Baker Hughes Company

Baker Hughes Company (NASDAQ: BKR) is an energy technology company with a portfolio of technologies and services that span the energy and industrial value chain. The Company operates in two segments: Oilfield Services & Equipment (OFSE) and Industrial & Energy Technology (IET). OFSE segment provides products and services for onshore and offshore oilfield operations across the lifecycle of a well, ranging from exploration, appraisal, and development, to production, rejuvenation, and decommissioning.

Recent Business and Financial Updates

- Earnings Release Schedule: Baker Hughes announced it will release its fourth-quarter and full-year 2024 financial results on January 30, 2025, at 5 p.m. Eastern Time, followed by a webcast to discuss the results on January 31, 2025, at 9:30 a.m. Eastern Time. The webcast will be accessible through the company’s investor relations website, with a recorded version available post-event.

- Third-Quarter Financial and Operational Highlights: Baker Hughes Company reported strong performance for the third quarter of 2024, marked by orders totaling USD 6.7 billion, including USD 2.9 billion from the Industrial & Energy Technology (IET) segment. The Remaining Performance Obligation (RPO) reached USD 33.4 billion, with a record USD 30.2 billion attributed to IET. Revenue for the quarter was USD 6.9 billion, reflecting a 4% increase year-over-year. The company achieved a net income attributable to Baker Hughes of USD 766 million, with GAAP diluted earnings per share (EPS) at USD 0.77 and adjusted diluted EPS at USD 0.67. Adjusted EBITDA reached USD 1,208 million, a 23% increase compared to the prior year, while cash flows from operating activities stood at USD 1,010 million, and free cash flow amounted to USD 754 million. Returns to shareholders during the quarter totaled USD 361 million, including USD 152 million in share repurchases.

- Record-Setting Operational Performance: Chairman and CEO Lorenzo Simonelli emphasized the company’s record-setting adjusted EBITDA margins of 17.5%, the highest since its inception. He attributed the performance to operational excellence across both segments, improved pricing, and disciplined cost management. Simonelli highlighted IET’s consistent order momentum and strategic wins, including the largest Integrated Compressor Line (ICL) award to date from Dubai Petroleum Establishment and FPSO projects in Angola and Latin America. These achievements demonstrate the company’s ability to provide critical energy infrastructure solutions while advancing sustainability goals.

- Segment Contributions and Technological Advancements: Industrial & Energy Technology (IET) secured significant contracts across gas infrastructure and Floating Production Storage and Offloading (FPSO) projects, leveraging its advanced compression solutions. A notable multi-decade agreement for LNG facility maintenance in the Middle East underscored the segment's ability to offer long-term, value-driven services. Oilfield Services & Equipment (OFSE) also delivered robust results, strengthening partnerships with Petrobras and securing strategic contracts in the Santos Basin and Australia’s Cooper Basin. The company further advanced digital innovation with the launch of CarbonEdge™, a comprehensive solution for optimizing carbon capture, utilization, and storage (CCUS) projects, and expanded adoption of its Leucipa™ production optimization platform.

- Revenue and Operating Income Analysis: Total revenue for the quarter amounted to USD 6.9 billion, with the IET segment achieving a 9% year-over-year increase driven by strong order activity. Operating income, as per GAAP, was USD 930 million, representing a 30% year-over-year increase. Adjusted operating income and adjusted EBITDA showed similar growth trends, supported by improved pricing, higher volume in the IET segment, and structural cost reductions. These gains were partially offset by inflationary pressures and unfavorable business mix.

- Financial Strength and Strategic Outlook: The company ended the quarter with a RPO of USD 33.4 billion, reflecting stable long-term demand across its portfolio. Income tax expense was reported at USD 235 million, and other non-operating income totaled USD 134 million, driven by gains in equity investments. Free cash flow for the quarter reached USD 754 million, underscoring strong operational cash generation. Baker Hughes remains committed to shareholder returns, evidenced by continued share repurchases and dividends.

- Sustained Progress and Future Confidence: Simonelli reiterated the company’s confidence in achieving its full-year EBITDA guidance midpoint and progressing toward the long-term target of 20% EBITDA margins across segments. He credited Baker Hughes’ lifecycle service offerings, diversified portfolio, and strategic cost improvements for making the company less cyclical and capable of delivering consistent earnings and free cash flow. He concluded by emphasizing the strength of the company’s culture and its ability to execute its strategic vision effectively.

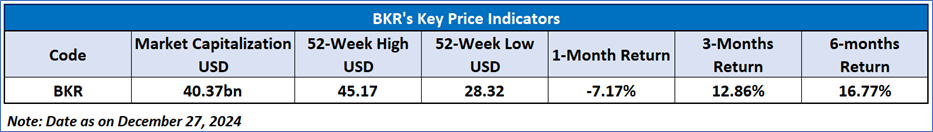

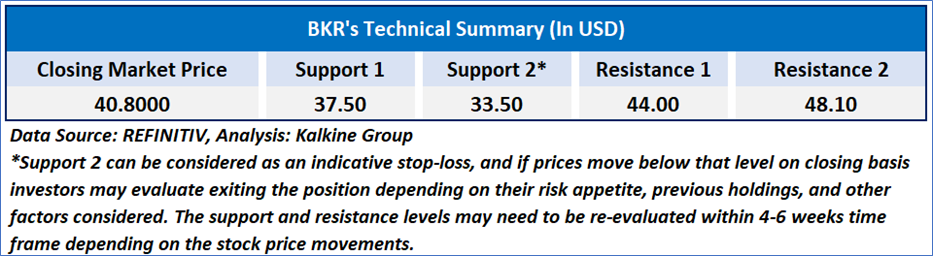

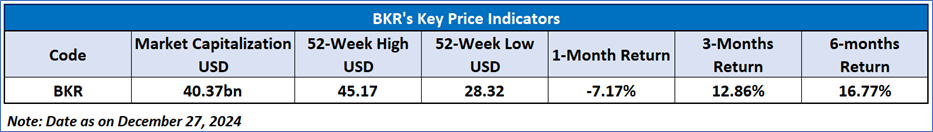

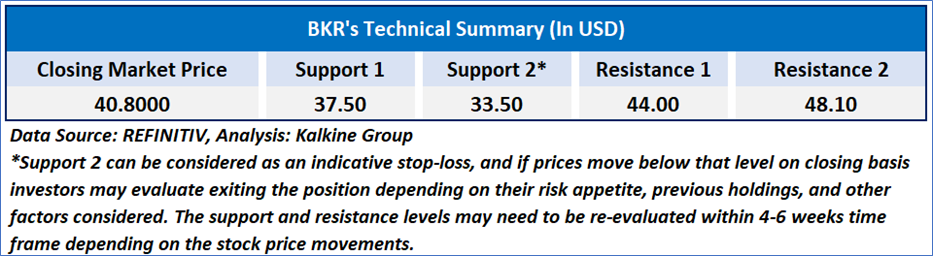

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 45.19, currently recovering, with expectations an upward momentum from the near important support zone of USD 38.00-USD 40.00. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given for Baker Hughes Company (NASDAQ: BKR) at the closing market price of USD 40.80 as of December 27, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 27, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...