Baidu Inc

Baidu Inc (NASDAQ: BIDU) is a Chinese language Internet search provider. The Company offers a Chinese language search platform on its Baidu.com Website that enables users to find information online, including Webpages, news, images, documents and multimedia files, through links provided on its Website. The Company operates through two segments, Baidu Core segment and iQIYI segment.

Recent Financial and Business Updates:

- Baidu, Inc. disclosed its intention to unveil financial results for the Fourth Quarter and Fiscal Year 2023 concluded on December 31, 2023. The announcement is scheduled to occur before the commencement of the U.S. market on February 28, 2024. Subsequently, Baidu's management will conduct an earnings conference call at 7:30 AM on February 28, 2024, U.S. Eastern Time (8:30 PM on February 28, 2024, Beijing Time). Investors and stakeholders anticipate insights into Baidu's financial performance during this reporting period.

- Operational Milestones and Corporate Initiatives: Baidu, a prominent technology company, achieved significant operational milestones and implemented strategic corporate initiatives during the reported period. Notably, the introduction of ERNIE 4.0 (EB4) in October 2023 marked a pivotal advancement, providing users access via ERNIE Bot and the cloud API for enterprise clients. Additionally, the company executed a shareholder-friendly approach by returning USD 126 million in Q3 2023, aggregating to an impressive cumulative repurchase of USD 351 million under the ongoing share repurchase program. Demonstrating a commitment to ethical technology practices, Baidu established the Technology Ethics Committee in October 2023.

- Intelligent Driving Success and Ride-Hailing Growth: Baidu's foray into intelligent driving witnessed remarkable success, notably with its autonomous ride-hailing service, Apollo Go. In Q3 2023, Apollo Go delivered 821K rides, reflecting a substantial 73% year-over-year increase. The cumulative rides provided to the public reached a noteworthy 4.1 million as of September 30, 2023, underscoring Baidu's leadership in the autonomous transportation sector.

- Mobile Ecosystem Expansion and Revenue Contributions: Baidu's mobile ecosystem exhibited robust growth, with Baidu App achieving 663 million Monthly Active Users (MAUs) in September 2023—a 5% year-over-year increase. Within this ecosystem, Managed Page played a pivotal role, contributing 53% to Baidu Core's online marketing revenue during the third quarter of 2023.

- iQIYI's Performance Metrics in Entertainment Domain: The entertainment arm of Baidu, iQIYI, reported noteworthy performance metrics. The average daily number of total subscribing members for the quarter stood at an impressive 107.5 million. Additionally, the Monthly Average Revenue per Membership (ARM) witnessed a substantial 12% year-over-year increase, reaching RMB 15.54.

- Financial Highlights for Q3 2023: Baidu's financial performance for the third quarter of 2023 reflected positive growth. Total revenues reached RMB 34.4 billion (USD 4.72 billion), marking a commendable 6% year-over-year increase. Within Baidu Core, revenue rose to RMB 26.6 billion (USD 3.64 billion), with a robust operating income of RMB 5.5 billion (USD 754 million) and a solid operating margin of 21%. The non-GAAP operating income for Baidu Core was RMB 6.7 billion (USD 914 million), boasting a non-GAAP operating margin of 25%.

- Liquidity and Financial Position: As of September 30, 2023, Baidu maintained a strong financial position, with cash, cash equivalents, restricted cash, and short-term investments totaling RMB 202.7 billion (USD 27.78 billion). The company reported a free cash flow of RMB 6.0 billion (USD 822 million), excluding iQIYI, further affirming its financial resilience.

- Appointment of Independent Director and Leadership Addition: A noteworthy recent development included the appointment of Ms. Sandy Ran Xu as an independent director of the Board of Directors, effective from January 1, 2024. Ms. Xu, currently serving as CEO of JD.com, brings valuable expertise, having previously served as CFO of JD.com and possessing an extensive background in auditing with PricewaterhouseCoopers.

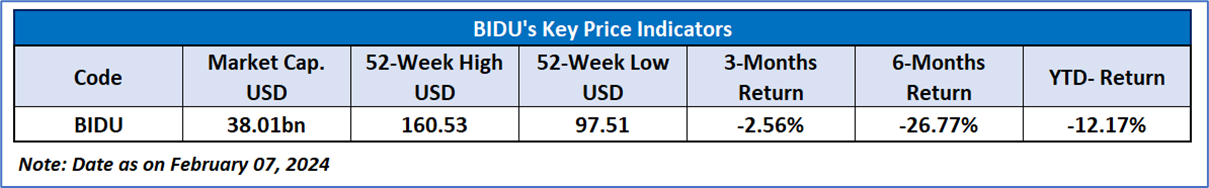

Technical Observation (on the daily chart)

The Relative Strength Index (RSI), calculated over a 14-day span, stands at 43.88, currently recovering from the oversold zone, signifying the likelihood of either more consolidation or a brief surge soon. Adding to this, the stock presently finds itself positioned below both the 21-day and 50-day Simple Moving Averages (SMA), which could function as a dynamic short-term resistance levels. Now, the stock's price hovers around a crucial support range of USD 95.00 to USD 105.00, with an anticipation of an impending upward shift originating in case of a support from these support levels as the price is also showing expectations of a bullish divergence on the daily time frame.

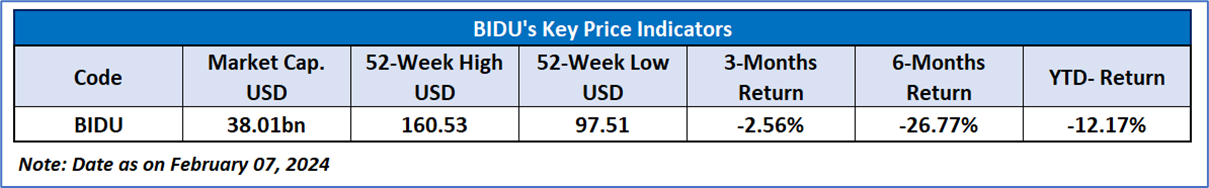

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Baidu Inc (NASDAQ: BIDU) at the current market price of USD 104.81, as of February 07, 2024, at 06:45 am PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

How to Read the Charts?

The yellow colour line reflects the 21-period simple moving average (SMA) while the blue line indicates the 50- period simple moving average (SMA). SMA helps to identify existing price trends. If the prices are trading above the 21-period and 50-period moving average, then it shows prices are currently trading in a bullish trend.

The orange colour line in the chart’s lower segment reflects the Relative Strength Index (14-Period) which indicates price momentum and signals momentum in trend. A reading of 70 or above suggests overbought status while a reading of 30 or below suggests an oversold status.

The red and green colour bars in the chart’s lower segment show the volume of the stock. The volume is the number of shares that changed hands during a given day. Stocks with high volumes are more liquid than stocks with lesser volume as liquidity in stocks helps with easier and faster execution of the order.

The Orange colour lines are the trend lines drawn by connecting two or more price points and used for trend identification purposes. The trend line also acts as a line of support and resistance.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Abbreviations

CMP: Current Market Price

SMA: Simple Moving Average

RSI: Relative Strength Index

USD: United States dollar

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is February 07, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: The report publishing date is as per the Pacific Time Zone.

AU

Please wait processing your request...

Please wait processing your request...