Patterson-UTI Energy Inc

Patterson-UTI Energy, Inc. (NASDAQ: PTEN) is a provider of drilling and completion services to oil and natural gas exploration and production companies in the United States and other select countries, including contract drilling services, integrated well completion services and directional drilling services in the United States. The Company operates through three segments: Drilling Services, Completion Services, and Drilling Products.

Recent Business and Financial Updates

- First Quarter 2024 Financial Results and Key Highlights

- Revenue and Net Income: For the first quarter of 2024, Patterson-UTI reported total revenue of USD 1.5 billion. Net income attributable to common stockholders was USD 51 million, or USD 0.13 per share, which includes USD 12 million in merger and integration expenses. Excluding these expenses, the adjusted net income attributable to common stockholders was USD 61 million, or USD 0.15 per share. The company also reported an adjusted EBITDA of USD 375 million, excluding merger and integration expenses.

- Cash Flow and Shareholder Returns: Cash from operations amounted to USD 366 million, and free cash flow was USD 139 million. The company achieved its annualized synergy target of USD 200 million from the NexTier merger. In the first quarter, Patterson-UTI returned USD 130 million to shareholders, confirming its expectation to return at least USD 400 million to shareholders in 2024. This included USD 98 million used to repurchase 9 million shares, resulting in a 4% reduction of post-transaction shares outstanding since the NexTier merger and Ulterra acquisition. The company has USD 945 million remaining in share repurchase authorization and declared a quarterly dividend of USD 0.08 per share, payable on June 17, 2024, to holders of record as of June 3, 2024.

- Drilling Services:

- Segment Performance: In the first quarter, Drilling Services revenue totaled USD 458 million, with an adjusted gross profit of USD 186 million, in line with prior guidance. U.S. Contract Drilling revenue was USD 393 million, with an adjusted gross profit of USD 178 million. The segment saw a slightly higher rig count, offsetting lower revenue per day, with U.S. operating days totaling 11,024. The average rig revenue per operating day was USD 35,680, and adjusted gross profit per operating day was USD 16,170.

- As of March 31, 2024, term contracts for U.S. drilling rigs projected future dayrate drilling revenue of approximately USD 527 million. The company expects an average of 70 rigs operating under term contracts in the second quarter of 2024, and 41 rigs on average over the following year.

- International and Directional Drilling: Other Drilling Services revenue, including International Contract Drilling and Directional Drilling, was USD 64 million with an adjusted gross profit of USD 8 million.

- Completion Services: Completion Services revenue for the first quarter was USD 945 million, with an adjusted gross profit of USD 199 million. The segment saw a sequential decline in activity, primarily in natural gas basins, but remained at the high end of guidance due to cost controls and synergy capture from the NexTier merger. Despite market slowdowns, financial performance was steady, with strong returns from natural gas-powered assets.

- Drilling Products: First quarter Drilling Products revenue was USD 90 million, with an adjusted gross profit of USD 41 million. Revenue grew sequentially, driven by Ulterra's International operations. Adjusted gross profit improved, reflecting strong market penetration. Temporary increases in direct operating costs and depreciation expenses were noted due to purchase price accounting for the Ulterra acquisition.

- Outlook:

- Future Activity: Patterson-UTI anticipates steady drilling and completion activity in oil basins, with potential increases in rig counts later in the year based on current oil prices. Natural gas basin activity is expected to stabilize at second-quarter levels through year-end.

- Segment Projections:

- Drilling Services: Expected to operate an average of 114 U.S. rigs in the second quarter, with a slight decline in adjusted gross profit per operating day.

- Completion Services: Expected revenue of approximately USD 860 million in the second quarter, with USD 690 million in direct operating costs and an adjusted gross profit of around USD 170 million.

- Drilling Products: Projected steady performance with growth in international operations offsetting seasonal declines.

- Other Revenue: Expected to remain flat compared to the first quarter.

- Expenses: The company expects second quarter selling, general, and administrative expenses of approximately USD 65 million, and depreciation, depletion, amortization, and impairment expenses of about USD 265 million.

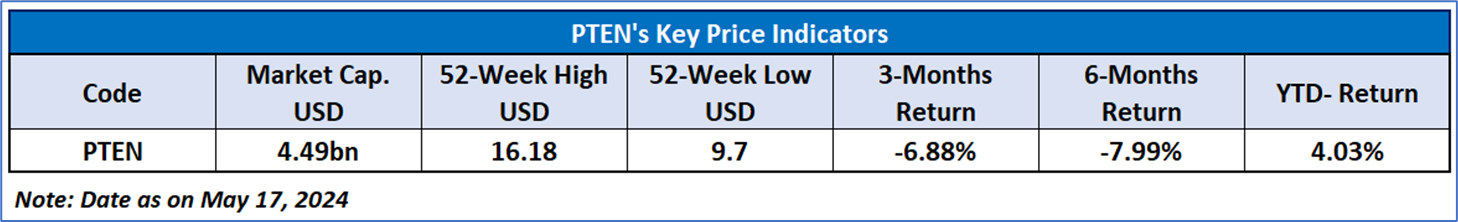

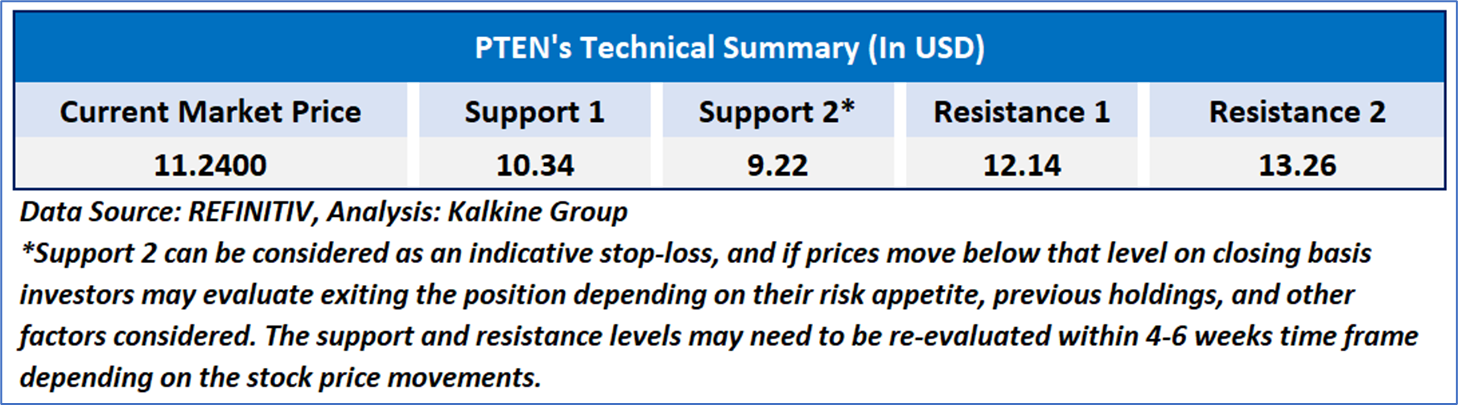

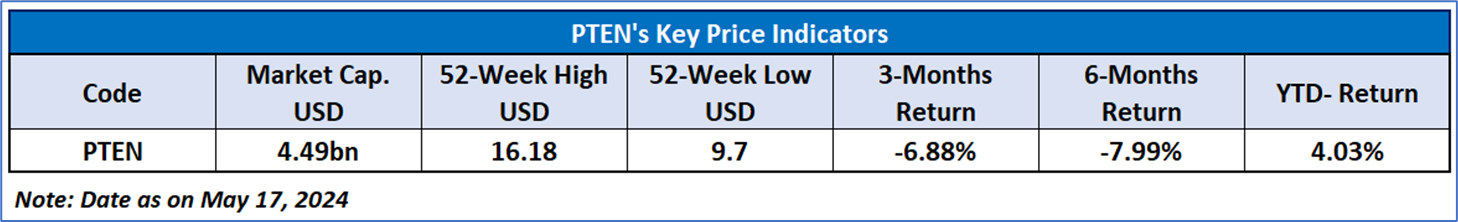

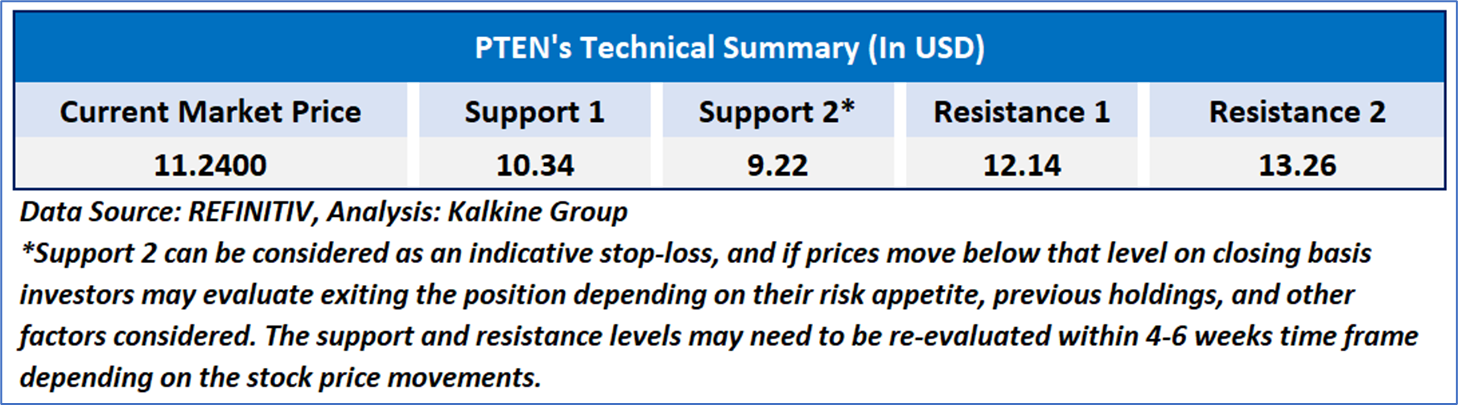

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands upward trending with value of 51.54, with expectations of a consolidation or an upward momentum. Additionally, the stock's current positioning is between both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support and resistance levels respectively.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Patterson-UTI Energy, Inc. (NASDAQ: PTEN) at the current market price of USD 11.24 as of May 17, 2024, at 08:30 am PDT.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is May 17, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...