Super Micro Computer

Super Micro Computer (NASDAQ: SMCI) specializes in delivering application-optimized total IT solutions. The company provides accelerated compute platforms, which include server and storage systems tailored for specific applications. These solutions cater to diverse markets such as enterprise data centers, cloud computing, artificial intelligence (AI), 5G technology, and edge computing.

Positive Growth Prospects

- Record Growth in Net Sales and Revenue Expansion: Supermicro demonstrated remarkable growth in fiscal year 2024, achieving net sales of $14.94 billion, more than doubling from $7.12 billion in fiscal year 2023. The fourth quarter alone saw net sales rise to $5.31 billion, a significant improvement from $3.85 billion in the prior quarter and $2.18 billion in the same quarter last year. This exceptional performance underscores the company's ability to meet the increasing demand for AI infrastructure and data center solutions.

- Strong Earnings Growth and Profitability: The company's profitability reflected its strong operational performance, with fiscal year 2024 net income surging to $1.21 billion, up from $640 million in fiscal year 2023. Non-GAAP diluted earnings per share rose impressively to $22.09, an 87% year-over-year increase, further showcasing Supermicro's ability to scale efficiently and maintain high margins amid growing demand.

- Technological Leadership and Strategic Investments: Supermicro continues to strengthen its market position through innovative technologies like rack-scale DLC liquid cooling and Datacenter Building Block Solutions. These advancements align well with the company's expansion efforts in Malaysia and Silicon Valley, enhancing its supply chain security, economies of scale, and ability to cater to the growing AI revolution.

- Future Growth Projections and Stock Split: The company's fiscal year 2025 projections are promising, with anticipated net sales of $26.0 billion to $30.0 billion and robust earnings per share growth. Additionally, the Board of Directors approved a 10-for-1 forward stock split, expected to increase the stock's liquidity and accessibility to a broader investor base.

Growth Challenges

- Declining Gross Margins: Despite record sales, Supermicro's gross margin has declined, dropping from 17.0% in Q4 FY2023 to 11.2% in Q4 FY2024. This downward trend was also evident quarter-over-quarter, with Q3 FY2024 gross margins at 15.5%. This indicates potential pricing pressure or rising costs that could impact profitability in the future.

- Cash Flow Challenges: The company reported cash flow used in operations of $635 million in Q4 FY2024, reflecting cash management challenges despite strong revenue growth. Combined with capital expenditures of $27 million, this raises concerns about the company's ability to fund future growth without impacting its financial stability.

- Increased Debt Levels: As of June 30, 2024, Supermicro's total debt, including bank debt and convertible notes, stood at $2.17 billion, exceeding its total cash and cash equivalents of $1.67 billion. This elevated debt level may pose risks if interest rates rise or if the company faces unforeseen financial pressures.

- Earnings Decline Quarter-over-Quarter: While net income and EPS have improved year-over-year, Q4 FY2024 showed a decline in net income to $353 million from $402 million in Q3 FY2024. Similarly, diluted earnings per share dropped from $6.56 in Q3 FY2024 to $5.51 in Q4 FY2024, indicating a possible slowdown in earnings momentum.

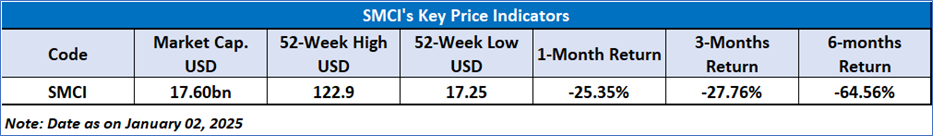

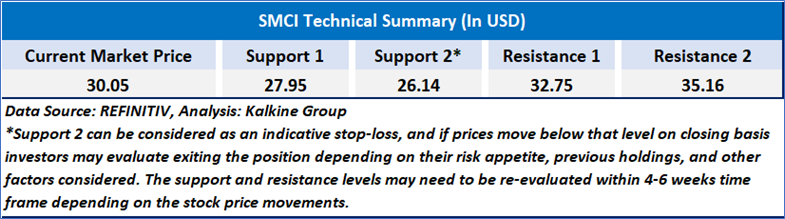

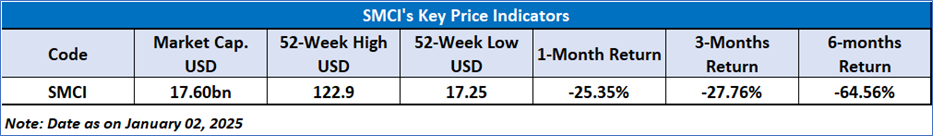

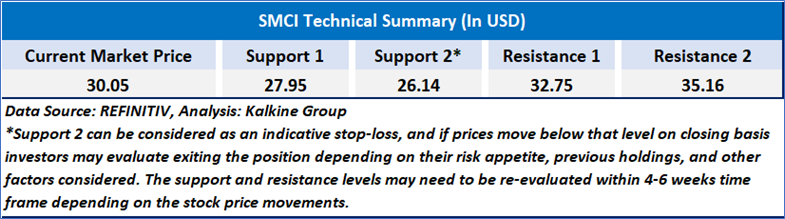

Technical Observation (on the daily chart):

The stock reached a high in April, followed by a consistent downtrend, indicating bearish momentum. The 21-day (yellow) moving average remains below the 50-day (blue) moving average, confirming the ongoing downtrend. Recent price action shows the stock consolidating between $30 and $35, potentially forming a base. The RSI (Relative Strength Index) at 34 is approaching oversold territory, suggesting a possible short-term rebound. Volume levels are relatively subdued, except for occasional spikes, indicating lower trading activity and waning investor interest. A breakout above the 50-day MA or further RSI improvement could signal a reversal.

Supermicro's performance in fiscal year 2024 showcases impressive revenue growth, doubling year-over-year to $14.94 billion, driven by surging demand for AI infrastructure and innovative technologies. However, this growth is tempered by challenges, including declining gross margins, reduced quarterly earnings, and cash flow pressures, with operational cash outflows of $635 million in Q4. While strategic investments in Malaysia and Silicon Valley strengthen long-term prospects, rising debt levels and margin compression highlight potential risks. Overall, the company is well-positioned for growth but must address these financial and operational challenges to sustain its momentum.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Watch’ rating has been given to Super Micro Computer (NASDAQ: SMCI) at the closing market price of USD 30.05 as of January 02,2025.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 02,2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...