business and Strategic Updates

- Taobao and Tmall Group: During the quarter, Alibaba intensified its investments in strategic initiatives aimed at improving user experience, including enhancements in price competitiveness, customer service, membership benefits, and technology. These efforts resulted in increased purchase frequency and positive user feedback. Additionally, the adoption of a more open payment and logistics system has improved convenience for consumers and operational efficiency for merchants. The implementation of a software service fee based on GMV and rebates for small and medium-sized merchants further aligned with industry practices. Notably, GMV growth was driven by double-digit order growth, supported by the success of the 11.11 Global Shopping Festival. The 88VIP membership program also continued to expand, reaching 46 million members.

- Cloud Intelligence Group: Revenue from the Cloud Intelligence Group grew by 7% year-over-year to RMB29,610 million (USD4,219 million), driven by double-digit growth in public cloud services and triple-digit growth in AI-related product revenue for the fifth consecutive quarter. Alibaba Cloud's leadership in public cloud and AI platforms in China was reaffirmed through recognitions such as being named a Leader in The Forrester Wave™: Public Cloud Platforms in China 2024 report. The launch of the upgraded Qwen 2.5 large model family and improvements in AI cost efficiency further enhanced Alibaba Cloud's position in the market.

- Alibaba International Digital Commerce Group (AIDC): AIDC reported revenue of RMB31,672 million (USD4,513 million), representing a robust 29% year-over-year growth. This performance was driven by the success of cross-border businesses such as AliExpress’ Choice model, which benefited from improved unit economics and strengthened synergies with Cainiao logistics operations. The launch of the AliExpressDirect model further enhanced fulfillment efficiency and product variety.

- Cainiao Smart Logistics Network Limited: Cainiao's revenue grew by 8% year-over-year to RMB24,647 million (USD3,512 million), primarily due to increased cross-border fulfillment demand. The company continues to expand its digitalized global logistics network and recently began providing logistics services on other e-commerce platforms.

- Local Services Group: Revenue from the Local Services Group grew by 14% year-over-year to RMB17,725 million (USD2,526 million), supported by growth in orders for Amap and Ele.me as well as higher revenue from marketing services. Operational losses narrowed due to improved efficiency and increased scale, with Amap achieving record daily active users during the National Day holiday.

- Digital Media and Entertainment Group: Revenue for this segment was RMB5,694 million (USD811 million), a 1% year-over-year decline. However, operating losses narrowed due to higher advertising revenue and improved content investment efficiency at Youku.

- Share Repurchase Program: During the quarter, Alibaba repurchased 414 million ordinary shares (equivalent to 52 million ADSs) for a total of USD4.1 billion. This resulted in a net reduction of 405 million ordinary shares, or 2.1% of outstanding shares, as of September 30, 2024. The remaining authorization for the share repurchase program stands at USD22.0 billion, effective through March 2027.

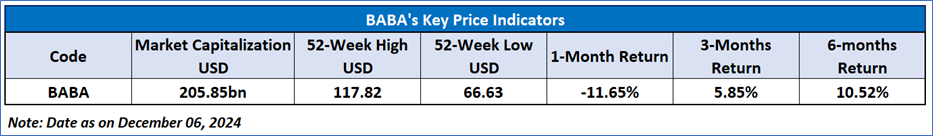

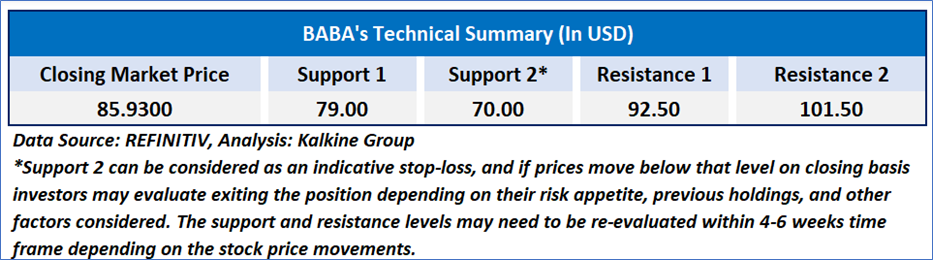

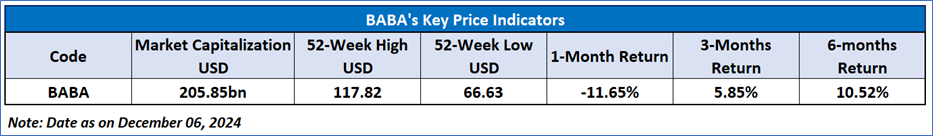

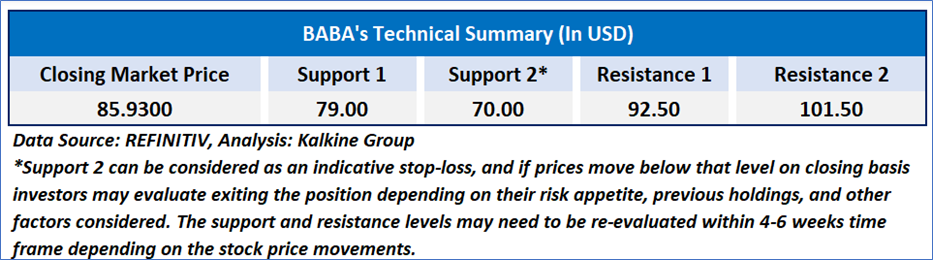

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 40.22, currently recovering from oversold zone, with expectations of a consolidation or an upward momentum if the price sustains above an important support of USD80-USD 85. Additionally, the stock's current positioning is between both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance and support levels respectively.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given for Alibaba Group Holding Ltd (NYSE: BABA) at the closing price of USD 85.93, as of December 06, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 06, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...