Dell Technologies Inc.

Dell Technologies Inc. (NYSE: DELL) is involved in the design, development, production, marketing, sales, and support of a broad array of integrated solutions, products, and services. The company functions in two main segments: Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG).

Recent Business and Financial Updates

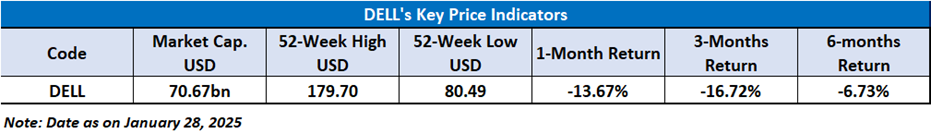

- Revenue Growth and Profitability: Dell Technologies reported strong financial results for the third quarter of fiscal 2025, achieving total revenue of USD 24.4 billion, up 10% compared to the same period last year. Operating income for the quarter was USD 1.7 billion, reflecting a 12% year-over-year increase. Non-GAAP operating income, which excludes certain items for a more accurate financial picture, also grew by 12% to USD 2.2 billion. The company’s diluted earnings per share (EPS) reached USD 1.58, a 16% increase year over year, while non-GAAP diluted EPS rose by 14%, totaling USD 2.15. Dell’s strong performance was further highlighted by robust cash flow, with cash flow from operations amounting to USD 1.6 billion and ending the quarter with USD 6.6 billion in cash and investments.

- Performance of the Infrastructure Solutions Group (ISG): The Infrastructure Solutions Group (ISG) delivered impressive results, with revenue rising to a record USD 11.4 billion, up 34% compared to the same quarter last year. This growth was largely driven by a remarkable 58% increase in servers and networking revenue, which reached USD 7.4 billion. The strong demand for both AI and traditional server solutions played a significant role in this performance. Storage revenue also saw a 4% increase, reaching USD 4.0 billion. Operating income for ISG totaled USD 1.5 billion, a 41% increase from the previous year. Dell remains focused on the growing AI market, with AI server orders reaching USD 3.6 billion in Q3 and a pipeline that has expanded by more than 50%.

- Client Solutions Group (CSG) Revenue and Decline: The Client Solutions Group (CSG) posted revenue of USD 12.1 billion for the third quarter, which represented a slight 1% decline year over year. While commercial client revenue grew by 3%, reaching USD 10.1 billion, the consumer segment faced a notable challenge, with revenue falling by 18% to USD 2.0 billion. The overall operating income for CSG stood at USD 694 million, a decrease of 25% from the previous year. While the commercial sector performed well, the decline in consumer revenue contributed to the overall dip in the segment's performance. Despite the challenges, CSG's commercial client business remained a key strength for Dell.

- Strong Cash Flow and Financial Position: Despite a decrease in cash flow from operations, Dell Technologies maintained a strong financial position. The company reported cash flow from operations of USD 1.6 billion, a decline from the USD 2.2 billion reported during the same quarter last year. However, the company ended the quarter with USD 6.6 billion in cash and investments, ensuring a solid financial foundation for future investments and strategic initiatives. Dell's ability to generate significant cash flow reinforces its stability and flexibility to navigate market changes while continuing to fund growth opportunities.

- Non-GAAP Results Highlight Growth: Dell’s non-GAAP results for the third quarter of fiscal 2025 further underscored its financial strength. Non-GAAP operating income grew by 12%, totaling USD 2.2 billion. Non-GAAP net income was USD 1.5 billion, reflecting an 11% increase compared to the same period last year. Additionally, non-GAAP diluted EPS reached USD 2.15, marking a 14% year-over-year rise. For the nine months ending November 1, 2024, Dell reported a non-GAAP diluted EPS of USD 5.31, which represented an 8% increase from the previous year. These results highlight Dell's continued focus on profitability and its ability to deliver solid financial returns.

- Segment Performance and Contribution to Income: Dell's operating segments showed varied performance in the third quarter, with the Infrastructure Solutions Group (ISG) leading the charge. ISG’s operating income represented 68% of the company’s total reportable segment income, driven by strong growth in servers and networking. In contrast, the Client Solutions Group (CSG) accounted for 32% of total segment income, with a decline in consumer revenue affecting overall performance. However, the commercial client segment within CSG demonstrated positive growth, offsetting some of the challenges faced by the consumer business. Despite the consumer segment's struggles, CSG's commercial business helped maintain a steady income contribution.

- AI Leadership and Future Outlook: Dell Technologies continues to strengthen its position in the rapidly growing AI market. The company reported a record USD 3.6 billion in AI server orders during the third quarter, driven by heightened demand across various customer segments. The AI pipeline has expanded by more than 50%, signaling significant future growth opportunities. Dell’s focus on AI technology positions the company well to capitalize on this trend as the market for AI solutions continues to evolve. Looking ahead, Dell remains optimistic about its AI and infrastructure solutions, expecting these segments to continue driving growth in the coming quarters.

- Outlook and Strategic Focus: As Dell Technologies moves forward, its strategic focus remains on building its leadership in AI, enhancing profitability, and delivering strong cash performance. The company continues to focus on driving growth across its key segments, including ISG and CSG, while maintaining a strong balance sheet. With an increasing demand for AI solutions, Dell is well-positioned to capitalize on market opportunities and further strengthen its competitive position. The company’s efforts to expand its AI offerings and deliver innovative solutions will likely play a pivotal role in driving sustained growth in fiscal 2025 and beyond.

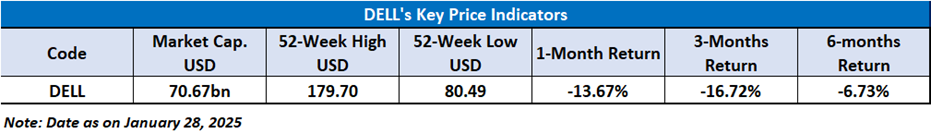

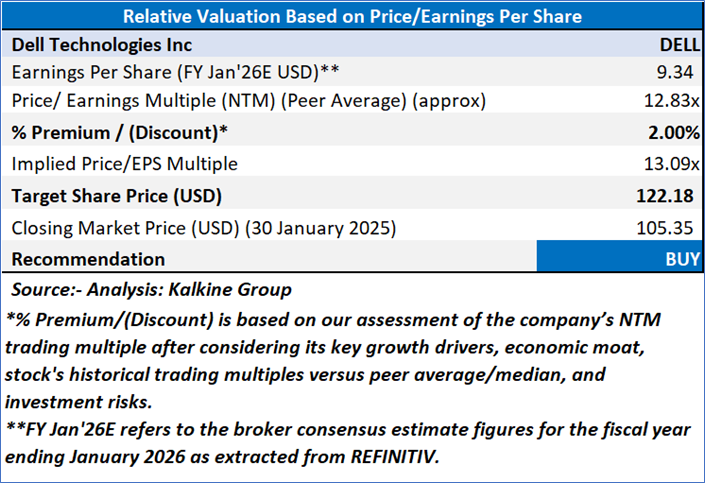

Valuation (Using P/E Methodology)

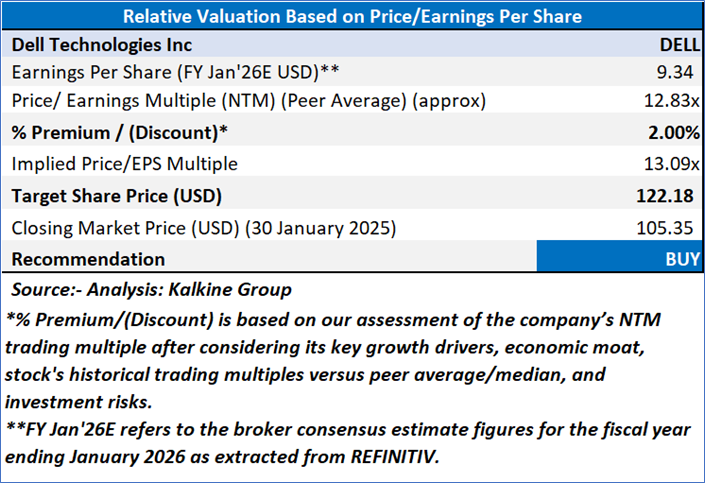

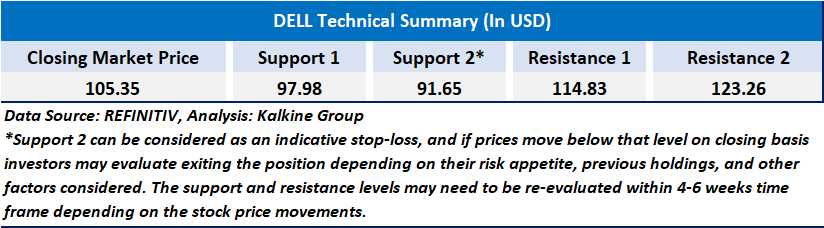

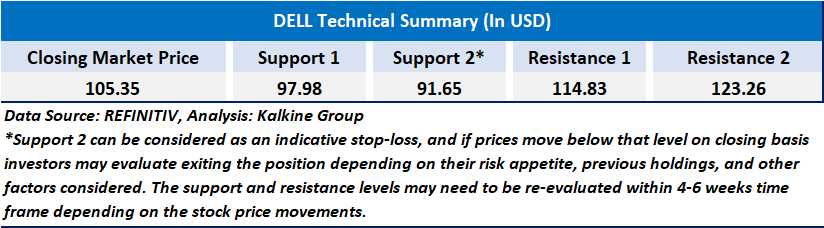

Technical Observation (on the daily chart):

DELL's stock on the daily chart shows potential for upward movement, as it trades above a key horizontal support level, indicating bullish momentum. The RSI at 30.67 suggests the stock is nearing oversold territory, which may signal a reversal if market conditions improve. However, the stock remains below its Simple Moving Average (SMA), indicating underperformance relative to its historical average. Critical resistance levels are at USD 00.001 and USD 00.002, while support levels are at USD 00.003 and USD 00.004. These levels are important for traders to monitor for potential price action and trend reversals.

Dell Technologies reported strong third-quarter fiscal 2025 results, with revenue reaching USD 24.4 billion, up 10% year over year. The Infrastructure Solutions Group (ISG) achieved record revenue of USD 11.4 billion, driven by robust AI and server demand. Despite a slight decline in Consumer revenue, the Client Solutions Group (CSG) saw solid growth in commercial clients. Non-GAAP earnings per share increased by 14%, reflecting Dell’s focus on profitability, while its AI leadership and strong cash position position the company for continued success.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Dell Technologies Inc. (NYSE: DELL) at the closing market price of USD 105.35 as of January 30,2025.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 30th,2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...