Open Text Corporation

Open Text Corporation (NASDAQ: OTEX) is a Canada-based information management company, which provides software and services. Its comprehensive Information Management platform and services provide secure and scalable solutions for global companies, small and medium-sized businesses (SMBs), governments and consumers around the world.

Recent Business and Financial Updates

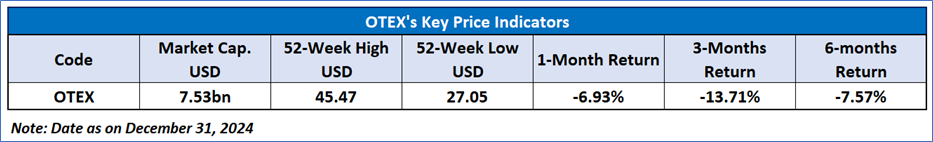

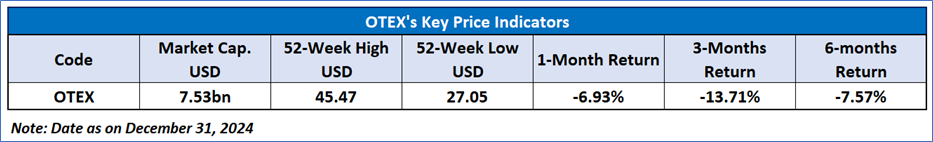

- First Quarter Financial Performance: OpenText reported total revenues of USD 1.27 billion in the first quarter of fiscal 2025, reflecting an 11.0% decline year-over-year (Y/Y). When adjusted for the AMC divestiture, the decline was reduced to 1.8%. Annual recurring revenues (ARR) reached USD 1.05 billion, a decrease of 8.4% Y/Y, or 1.1% on an adjusted basis. Cloud revenues exhibited growth, increasing by 1.3% Y/Y to USD 457 million, while enterprise cloud bookings rose significantly by 10.3% Y/Y to USD 133 million.

- Profitability and Cash Flow Overview: The company recorded GAAP-based net income of USD 84 million, equating to diluted earnings per share (EPS) of USD 0.32, up 6.7% Y/Y. Adjusted EBITDA for the quarter was USD 444 million, delivering a margin of 35.0% and exceeding the company’s internal targets. However, operating cash flows were negative at USD 78 million, and free cash flows amounted to a negative USD 117 million, impacted by a one-time tax payment related to the AMC divestiture.

- Shareholder Returns: OpenText continued to prioritize returning capital to shareholders by distributing USD 154 million during the quarter. This included USD 69 million in dividends and USD 85 million in share repurchases under the Fiscal 2025 Repurchase Plan. The plan authorizes the repurchase of up to USD 300 million of common shares through August 6, 2025.

- Key Business Achievements: The quarter was marked by several strategic accomplishments, including notable customer wins with organizations such as Alaska Airlines, Bombardier, and Raytheon Systems Limited. OpenText received recognition as a leader in IDC MarketScape: Worldwide Intelligent Content Services 2024 and was named one of TIME Magazine's World's Best Companies for the second consecutive year. Additionally, the company advanced its innovation strategy with AI-driven enhancements in DevSecOps and achieved FedRAMP® authorization for its IT Management Platform.

- Dividend Declaration: The Board of Directors declared a quarterly cash dividend of USD 0.2625 per common share, payable on December 20, 2024, to shareholders of record as of November 29, 2024. This declaration reflects OpenText’s continued commitment to returning value to its shareholders through consistent dividends.

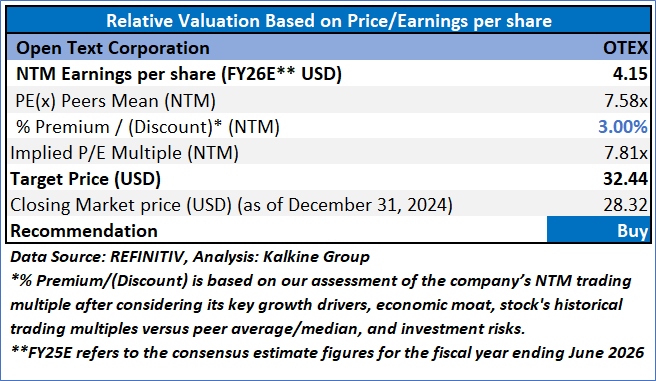

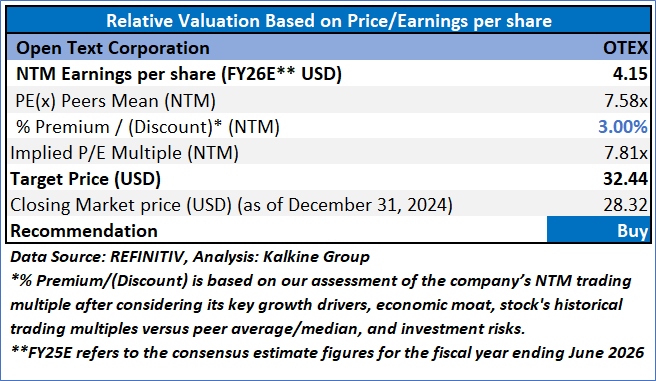

Valuation

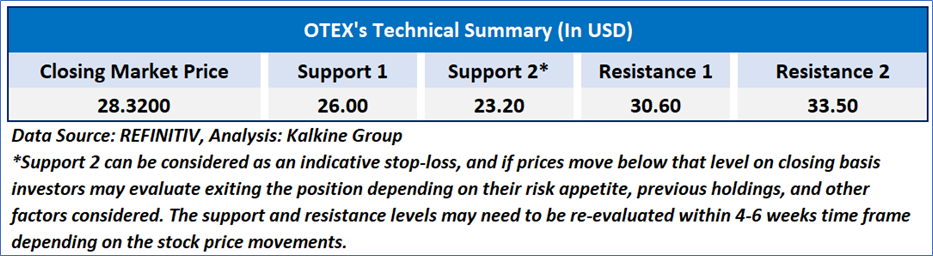

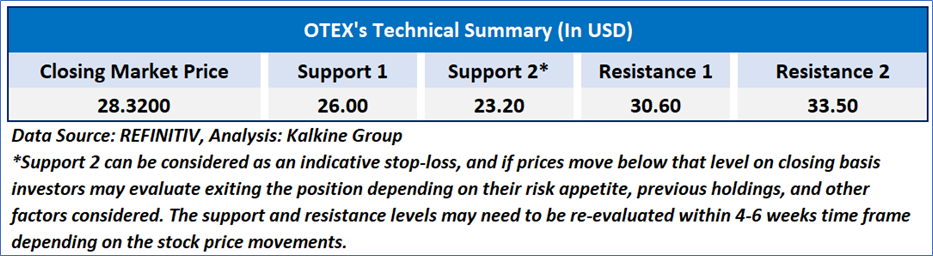

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 40.45, recovering from oversold zone, with expectations an upward momentum from the near important support zone of USD 27- USD 28. Additionally, the stock's current positioning is below both the 21-period SMA and 50-period SMA, which may serve as dynamic short to medium-term resistance levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, valuation upside potential and technical indicators analysis, a ‘Buy’ rating has been given for Open Text Corporation (NASDAQ: OTEX) at the closing market price of USD 28.32 as of December 31, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 31, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...