Tencent Music Corporation

Tencent Music Entertainment Group (NYSE: TME) is a holding company mainly engaged in the provision and operation of online music entertainment platform. The Company is mainly engaged in the provision of online music services, social entertainment services and other services. The Company operates four major product brands, QQ Music, Kugou Music, Kuwo Music and WeSing, through which the Company provides online music and social entertainment services to address the music entertainment needs of audience in China.

Recent Financial and Business Updates:

Financial Highlights:

- Harmonious Revenues Amidst Challenges: TME's RMB6.57 Billion (USD 900 Million) Performance: In the third quarter of 2023, Tencent Music Entertainment Group (TME) reported total revenues of RMB6.57 billion (USD 900 million), reflecting a 10.8% year-over-year decrease. This decline primarily resulted from decreased revenues in social entertainment services and other segments. However, revenues from music subscriptions exhibited significant growth, reaching RMB3.19 billion (USD 438 million), a 42.0% increase year-over-year, with 103.0 million paying users.

- Net Profit Crescendo: RMB1.26 Billion (USD 173 Million) in a Harmonic Surge: The net profit for the third quarter was RMB1.26 billion (USD 173 million), indicating a 15.6% year-over-year growth. Diluted earnings per American Depositary Share (ADS) amounted to RMB0.74 (USD 0.10). The total cash, cash equivalents, and term deposits as of September 30, 2023, stood at RMB30.96 billion (USD 4.24 billion).

- Operational Crescendos: TME's Dual-Engine Strategy Strikes the Right Chords: The operational metrics for the third quarter revealed a decline in monthly active users (MAUs) for online music but an increase in paying users for both online music and social entertainment. The monthly average revenue per paying user (ARPPU) for online music experienced growth, while ARPPU for social entertainment declined.

- Operational Crescendos: TME's Dual-Engine Strategy Strikes the Right Chord: TME emphasized its dual-engine content-and-platform strategy, focusing on strengthening its music ecosystem. This involved fostering partnerships with record labels and artists, hosting events for artist promotion, enhancing technology capabilities in content creation, and leveraging Large Language Models (LLMs) for improved music discovery.

- Financial Fortitude: A Detailed Sonata of TME's Q3 2023 Performance: Total revenues decreased by 10.8% to RMB6.57 billion, driven by a decline in social entertainment services. However, revenues from online music services increased by 32.7%, reaching RMB4.55 billion (USD 624 million). The gross margin increased to 35.7%, attributed to strong growth in music subscriptions and advertising services. Operating expenses decreased by 11.8% year-over-year, contributing to an operating profit growth of 13.0%. Net profit for the quarter was RMB1.26 billion (USD 173 million), and non-IFRS net profit was RMB1.50 billion (USD 206 million).

- Earnings Anthem: TME Strikes a Chord with RMB0.74 (USD 0.10) per ADS: Basic and diluted earnings per ADS were RMB0.75 (USD 0.10) and RMB0.74 (USD 0.10), respectively. TME reported a combined balance of RMB30.96 billion (USD 4.24 billion) in cash, cash equivalents, and term deposits as of September 30, 2023.

- Strategic Symphony: TME's USD 500 Million Share Repurchase Program Resonates: Under the USD 500 million Share Repurchase Program, TME repurchased 15.8 million ADSs from the open market, totaling approximately USD 103 million as of September 30, 2023.

Technical Observation (on the daily chart)

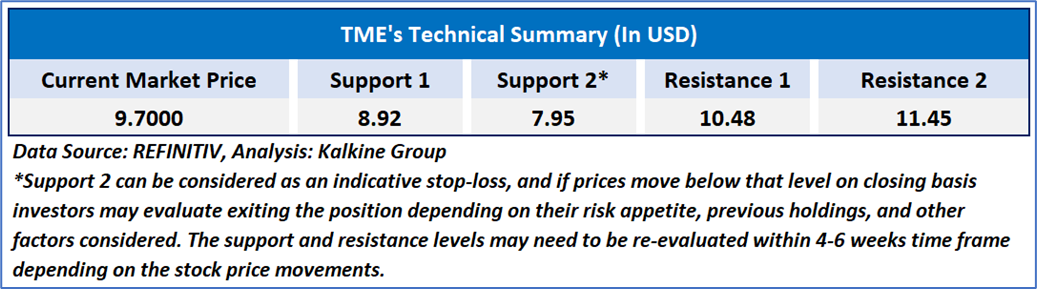

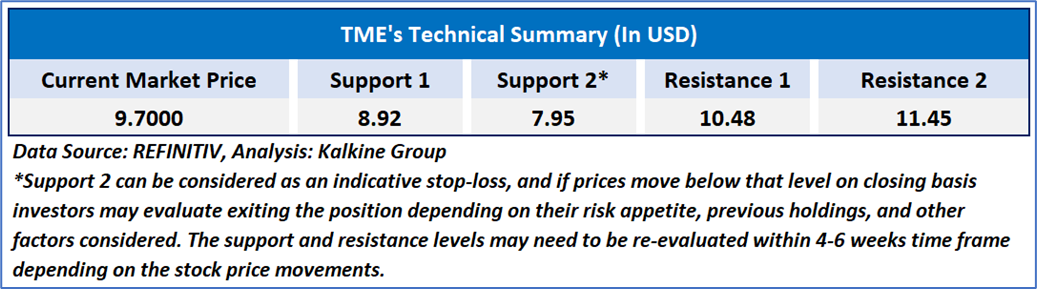

The Relative Strength Index (RSI), calculated over a 14-day span, stands at 63.27, currently upward trending, signifying the likelihood of either more consolidation or a brief surge. Adding to this, the stock presently finds itself positioned above both the 21-day and 50-day Simple Moving Averages (SMA), which could function as a dynamic short-term support levels. Now, the stock's price has broken above an important resistance level of USD 9.00, with expectations of an upside movement with the next important resistance around USD 11-USD 11.50.

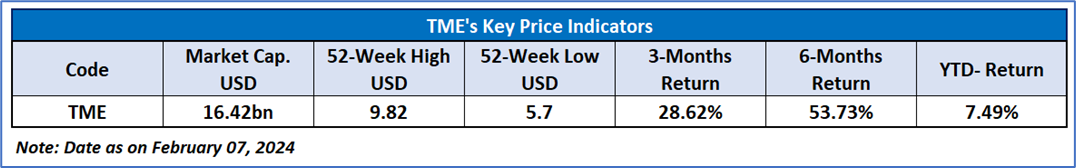

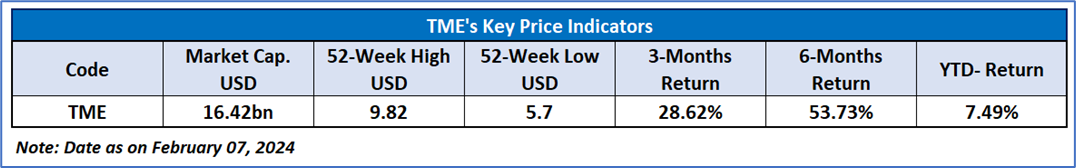

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Tencent Music Entertainment Group (NYSE: TME) at the current market price of USD 9.70, as of February 07, 2024, at 07:45 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is February 07, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

AU

Please wait processing your request...

Please wait processing your request...