Baker Hughes Company

Baker Hughes Company (NASDAQ: BKR) is an energy technology firm offering a range of technologies and services across the energy and industrial sectors. The company operates in two main segments: Oilfield Services & Equipment (OFSE) and Industrial & Energy Technology (IET).

Recent Business and Financial Updates

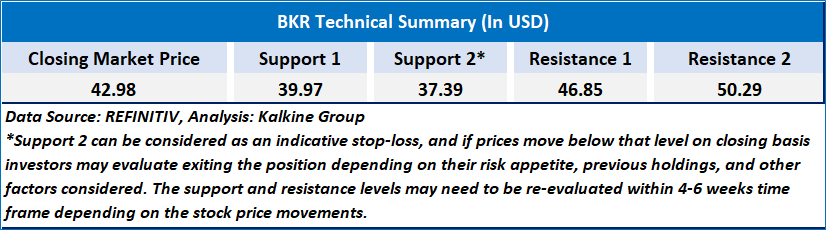

- Key Financial Results: Baker Hughes Company reported robust financial results for the third quarter of 2024, highlighting continued operational excellence and growth. The company achieved USD 6.7 billion in orders, with the Industrial & Energy Technology (IET) segment contributing USD 2.9 billion. Total revenue for the quarter reached USD 6.9 billion, reflecting a 4% increase compared to the previous year. Attributable net income amounted to USD 766 million, a 48% year-over-year rise, while adjusted earnings per share (EPS) came in at USD 0.67, a 59% increase from the prior year. Adjusted EBITDA surged by 23%, reaching USD 1.2 billion, driven by pricing and productivity gains across both segments.

- IET Segment Performance: The IET segment demonstrated a solid performance despite a decline in orders, which fell by 34% year-over-year to USD 2.9 billion. This drop was primarily driven by a significant reduction in Gas Technology Equipment (GTE) orders, which were down 61%. Revenue in this segment, however, increased by 9% year-over-year, totalling USD 2.9 billion. Notable contributors to this growth included strong demand for Climate Technology Solutions and a 6% year-over-year increase in Gas Technology revenues. The IET segment also posted impressive operating income of USD 474 million, up 37% compared to the third quarter of 2023, and EBITDA of USD 528 million, reflecting a 31% year-over-year increase.

- OFSE Segment Performance: The Oilfield Services & Equipment (OFSE) segment reported a slight decline in orders of USD 3.8 billion, down 9% from the previous year. However, OFSE revenue remained stable year-over-year at USD 3.96 billion, marking a minimal sequential decline of 1%. The segment benefited from solid pricing and productivity, particularly in its Subsea & Surface Pressure Systems product line, which saw a 20% increase in revenue compared to the previous year. Operating income for OFSE reached USD 547 million, an 18% increase from the prior year, while segment EBITDA stood at USD 765 million, up 14% year-over-year, further indicating the segment's operational efficiency.

- EBITDA and Margin Expansion: The company’s overall EBITDA reached a record USD 1.2 billion, reflecting a 7% sequential increase and a 23% year-over-year gain. This was driven by continued pricing improvements across both segments, along with successful cost-out initiatives. The company also saw substantial margin expansion, with total adjusted EBITDA margins increasing to 17.5%, the highest since Baker Hughes' formation. This performance reflects the ongoing operational discipline and focus on cost management that has been a key priority for the company.

- Cash Flow Generation: Baker Hughes demonstrated strong cash flow generation during the quarter, with operating cash flow reaching USD 1.01 billion. Free cash flow totalled USD 754 million, a 27% year-over-year increase. The company also returned USD 361 million to shareholders through a combination of dividends and share repurchases, underscoring its commitment to returning capital to investors while maintaining a solid balance sheet.

- IET Achievements in Gas and Climate Technologies: The IET segment continued to deliver notable achievements in its Gas Technology and Climate Technology Solutions businesses. IET secured a landmark Integrated Compressor Line (ICL) award from Dubai Petroleum Establishment, marking the largest ICL order in the company's history. The order involves supplying 10 units for the Margham Gas storage facility, which will support Dubai’s energy grid by improving the flexibility of its natural gas and solar energy systems. Additionally, the IET Gas Technology Services (GTS) business secured a multi-decade contract for an LNG facility in the Middle East, further solidifying the company's presence in the energy transition space.

- Strategic Collaborations and Innovation: Baker Hughes continues to advance its digital and decarbonization capabilities. The company launched CarbonEdge, an innovative digital solution powered by Cordant™, which provides real-time data and alerts on carbon dioxide (CO2) flows across carbon capture, utilization, and storage (CCUS) infrastructure. This new solution aims to help operators mitigate risks and improve decision-making in their decarbonization efforts. Additionally, Baker Hughes expanded the use of its Leucipa™ intelligent field production solution with a major global operator in the Permian Basin, optimizing production through real-time field orchestration.

- Outlook: The company’s operational discipline remains a key driver of its growth, with both segments making significant progress toward their long-term EBITDA margin targets. Baker Hughes remains confident in achieving its full-year EBITDA guidance midpoint, with a stable outlook and continued momentum in key markets. The company’s diversified portfolio, strong recurring revenue streams, and reduced exposure to cyclicality position it well for long-term success.

- Sustainability Partnership: Baker Hughes (NASDAQ: BKR) and SOCAR have announced the signing of a contract for an integrated gas recovery and hydrogen sulfide (H2S) removal system aimed at significantly reducing downstream flaring at SOCAR’s Heydar Aliyev Oil Refinery in Baku, Azerbaijan. The contract was finalized during COP29 in Baku, with Baker Hughes Chairman and CEO Lorenzo Simonelli and SOCAR President Rovshan Najaf in attendance. This collaboration underscores both companies' commitment to improving environmental performance and reducing emissions in the region

Technical Observation (on the daily chart):

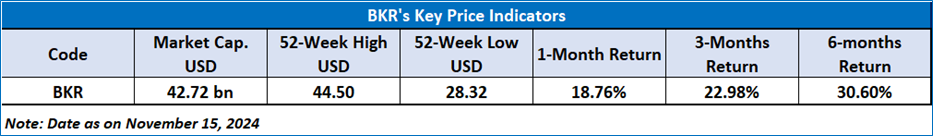

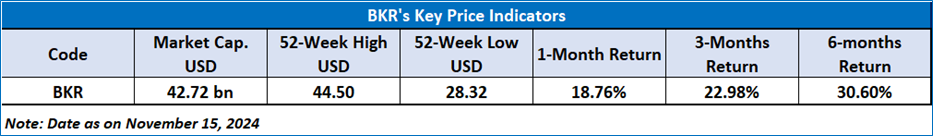

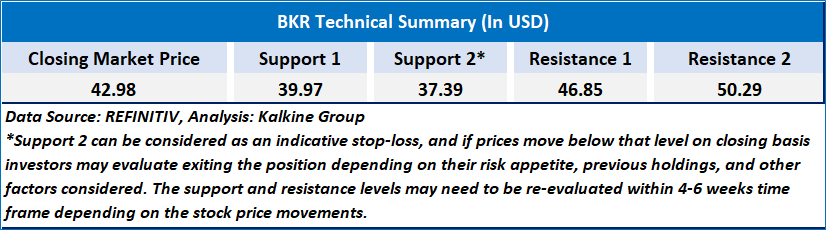

ASML's stock price recently closed at 42.98, finding support at key levels of 39.97 and 37.39. Resistance is seen at 46.85 and 50.29. The 14-day Relative Strength Index (RSI) stands at 71.23, indicating the potential for a short-term pullback, which could pave the way for a subsequent upward move. Moreover, both the 21-day and 50-day Simple Moving Averages (SMAs) are positioned below the current price, providing additional support and reinforcing the bullish sentiment.

As per the above-mentioned price action, recent key business and financial updates, price momentum over one month, and technical indicators analysis, a ‘WATCH’ rating has been given to Baker Hughes Company (NASDAQ: BKR) at the current market price of USD 42.98 as of November 18,2024 at 06:43 AM PDT.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is November 18, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...