NIO Inc

NIO Inc (NYSE: NIO) is a China-based holding company principally engaged in the research, development and manufacturing of premium smart electric vehicles. The Company is mainly engaged in the design, development, manufacture and sales of high-end smart electric vehicles. The Company's products mainly include ES8, ES6, EC6 and ET7. The Company develops battery swapping technologies and autonomous driving technologies. Its electric vehicles apply NAD (NIO Autonomous Driving) technology, including super computing platform NIO Adam and super sensing system NIO Aquila.

Recent Financial and Business Updates:

Operating Highlights for the Fourth Quarter and Full Year of 2023: In the fourth quarter of 2023, vehicle deliveries totaled 50,045 units, comprising 33,679 premium smart electric SUVs and 16,366 premium smart electric sedans. This marked a 25.0% increase from the fourth quarter of 2022 and a 9.7% decrease from the third quarter of 2023. Throughout 2023, total vehicle deliveries amounted to 160,038 units, reflecting a notable 30.7% increase from the previous year.

Financial Highlights for the Fourth Quarter of 2023: Vehicle sales in the fourth quarter of 2023 reached RMB15,438.7 million (USD2,174.5 million), representing a 4.6% increase from the fourth quarter of 2022 and an 11.3% decrease from the third quarter of 2023. The vehicle margin for this quarter stood at 11.9%, compared to 6.8% in the fourth quarter of 2022 and 11.0% in the third quarter of 2023. Total revenues for the quarter reached RMB17,103.2 million (USD2,408.9 million), marking a 6.5% increase from the fourth quarter of 2022 and a 10.3% decrease from the third quarter of 2023. Gross profit amounted to RMB1,279.2 million (USD180.2 million), with a gross margin of 7.5%. However, loss from operations was RMB6,625.3 million (USD933.2 million), and the net loss was RMB5,367.7 million (USD756.0 million).

Financial Highlights for the Full Year of 2023: Throughout 2023, vehicle sales totaled RMB49,257.3 million (USD6,937.7 million), an 8.2% increase from the previous year. Total revenues for the year amounted to RMB55,617.9 million (USD7,833.6 million), reflecting a 12.9% increase from the previous year. However, gross profit decreased by 40.7% to RMB3,051.8 million (USD429.8 million), with a gross margin of 5.5%. Loss from operations increased by 44.8% to RMB22,655.2 million (USD3,190.9 million), and the net loss increased by 43.5% to RMB20,719.8 million (USD2,918.3 million).

Recent Developments: In January and February 2024, NIO delivered 10,055 and 8,132 vehicles, respectively, with cumulative deliveries reaching 467,781 units. On December 23, 2023, NIO unveiled the ET9, a smart electric executive flagship, during NIO Day 2023 in Xi’an, China. Furthermore, NIO completed a strategic equity investment of USD2.2 billion from CYVN Investments RSC Ltd and finalized a technology license agreement with Forseven Limited on February 26, 2024.

Technical Observation (on the daily chart)

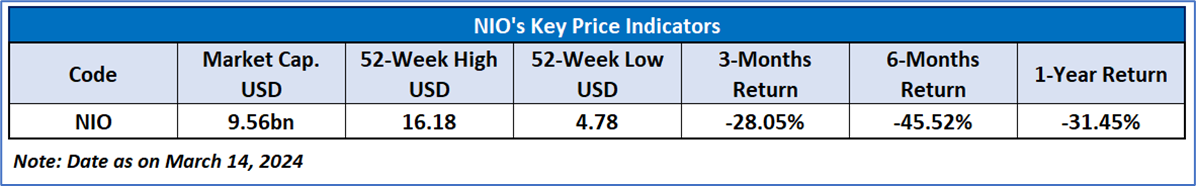

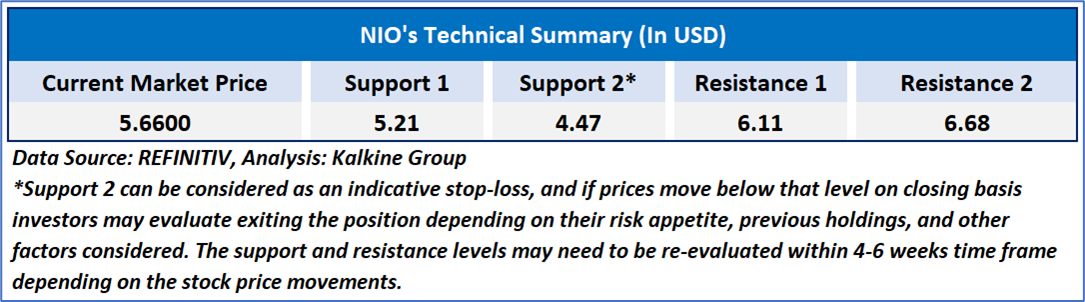

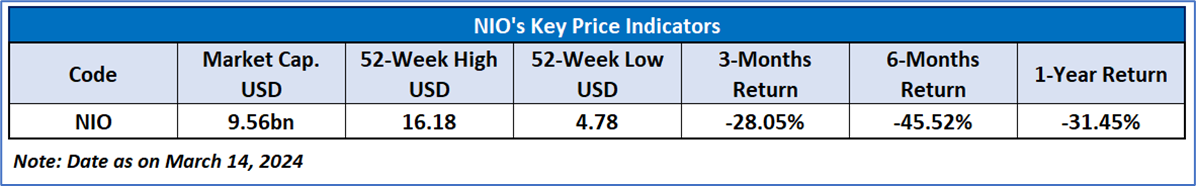

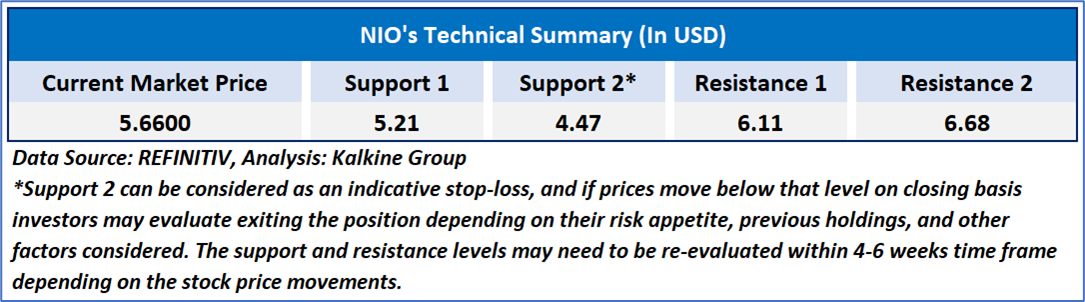

The Relative Strength Index (RSI), calculated over a 14-day span, stands at 45.22, currently consolidating, signifying the likelihood of either more consolidation or an upward momentum. Adding to this, the stock presently finds itself positioned below both the 21-day and 50-day Simple Moving Averages (SMA), which could function as a dynamic short-term resistance levels. Now, the stock's price is currently near a support zone of USD 5.00-USD 5.50, with expectations of an upside movement from the support levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Speculative Buy’ rating has been given to NIO Inc (NYSE: NIO) at the current market price of USD 5.66, as of March 14, 2024, at 07:30 am PDT.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is March 14, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

AU

Please wait processing your request...

Please wait processing your request...