Tesla Inc

Tesla, Inc. (NASDAQ: TSLA) designs, develops, manufactures, sells and leases high-performance fully electric vehicles and energy generation and storage systems, and offers services related to its products. The Company's segments include automotive, and energy generation and storage. The automotive segment includes the design, development, manufacturing, sales and leasing of high-performance fully electric vehicles, and sales of automotive regulatory credits.

Recent Business and Financial Updates

- Record Production and Deliveries in Q4 2024: In the fourth quarter of 2024, Tesla achieved significant milestones with approximately 459,000 vehicles produced and over 495,000 vehicles delivered, setting new records for both metrics. This quarter's performance included the production of 436,718 Model 3/Y vehicles and 22,727 units of other models, with deliveries reaching 471,930 and 23,640, respectively. The strong delivery numbers reflect a 5% and 6% application of operating lease accounting for Model 3/Y and other models, respectively. For the entire year of 2024, Tesla produced a total of 1,773,443 vehicles and delivered 1,789,226, underscoring the company’s robust production and delivery capabilities.

- Energy Storage and Upcoming Financial Results: Tesla also achieved a record deployment of 11.0 GWh of energy storage products in the fourth quarter, contributing to a total of 31.4 GWh for the year 2024. This highlights Tesla’s ongoing commitment to expanding its energy storage solutions. The company plans to release its financial results for Q4 2024 after market close on January 29, 2025. Following the release, Tesla management will host a live question and answer webcast at 4:30 p.m. Central Time (5:30 p.m. Eastern Time) to discuss the financial and business performance, as well as the outlook for the future.

- Financial Performance: In the third quarter of 2024, Tesla reported impressive financial results, achieving USD 2.7 billion in GAAP operating income and USD 2.2 billion in GAAP net income, alongside USD 2.5 billion in non-GAAP net income. The company achieved record vehicle deliveries for the quarter, showing both sequential and year-over-year growth. Tesla also recorded its second-highest regulatory credit revenues, reflecting the slower compliance of other OEMs with emissions standards. Notably, the cost of goods sold (COGS) per vehicle reached a record low of USD 35,100, highlighting Tesla's continued focus on cost efficiency.

- Operational Highlights: Tesla remains dedicated to accelerating the transition to sustainable energy, focusing on making electric vehicles (EVs) more affordable and competitive with other modes of transportation in terms of total cost of ownership. The company is on track to launch new, more affordable models in the first half of 2025. During the "We, Robot" event in October, Tesla unveiled its vision for offering autonomous transport at a lower cost per mile than rideshare, personal vehicle ownership, and public transit. The energy division also reported strong performance, achieving record gross margins and milestones such as producing 200 Megapacks in a single week at the Lathrop Megafactory and recording the highest Powerwall deployments for the second consecutive quarter.

- Cash Flow and Investments: Tesla reported USD 6.3 billion in operating cash flow and USD 2.7 billion in free cash flow for the third quarter, contributing to a USD 2.9 billion increase in cash and investments, now totaling USD 33.6 billion. The company continues to focus on leveraging the energy transition, investing in AI projects, expanding production capacity, and diversifying its vehicle and energy product lineup.

- Automotive and Energy Progress: Tesla's production and delivery volumes returned to year-over-year growth, with the company producing its 7-millionth vehicle in October. The successful ramp-up of the refreshed Model 3 helped lower COGS and boost production. The Cybertruck achieved sequential production growth and positive gross margins for the first time. In China, Tesla’s Shanghai factory reached significant milestones, including the production of its 3-millionth vehicle and the export of its 1-millionth vehicle. In Europe, the Model Y became the best-selling EV of all time in Norway and the top-selling vehicle in Europe for September.

- Technological Advancements: Tesla expanded its AI training compute capacity by over 75% in the third quarter, launched FSD (Supervised) V12 with improved safety and functionality, and introduced features such as "Actually Smart Summon." The company also unveiled its Cybercab and Robovan vehicles, designed for autonomy, with a highly efficient powertrain achieving 5.5 miles per kWh. Additionally, Tesla produced its 100-millionth 4680 battery cell and made significant advancements in dry-cathode manufacturing processes.

- Outlook: Tesla expects modest growth in vehicle deliveries in 2024 despite macroeconomic challenges, with energy storage deployments anticipated to more than double year-over-year. The launch of new, affordable vehicles in 2025, leveraging the next-generation platform, is expected to further drive growth. Tesla remains focused on balancing cost efficiency, maintaining a robust balance sheet, and advancing innovations in AI, software, and fleet-based profits to complement its hardware business.

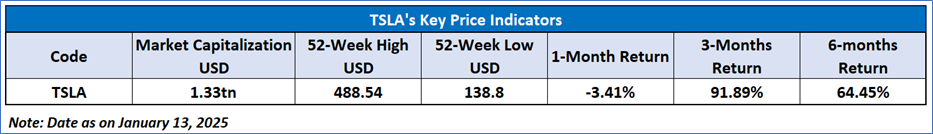

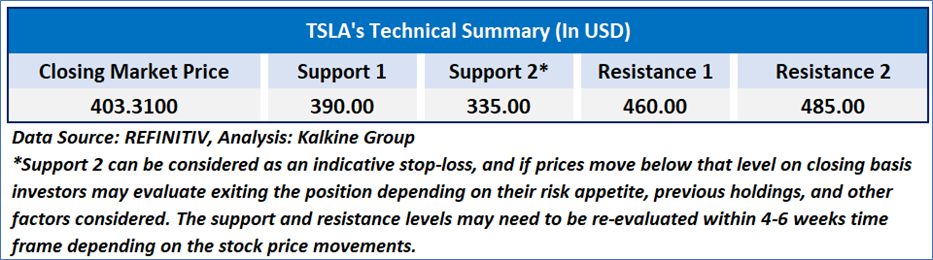

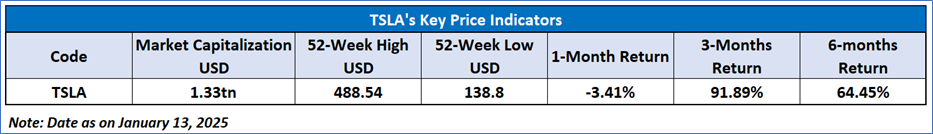

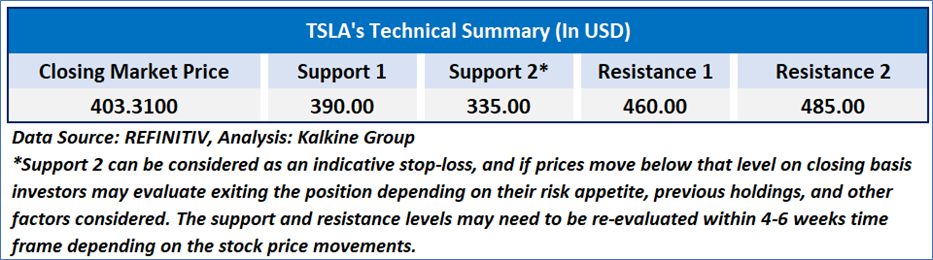

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 51.14, recovering from overbought zone, with expectations an upward momentum from the near important support zone of USD 360-USD 400. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given for Tesla, Inc. (NASDAQ: TSLA) at the closing price of USD 403.31, as of January 13, 2025.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 13, 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...