Lucid Group Inc

Company Overview: Lucid Group, Inc. (NASDAQ: LCID) is a technology and automotive company. The Company is focused on designing, developing, manufacturing, and selling of electric vehicles (EV), EV powertrains and battery systems using its own equipment and factories. It offers its own geographically distributed retail and service locations and through direct-to-consumer online and retail sales.

As per our previous US Daily report published on ‘LCID’ on 08th April 2024, Kalkine provided an ‘Speculative Buy’ stance on the stock at USD 2.70 based on “decent fundamentals, higher shareholder’s return, associated risks, higher topline financials and profitability metrics, and valuation” and the stock price has now moved by ~55.18% since then and has attained resistance 1 and resistance 2.

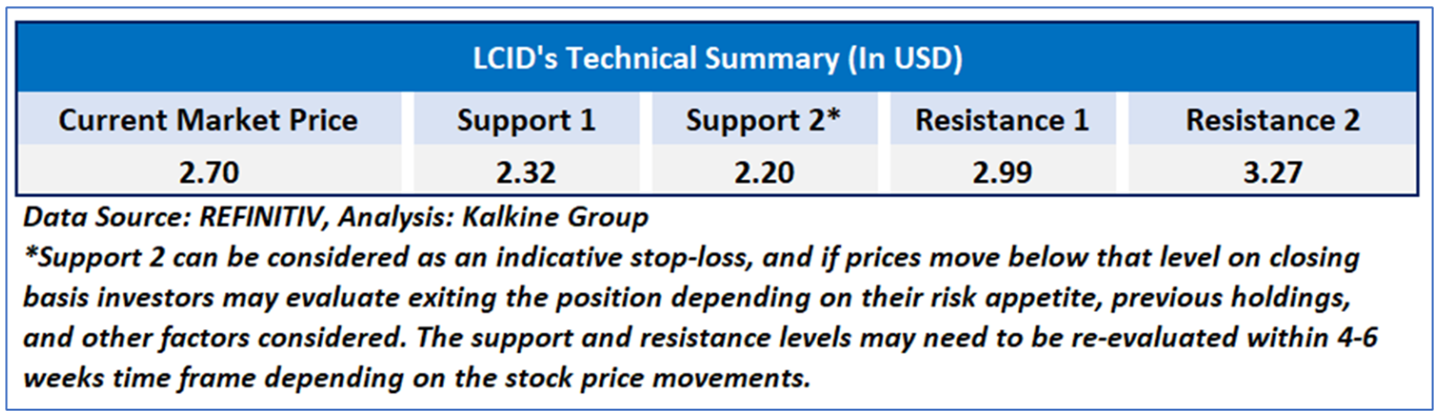

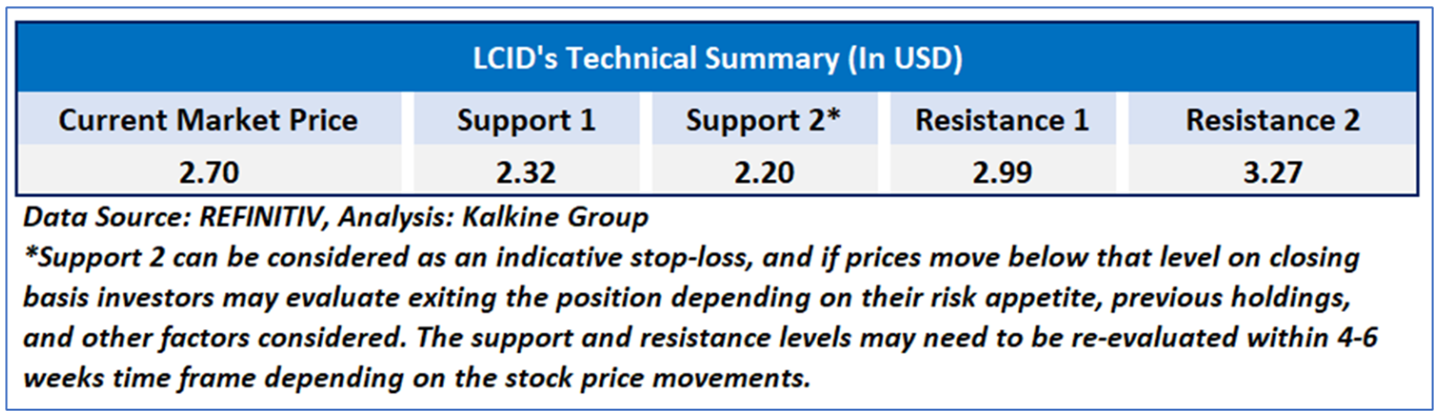

Noted below are the details of support and resistance levels provided in our previous report:

LCID’s Daily Chart

Considering the current trading levels, resistance 1 and resistance 2 attainment, RSI inside overbought levels, risks associated, and volatile market conditions on the back of higher interest rates, an ‘Sell’ rating is assigned to the “LCID” at the current market price of USD 4.19 (as of 12 July 2024, at 07:20 am PDT).

Note: This report may be updated with details around fundamental and technical analysis, price/ chart in due course, as appropriate

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is July 12, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.’

“Disclosure: Kalkine Equities LLC (Kalkine) Director Kunal Sawhney owns shares of Tesla Inc. since March 2024. Kalkine Equities LLC has covered Tesla Inc. in its report as general advice only. This information is provided for general informational purposes and should not be considered as personalized investment advice. Investors should conduct their own research and seek professional advice before making any investment decisions.”

AU

Please wait processing your request...

Please wait processing your request...