The Mosaic Company

The Mosaic Company (NYSE: MOS) is a producer and marketer of concentrated phosphate and potash crop nutrients. The Company is a provider of phosphate and potash fertilizers and feed ingredients for the global agriculture industry. The Company operates through three segments: Phosphates, Potash and Mosaic Fertilizantes.

Recent Business and Financial Updates

- The Mosaic Company's First Quarter 2024 Performance: The Mosaic Company unveiled its first quarter 2024 results, reporting a net earnings figure of USD 45 million and an Adjusted EBITDA of USD 576 million. Notable highlights included the announcement of a transaction with Ma'aden valuing Mosaic's stake at approximately USD 1.5 billion, the completion of an 800,000 tonne MicroEssentials capacity conversion, and the return of 88% of free cash flow to shareholders.

- Financial Overview: In the first quarter, revenues amounted to USD 2.7 billion, marking a 26 percent decline from the year-ago period primarily due to lower selling prices. Despite this, the gross margin rate stood at 14.9 percent, down from 18.6 percent in the previous year. Net earnings for the quarter totaled USD 45 million, reflecting a decline from USD 435 million in the corresponding period last year. Adjusted EBITDA totaled USD 576 million, down from USD 777 million in the first quarter of 2023. Cash from operating activities was reported at USD (80) million, while free cash flow stood at USD 203 million, compared to USD 149 million and USD 191 million, respectively, in the prior year quarter.

- Segment Performance: Potash operating earnings in the first quarter amounted to USD 198 million, down from USD 402 million in the same period last year, while Adjusted EBITDA totaled USD 281 million, a decline from USD 474 million previously. Phosphate operating earnings stood at USD 40 million, compared to USD 266 million in the prior year period, with Adjusted EBITDA totaling USD 277 million, down from USD 382 million in the first quarter of 2023. Mosaic Fertilizantes reported operating earnings of USD 42 million, increasing from USD(32) million in the same quarter last year, with Adjusted EBITDA reaching USD 83 million, up from USD 3 million in the first quarter of 2023.

- Portfolio and Capital Allocation Highlights: Mosaic's strategic initiatives included the completion of high-return and low-capital-intensity projects, such as the MicroEssentials capacity conversion and the Esterhazy Hydrofloat project. Additionally, progress was noted in the company's cost reduction plan, targeting USD150 million in run rate cost reductions by the end of 2025. Mosaic returned USD 178 million of capital to shareholders through the first quarter of 2024, including share repurchases totaling USD 108 million.

- Market Outlook and Expectations: Agricultural fundamentals remained constructive, with expectations for continued pressure on grains and oilseeds stock-to-use ratios. The company anticipated a shift in weather patterns from El Nino to La Nina, which would create a favorable backdrop in certain regions. Despite global potash supply constraints, strong palm oil fundamentals were expected to drive demand recovery in Southeast Asia. The company provided modeling assumptions for full-year 2024, including total capital expenditures ranging from USD 1.1 to 1.2 billion, depreciation, depletion & amortization between USD 960 and 990 million, and selling, general, and administrative expenses between USD 470 and 500 million.

Technical Observation (on the daily chart):

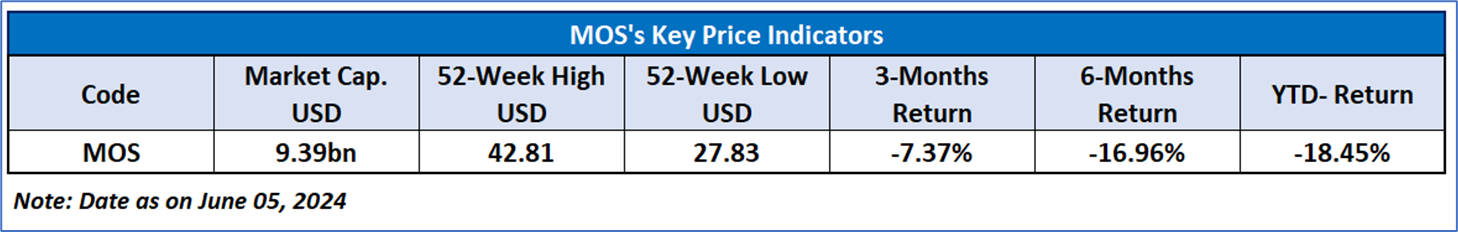

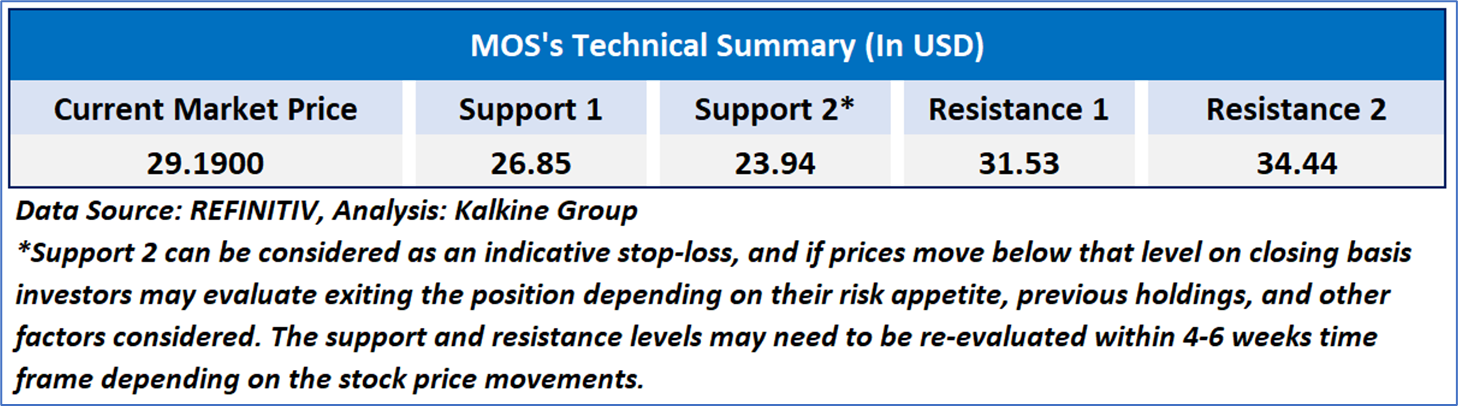

The Relative Strength Index (RSI) over a 14-day period stands at a value of 40.72, with expectations of a consolidation or an upward momentum, with expectations of bullish divergence. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels. The current price is near an important support zone of USD 27-USD 29, if sustains will lead to a reversal to higher resistance 2 levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Hold’ rating has been given to The Mosaic Company (NYSE: MOS) at the current market price of USD 29.19 as of June 05, 2024, at 07:10 am PDT.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is June 05, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...