Sunrun Inc

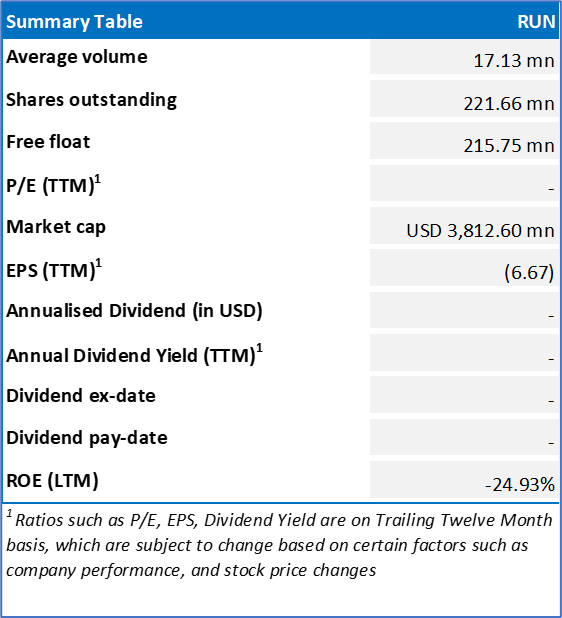

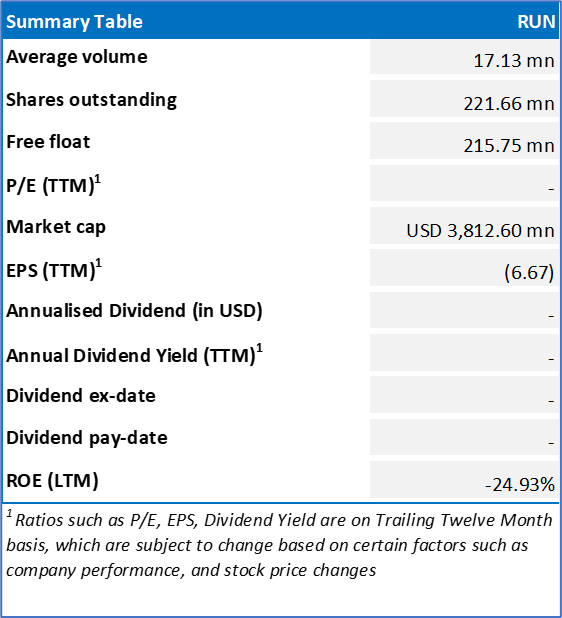

Sunrun Inc (NASDAQ: RUN) is a battery storage, home solar, and energy services company. Predominantly, it is engaged in designing, installation, selling, development, maintaining, and ownership of residential solar energy systems.

Rationale – Sell at USD 17.48

- Trading around Resistance: RUN’s stock price has breached the R2 level suggested in the previous report published on 25th June 2024. Considering the market conditions and the price action, there is a chance of a pullback from resistance levels.

- Declining Revenues: RUN’s revenue declined y-o-y by 22.31% in Q1 FY24 to USD 458.2 mn, compared to USD 589.8 mn in Q1 FY23. Subsequently, the company’s net margin of -61.8% in Q1 FY24 has underperformed relative to industry’s median of 4.7%.

- Lower Liquidity: RUN’s current ratio of 1.31x in Q1 FY24 was found lower vs industry’s median of 2.21x.

- Overvalued Multiples: On a forward 12-month basis – key trading multiples such as EV/EBITDA and EV/Sales are trading higher than the average of Renewable Energy sector.

- Macroeconomic Risk: The market sentiments can remain weak in the short-term due to the subdued consumer disposable income, geopolitical tensions, and political risks.

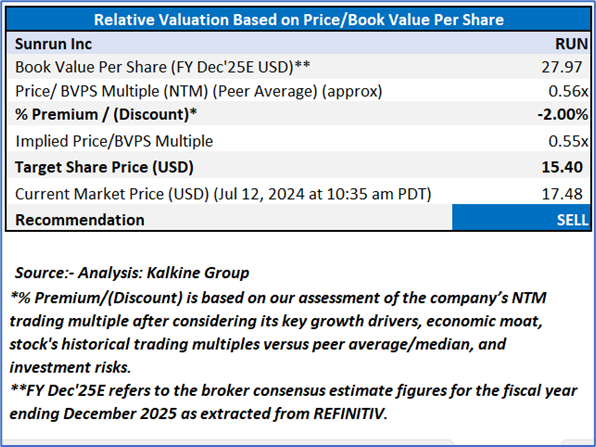

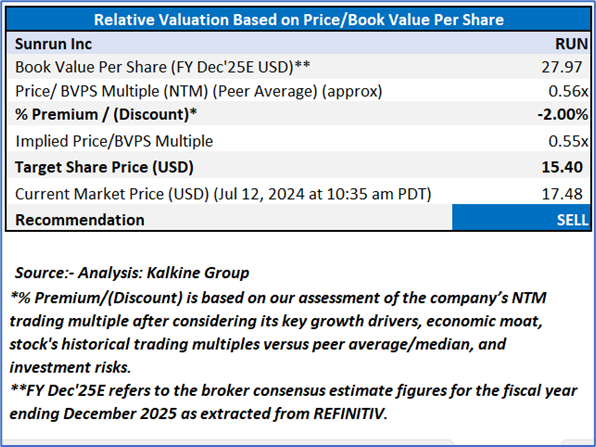

Valuation

RUN is expected to trade at a slight discount of 2%, based on its declining sequential revenue and downgraded liquidity measures relative to industry’s median. For conducting the valuation, the following peers have been considered: FuelCell Energy, Inc (NASDAQ: FCEL), Plug Power Inc (NASDAQ: PLUG), FTC Solar Inc (NASDAQ: FTCI), and Blink Charging Co (NASDAQ: BLNK).

Share Price Chart

RUN’s Daily Chart, Source: REFINITIV

Conclusion

Based on the current trading levels, declining revenues in Q1 FY24, lower liquidity than industry’s median, weaker margins compared to industry median and price action, a "SELL" recommendation on Sunrun Inc (NASDAQ: RUN) has been given at the current market price of USD 17.48 as of July 12, 2024 (10:35 am PDT).

Sunrun Inc (NASDAQ: RUN) is a part of Global Fully Charged Report.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.’

AU

Please wait processing your request...

Please wait processing your request...