CVS Health Corporation

CVS Health Corporation (NYSE: CVS) is a health solutions company. The Company operates in four segments: Health Care Benefits, Health Services, Pharmacy & Consumer Wellness, and Corporate/Other.

Recent Business and Financial Updates

- Financial Highlights: CVS Health Corporation announced a total revenue increase of 2.6% for the second quarter of 2024, amounting to USD 91.2 billion, up from the prior year's revenue. The company's GAAP diluted earnings per share (EPS) for the same period stood at USD 1.41, while the Adjusted EPS was reported at USD 1.83. The corporation also generated a year-to-date cash flow from operations of USD 8.0 billion, indicating its robust financial standing amid challenging market conditions.

- Revised Full-Year Guidance: The company has revised its full-year 2024 guidance to reflect the ongoing pressures within the Health Care Benefits segment. The updated GAAP diluted EPS guidance now ranges from USD 4.95 to USD 5.20, reduced from the previous forecast of at least USD 5.64. Similarly, the Adjusted EPS guidance has been adjusted to a range of USD 6.40 to USD 6.65, down from the earlier projection of at least USD 7.00. Cash flow from operations for the full year is now expected to be approximately USD 9.0 billion, a decrease from the prior estimate of at least USD 10.5 billion.

- CEO's Commentary: Karen S. Lynch, President and CEO of CVS Health, highlighted the company's distinctive strengths that position it for continued success in the evolving healthcare landscape. Lynch emphasized the accelerated pace of innovation, particularly in transparent pharmacy reimbursement models and the increasing use of biosimilars. She noted that CVS Health's integrated model is enabling the company to meet customer demands and achieve better patient outcomes, even in a challenging environment. Lynch also mentioned ongoing leadership changes in the Health Care Benefits segment, reflecting the company’s proactive approach to capitalize on emerging opportunities.

- Second Quarter Financial Performance: For the second quarter of 2024, CVS Health reported total revenues of USD 91.2 billion, reflecting a USD 2.3 billion increase from USD 88.9 billion in the same period in 2023. However, operating income decreased by 5.8%, amounting to USD 3.05 billion, compared to USD 3.23 billion in the prior year. Adjusted operating income also declined, falling by 16.4% to USD 3.74 billion from USD 4.48 billion. The decreases were primarily attributed to continued pressures in the Health Care Benefits segment, coupled with unfavourable Medicare Advantage star ratings.

- Segment Performance Overview: The Health Care Benefits segment experienced a significant reduction in operating income, largely driven by increased utilization pressures and adverse effects related to the company's Medicare Advantage star ratings for the 2024 payment year. Despite these challenges, the Pharmacy & Consumer Wellness segment exhibited revenue growth of 3.7% during the quarter, primarily due to increased prescription volume. Conversely, the Health Services segment experienced an 8.8% decrease in total revenues, attributed to the loss of a large client and ongoing price improvements in pharmacy services.

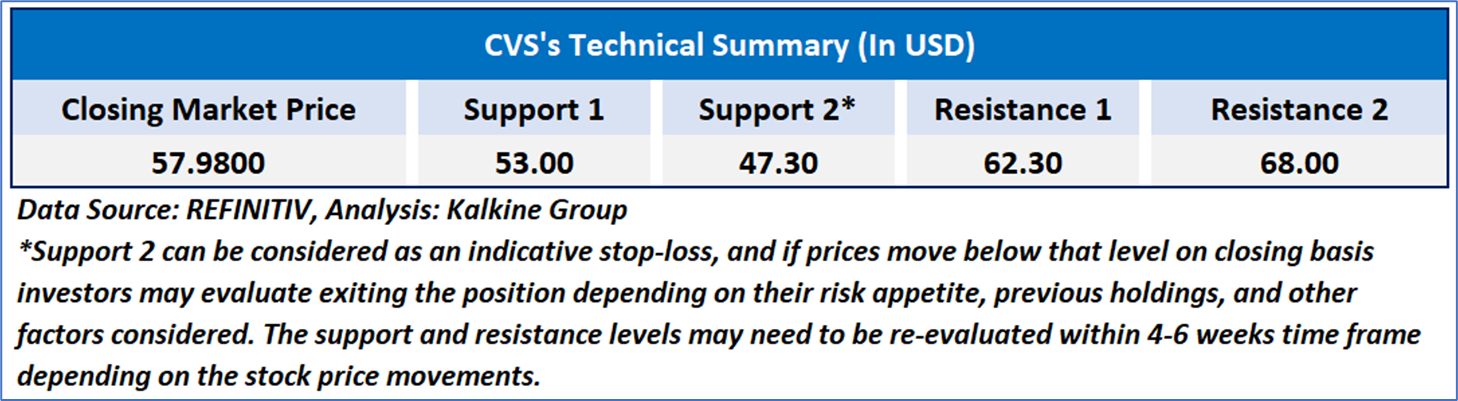

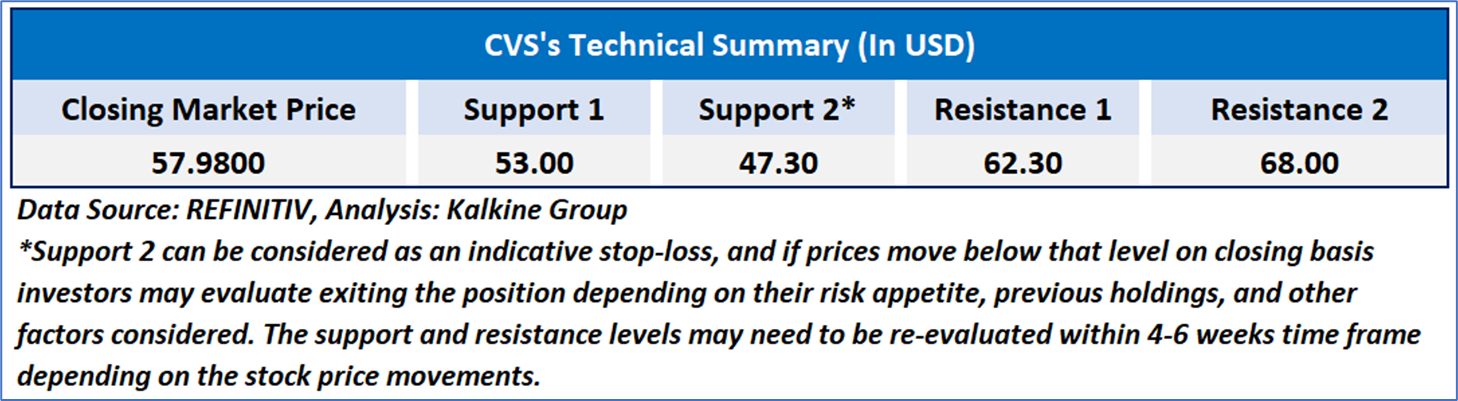

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 50.98, currently consolidating near 50 levels, with expectations of a consolidation or an upward momentum from the current support levels of USD 50.00- USD 55.00. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

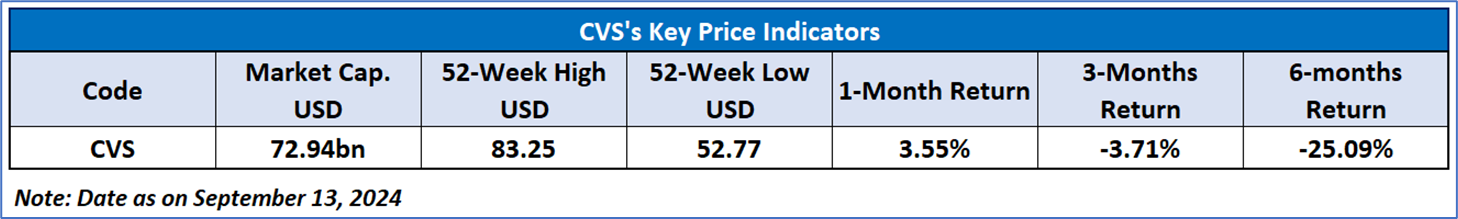

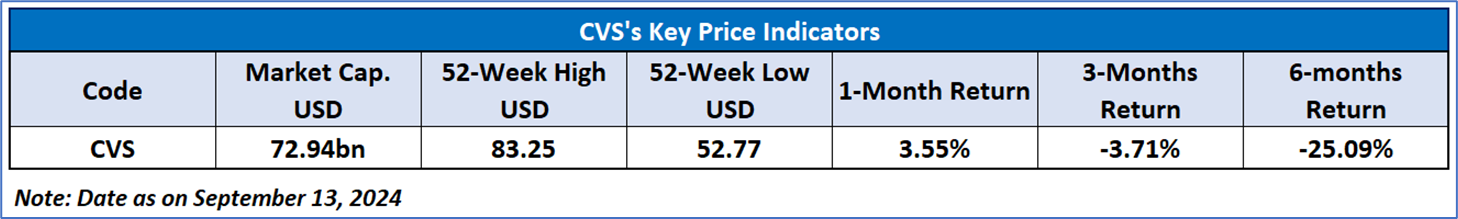

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to CVS Health Corporation (NYSE: CVS) at the closing market price of USD 57.98 as of September 13, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is September 13, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...