Bloom Energy Corporation

Bloom Energy Corporation (NYSE: BE) offers innovative technology solutions through its advanced energy platforms. The company produces the Bloom Energy Server and the Bloom Electrolyzer. Currently, over 1.2 gigawatts of Energy Servers are deployed across more than 1,200 sites in seven countries.

Positive Growth Prospects

- Improved Margins and Operational Efficiency: Bloom Energy showed significant improvement in its gross margin, rising to 23.8%, reflecting better cost control. The company reduced its operating loss by $94.1 million year-over-year. Strategic projects, such as a partnership with SK Eternix for a large-scale fuel cell installation, point to strong growth opportunities in clean energy.

- Positive Financial Guidance and Project Pipeline: Bloom Energy reaffirmed its 2024 revenue guidance of $1.4 billion to $1.6 billion and projected a 28% non-GAAP gross margin. Partnerships with SK Eternix and Quanta for major fuel cell projects suggest a strong project pipeline. The company’s improved EBITDA highlights better cost management and progress toward profitability.

Growth Challenges

- Declining Revenue and Operational Challenges: Revenue dropped by 17.5% year-over-year, highlighting the challenges of its project-based business model. While the operating loss decreased, non-GAAP operating profit fell by $43.7 million, and adjusted EBITDA dropped significantly. This suggests Bloom Energy is still struggling to generate consistent growth and profitability.

- Decreased Margins and Profitability Concerns: Despite improvements in gross margin, non-GAAP gross margin declined to 25.2%, signaling pricing or cost pressures. Non-GAAP operating income and EPS were lower than last year, raising concerns about the company’s ability to consistently deliver value to shareholders in the short term.

Technical Observation (on the daily chart):

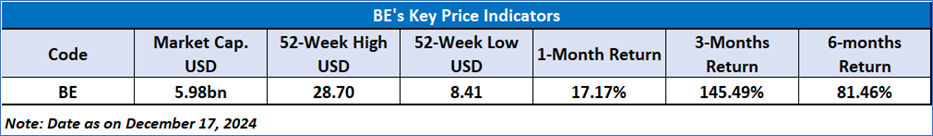

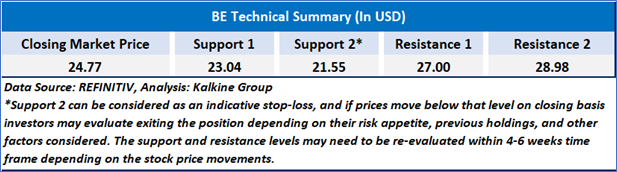

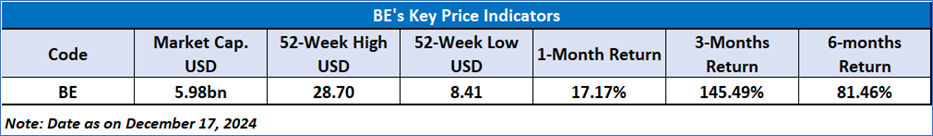

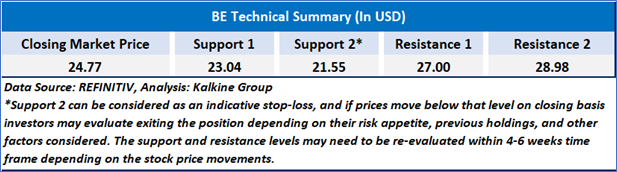

Bloom Energy Corp (BE) is currently in a bullish trend, with the stock recently pulling back after a strong rally in late October and November. The price is holding near the 21-day moving average ($25.49), which is acting as key support. While the RSI shows neutral momentum, it has been trending downward, indicating decreasing buying pressure. Support levels are at $25.49 and $20-$21, while resistance sits at $28. The outlook suggests that if the price remains above the 21-day MA, a potential reversal to $28 is possible. However, a breakdown below the 21-day MA could lead to further downside. Monitoring volume and price action around these levels is critical.

Bloom Energy reaffirmed its 2024 revenue guidance of $1.4 billion to $1.6 billion, with non-GAAP operating income expected between $75 million and $100 million, driven by major projects like its partnership with SK Eternix. However, declining margins and operating income indicate short-term challenges, and the company’s ability to execute and scale projects will be crucial for meeting targets.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Watch’ rating has been given to Bloom Energy Corporation (NYSE: BE) at the closing market price of USD 24.77 as of December 17,2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 17,2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...