State Street Corporation

Company Overview: State Street Corporation (NYSE: STT) is a financial holding company. The Company, through its subsidiary, State Street Bank and Trust Company (State Street Bank), provides a range of financial products and services to institutional investors. It operates through two lines of business: Investment Servicing and Investment Management.

As per our previous US Diversified Opportunities report published on ‘STT’ on 07th September 2023, Kalkine provided a ‘Buy’ stance on the stock at USD 69.86 based on “decent fundamentals, a correction in the stock price, industry above margins, upside indicated by the valuation, and key risks associated with the business” and the stock price has now moved by ~10.88% since then and the price is close to resistance 1 and resistance 2.

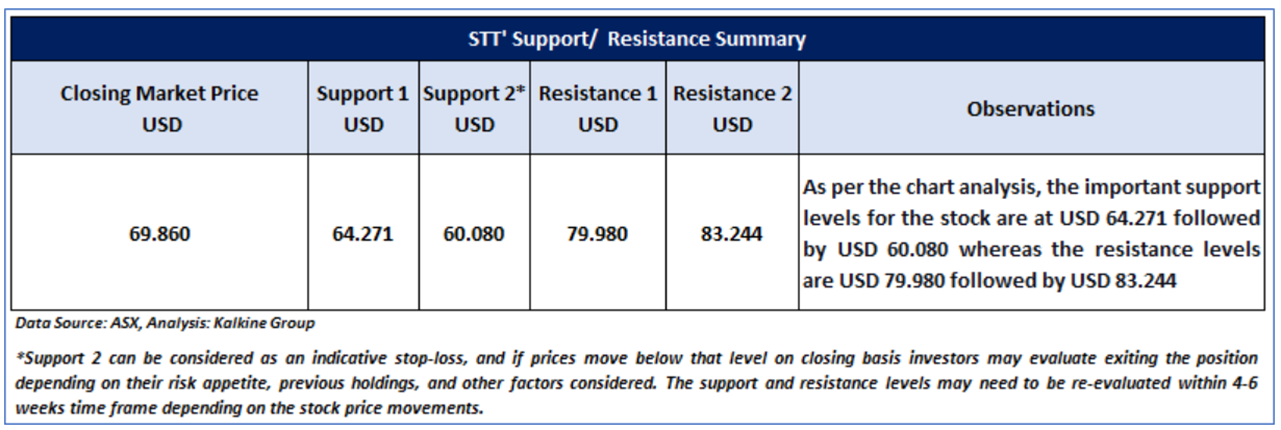

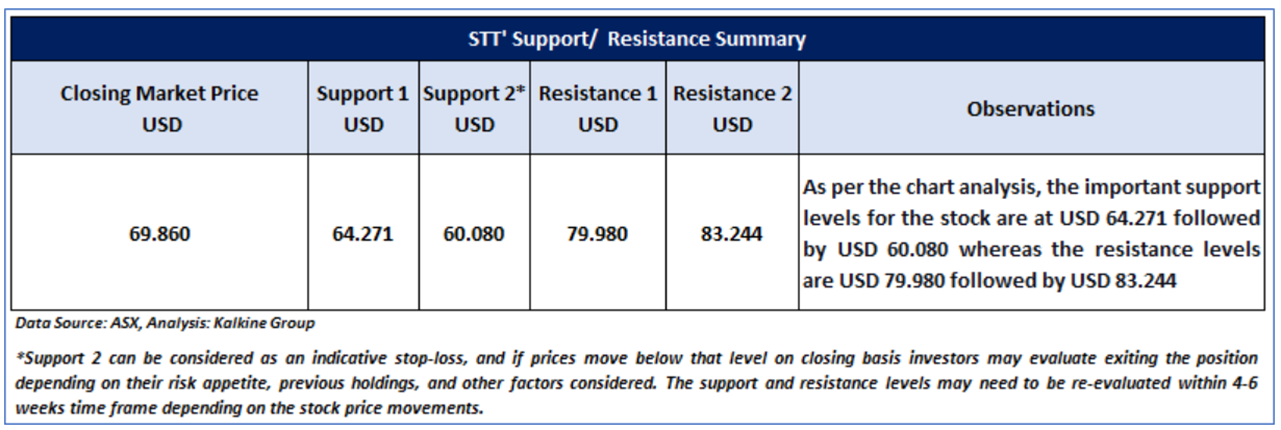

Noted below are the details of support and resistance levels provided in our previous report:

STT’s Daily Chart

Considering the resistance around the range of USD 75.00 – USD 80.00, close to resistance 1 and resistance 2 levels, current trading levels, risks associated, and volatile market conditions on the back of higher interest rates, a ‘Sell’ rating is assigned to the “STT” at the closing market price of USD77.46 (as of 29 December 2023).

Note: This report may be updated with details around fundamental and technical analysis, price/ chart in due course, as appropriate

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 29, 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.’

AU

Please wait processing your request...

Please wait processing your request...