Yiren Digital Ltd

Yiren Digital Ltd (NYSE: YRD) is a holding company primarily focused on running a digital personal financial management platform and offering a range of wealth, credit, and financial solutions to individual borrowers and small business owners. The company operates through three main segments. The Yiren Wealth segment provides a wealth management platform catering to the mass affluent demographic, offering comprehensive wealth solutions. The Yiren Credit segment runs a credit-tech platform that delivers a wide variety of online and offline loan products to individual borrowers and small business owners. The Others segment is involved in e-commerce, offering products like skincare, beauty items, electronics, and appliances, while also enabling users to finance their purchases with loans and offering customized non-financial products and services. Additionally, the company is involved in the insurance sector.

Recent Business and Financial Updates

- Financial Services Business Performance In the third quarter of 2024 (Q#FY24), Yiren Digital Ltd. facilitated a total of RMB13.4 billion (US$1.9 billion) in loans, marking a 3.5% increase from RMB12.9 billion in the previous quarter and a significant rise from RMB9.8 billion in the same period of 2023. The cumulative number of borrowers served reached 11.6 million by September 30, 2024, reflecting a 7.4% growth from 10.8 million at the end of Q2 2024. In the third quarter, 1.5 million borrowers were served, a slight increase of 0.4% from the prior quarter and a substantial rise from 1.2 million in the third quarter of 2023. The company is shifting its focus to enhancing the repeat rate among high-quality borrowers, following the success of efforts to optimize its customer mix. As of September 30, 2024, the outstanding balance of performing loans facilitated was RMB22.8 billion (US$3.2 billion), up 4.3% from the previous quarter and a significant increase from RMB15.1 billion in Q3 2023.

- Insurance Brokerage Business Growth: Yiren Digital’s insurance brokerage segment saw an increase in the cumulative number of insurance clients, reaching 1.47 million by the end of September 2024, a 4.3% rise from 1.41 million in Q2 2024. Compared to Q3 2023, this marked a notable growth from 1.26 million clients. In the third quarter of 2024, however, the number of clients served decreased to 82,291, a 7.3% decline from the previous quarter and a drop from 123,693 clients in the same period of 2023. Despite this decrease in client numbers, the gross written premiums in Q3 2024 amounted to RMB1.35 billion (US$192.6 million), marking a 27.4% increase from RMB1.06 billion in Q2 2024, driven by the recovery of the life insurance business post-product changes and rising renewed premiums.

- E-Commerce and Lifestyle Business Overview: Yiren Digital’s consumption and lifestyle business, conducted through its e-commerce platform and "Yiren Select" channel, generated a total gross merchandise volume (GMV) of RMB507.6 million (US$72.3 million) in Q3 2024. This represented a decrease of 8.5% from RMB554.6 million in the prior quarter and a drop from RMB563.2 million in the same period of 2023. The decline was primarily attributed to high penetration of the company’s products within the existing customer base, along with a strategic scaling back of product offerings to focus on upgrading customer segmentation. Despite the decrease, the company’s efforts to optimize its customer base contributed to solidifying its market presence.

- Financial Performance and Revenue Growth: Yiren Digital reported total net revenue of RMB1.48 billion (US$210.8 million) for Q3 2024, marking a 12.8% increase compared to RMB1.31 billion in Q3 2023. Revenue from the financial services segment totaled RMB836.2 million (US$119.2 million), reflecting a 25.2% increase year-over-year, driven by rising demand for the company’s small revolving loan products. The insurance brokerage business, however, faced a decline in revenue, which fell by 67.7% to RMB85.5 million (US$12.2 million), largely due to regulatory changes affecting life insurance sales and reduced commission fees in the industry. Meanwhile, revenue from the consumption and lifestyle business grew by 47.4% to RMB557.4 million (US$79.4 million), supported by continued expansion in customer base and service offerings.

- Expense and Cost Analysis: Yiren Digital's operating expenses in Q3 2024 saw significant increases in certain areas. Sales and marketing expenses reached RMB335.6 million (US$47.8 million), compared to RMB195.7 million in Q3 2023, driven by the expansion of the financial services segment and increased marketing efforts to attract high-caliber customers. The company’s origination, servicing, and other operating costs decreased to RMB205.9 million (US$29.3 million), down from RMB245.4 million in the same period of 2023, primarily due to a reduction in the costs associated with the insurance brokerage services. Research and development expenses surged to RMB150.8 million (US$21.5 million), reflecting Yiren Digital’s ongoing investment in AI and technological upgrades to drive innovation.

- Provision and Financial Metrics: The company’s general and administrative expenses also rose, totaling RMB80.1 million (US$11.4 million), compared to RMB53.5 million in Q3 2023, due to higher incentive bonuses and employee benefits. Additionally, allowance provisions for contract assets and receivables increased to RMB94.9 million (US$13.5 million), up from RMB72.7 million, reflecting the growing volume of loans facilitated on the platform. Provision for contingent liabilities saw a significant rise to RMB272.4 million (US$38.8 million) due to higher loan volumes facilitated under the company’s risk-taking model. Yiren Digital’s income tax expense for the quarter was RMB44.7 million (US$6.4 million), and net income decreased to RMB355.4 million (US$50.7 million) compared to RMB554.4 million in Q3 2023, driven by upfront provisions required by accounting principles.

- Cash Flow and Balance Sheet Position: Yiren Digital’s operating activities generated RMB50.4 million (US$7.2 million) in net cash during Q3 2024, a significant decrease from RMB645.4 million in the same period of 2023. The company used RMB1.86 billion (US$265.0 million) in investing activities, reflecting its ongoing strategic investments. Cash used in financing activities totaled RMB22.2 million (US$3.2 million), down from RMB502.6 million in Q3 2023. As of September 30, 2024, the company held cash and cash equivalents of RMB3.7 billion (US$528.1 million), a decrease from RMB5.5 billion at the end of Q2 2024, due to long-term investments in business expansion and potential acquisitions.

- Delinquency Rates and Dividend Policy: As of September 30, 2024, the delinquency rates for loans past due for 1-30 days, 31-60 days, and 61-90 days stood at 1.8%, 1.2%, and 1.2%, respectively, showing a slight improvement compared to the delinquency rates at the end of Q2 2024. In line with its semi-annual dividend policy, Yiren Digital distributed cash dividends in October 2024, representing 14% of earnings for the first half of 2024. The company also continued its share repurchase program, purchasing approximately 5.0 million ADSs for a total amount of US$16.5 million as of September 30, 2024.

- Fourth Quarter (Q4FY24) Outlook: Yiren Digital projects total revenue for the fourth quarter of 2024 to range between RMB1.3 billion and RMB1.5 billion, maintaining a healthy net profit margin. However, the company notes that this outlook is preliminary and subject to changes, depending on business and market conditions.

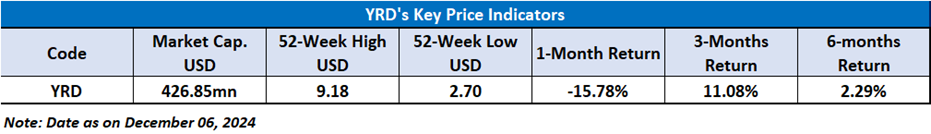

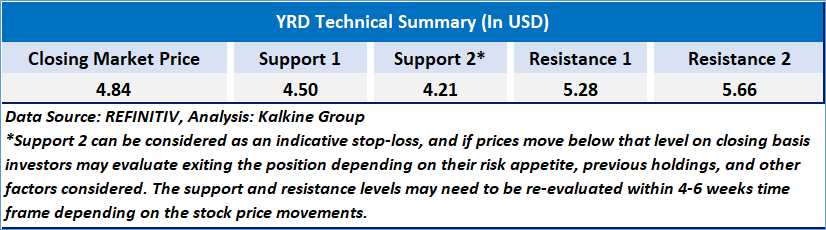

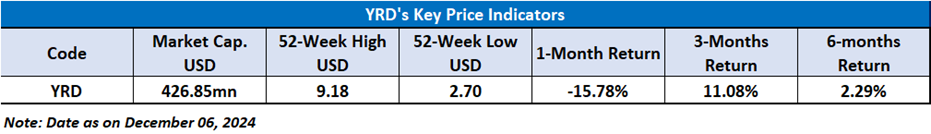

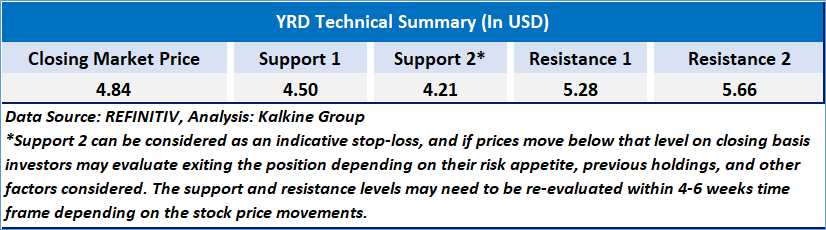

Technical Observation (on the daily chart):

YRD's stock price has demonstrated resilience at lower levels and is currently consolidating within a narrow range. A breakout to the upside could open the door to larger targets, suggesting further upward movement is possible. The 14-day Relative Strength Index (RSI) is currently below the midpoint but may be poised for an increase in the near future. Additionally, the stock price is trading below both its short-term and medium-term moving averages, indicating a potential retracement to these levels soon. Key support and resistance levels will play a crucial role in identifying potential trend reversals and continuations.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Yiren Digital Ltd (NYSE: YRD) at the closing market price of USD 4.84 as of December 06,2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 04, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...