MGM Resorts International

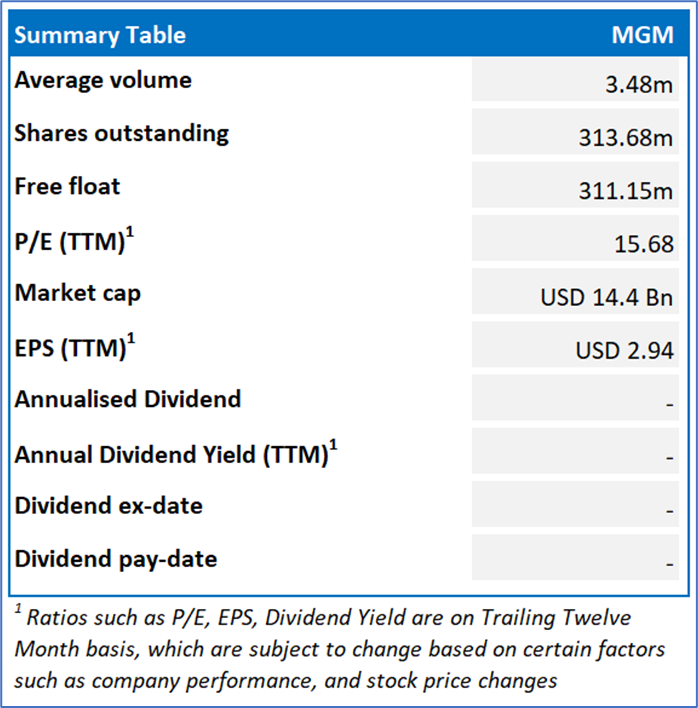

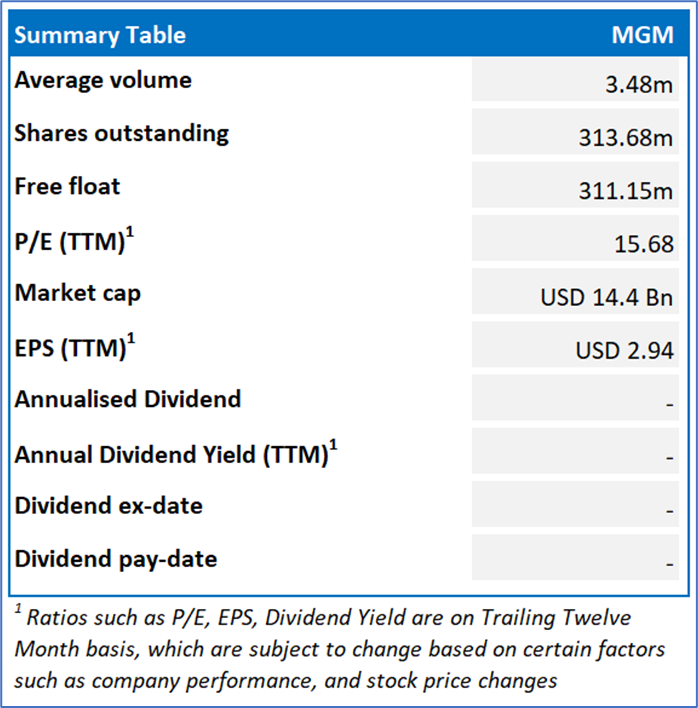

MGM Details

MGM Resorts International (NYSE: MGM) is a component of S&P 500 index. Predominantly, the company through its subsidiary companies located in different geographies tend to offer a global platform for gaming and entertainment.

Financial Results

- MGM reported financial results for the quarter ended March 31, 2024. It posted consolidated net revenues of $4.4 Bn, an increase of 13% as compared to the prior year quarter, mainly because of an increase in revenue at MGM China resulting from the continued ramp up of operations after the removal of COVID-19 related entry restrictions in Macau in the prior year quarter.

- Notably, net income attributable to MGM Resorts stood at $217 Mn in the current quarter as compared to $467 Mn in the prior-year quarter.

- In Q1 FY 2024, its consolidated adjusted EBITDAR stood at $1.2 Bn

Key Update:

MGM would be releasing its financial results for the second quarter 2024 after the market closes on July 31, 2024.

Outlook

The company’s venture in Japan is progressing with financing now in place as well as its recent hedging program has provided significant cost advantages for the development of the country's first integrated resort. However, the company is exposed to the risks such as uncertain capital and credit market conditions as well as higher competition.

Key Risks

The company’s business is affected by economic as well as market conditions in the jurisdictions in which it operates and in the locations in which its customers reside. Also, MGM’s businesses are subject to extensive regulation and the cost of compliance could adversely impact the business and results of operations.

Fundamental Valuation

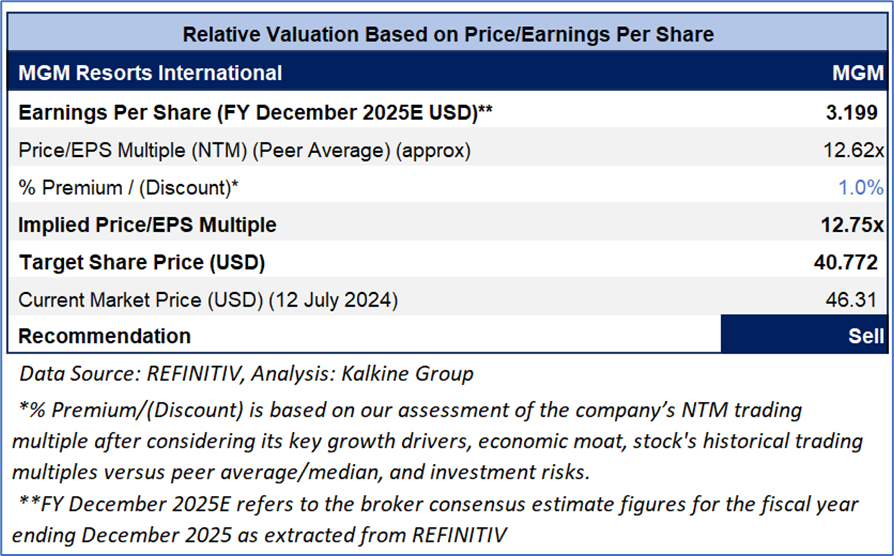

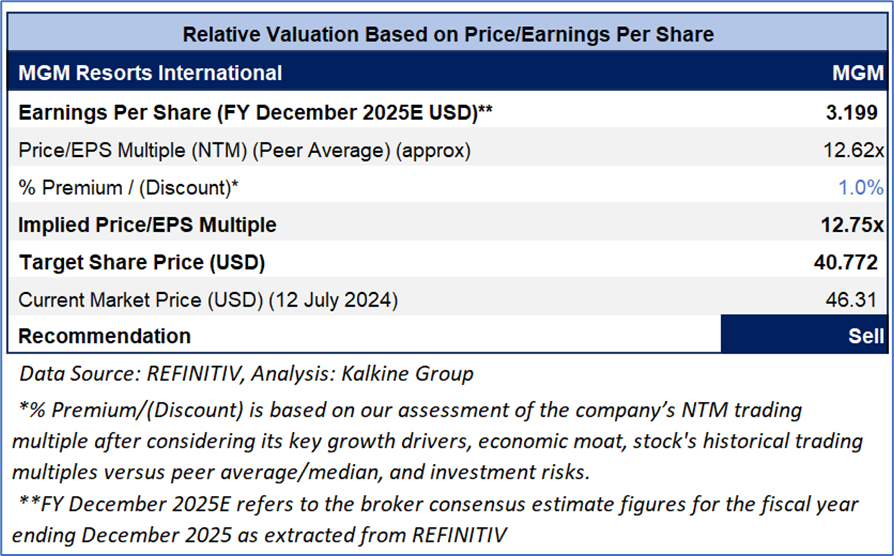

P/E Based Relative Valuation

Stock Recommendation

Over the last three months, the stock has given a return of ~7.6%. The stock has made a 52-week low and high of USD 34.12 and USD 51.35, respectively. The company’s performance is exposed to the risks related to the global slowdown and increased inflation. Also, because the significant number of major gaming resorts are concentrated on the Las Vegas Strip, MGM is exposed to greater risks than a gaming company which is more geographically diversified.

Notably, if the jurisdictions in which the company operates increase taxes and fees, its results could be adversely affected.

Considering the current trading levels, risks associated, and volatile market conditions on the back of higher interest rates, an ‘Sell’ rating is assigned to the “MGM” at the current market price of USD 46.31 as of July 12, 2024 (6:33 am PDT).

Technical Overview:

Daily Price Chart

MGM Resorts International (NYSE: MGM) is a part of Global Big Money Portfolio

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is Jul 12, 2024 (6:33 am PDT). The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.’

AU

-Copy_07_12_2024_15_08_04_319861.jpg)

Please wait processing your request...

Please wait processing your request...