Uranium Royalty Corp.

Uranium Royalty Corp (NASDAQ: UROY) is a company specializing in uranium royalties and streaming. Its strategy revolves around gaining exposure to uranium price fluctuations by making targeted investments in uranium assets, such as royalties, streams, debt, and equity in uranium companies, as well as holding physical uranium. The company’s portfolio includes a diverse range of uranium projects, such as Anderson, Church Rock, Cigar Lake/Waterbury Lake, Dawn Lake, Dewey-Burdock, Energy Queen, Lance, Langer Heinrich, McArthur River, Michelin, Reno Creek, and others.

Recent Business and Financial Updates

- At-the-Market Equity Program: The Company entered into the 2023 Distribution Agreement on August 8, 2023, establishing an at-the-market (ATM) equity program. Under this agreement, the Company was permitted to distribute up to US$40 million (or the equivalent in Canadian dollars) of common shares to the public. The program was terminated on September 1, 2024. On August 29, 2024, the Company renewed the ATM Program, enabling it to distribute up to US$39 million (or equivalent) of shares through agents, at its discretion, until the earlier of the full amount being raised or August 20, 2025. No ATM shares were distributed during the three-month period ending July 31, 2024.

- Physical Uranium Holdings and Sales: As of July 31, 2024, the Company held a total of 2,711,271 pounds of U3O8 at a weighted average cost of US$57.54 per pound. As of the date of this report, the holdings have slightly reduced to 2,701,271 pounds, with a higher weighted average cost of US$60.12 per pound. In 2024, the Company made several significant transactions involving physical uranium. In August 2024, the Company sold 160,000 pounds of U3O8 for approximately $18.0 million at a price of US$83.50 per pound. Additionally, agreements were made to purchase and sell further quantities of uranium, with scheduled deliveries and payments extending into late 2024 and 2025.

- Property Developments and Updates: Several of the Company’s underlying properties saw notable developments during the period. For instance, Cameco Corporation disclosed that Cigar Lake's production reached 5.3 million pounds of uranium during the second quarter of 2024, reflecting an increase from the previous year. Production expectations for 2024 remain at 18.0 million pounds. Similarly, the McArthur River/Key Lake operations reported higher production compared to the previous year, with a total of 6.2 million pounds produced in the second quarter of 2024. Other notable developments include the ongoing ramp-up at the Langer Heinrich mine in Namibia and Peninsula Energy Ltd.'s updated production plans for the Lance project in Wyoming.

- Strategic Asset Acquisitions and Partnerships: Uranium Royalty Corp. has significantly grown its portfolio through strategic acquisitions and partnerships. The company holds interests in high-potential uranium projects across Canada, the United States, and Namibia, including royalties on the Cigar Lake and McArthur River projects, as well as a 1% gross overriding royalty on the Russell Lake/Russell Lake South projects in the Athabasca Basin. In 2018, the company entered a strategic agreement with Yellow Cake plc, granting an option to acquire up to US$21.25 million of U3O8 by 2028 and access to uranium-related royalty and streaming opportunities. In 2024, the company made key acquisitions, including a 0.375% net smelter returns royalty on Spain’s Salamanca project for $0.7 million and a 6% gross overriding royalty on a portion of the Churchrock uranium project for $4.9 million. These acquisitions enhance Uranium Royalty Corp.'s exposure to key uranium production regions, strengthening its position in the sector.

- Financial Performance During Q1 FY24: For the three months ended July 31, 2024, the Company reported a net loss of $2.2 million, a significant increase compared to the net loss of $1.0 million recorded for the same period in the previous fiscal year. This increase in net loss was primarily driven by higher office and administration expenses, a shift in deferred income tax from a recovery of $0.5 million in the three months ended July 31, 2023, to an expense of $0.1 million in the current quarter. These factors were partially offset by a reduction in professional fees, insurance, transfer agent, and regulatory fees, as well as an increase in interest income by $0.2 million.

- Increase in Office and Administration Expenses: Office and administration expenses surged to $1.4 million in the three months ended July 31, 2024, compared to $0.4 million in the same period of 2023. This increase was primarily due to higher investor communications and marketing expenses, which amounted to $0.9 million in the current quarter, up from $0.1 million in the prior fiscal year. Additionally, uranium storage fees rose to $0.4 million from $0.2 million in the previous year. The rise in these expenses was attributable to more extensive marketing activities and a higher volume of uranium inventories during the quarter.

- Professional Fees and Insurance Expenses: The Company incurred professional fees and insurance costs of $0.3 million in the three months ended July 31, 2024, compared to $0.5 million during the same period in the previous fiscal year. These fees primarily cover audit, legal, and insurance-related expenses. The decrease in these costs was driven by reduced professional service fees in the current quarter.

- Interest Income and Foreign Exchange Loss: The Company recognized interest income of $0.2 million during the three months ended July 31, 2024, primarily generated from the net proceeds of a public offering completed in February 2024. This compared to a negligible amount of interest income in the same period of 2023. Additionally, the Company reported a foreign exchange loss of $0.1 million in both the three months ended July 31, 2024, and 2023. This loss primarily stemmed from the translation of U.S. dollar-denominated accounts receivable.

- Deferred Tax Expense and Comprehensive Income Loss: The Company recognized a deferred tax expense of $0.1 million in the three months ended July 31, 2024, compared to a deferred tax recovery of $0.5 million in the same period of the prior fiscal year. This recovery was due to the recognition of deferred tax assets resulting from non-capital losses carry forward and deferred financing costs, which were used to offset deferred tax liabilities. The decrease in the recovery was mainly due to a decline in the fair value of short-term investments.

During the same period, the Company recorded a loss under comprehensive income of $1.3 million on the revaluation of short-term investments, compared to a gain of $4.0 million in the prior year. This change was due to a decrease in the fair value of the common shares of Queen's Road Capital Investment Ltd. (QRC). Short-term investments are measured at fair value based on the quoted share price in the market.

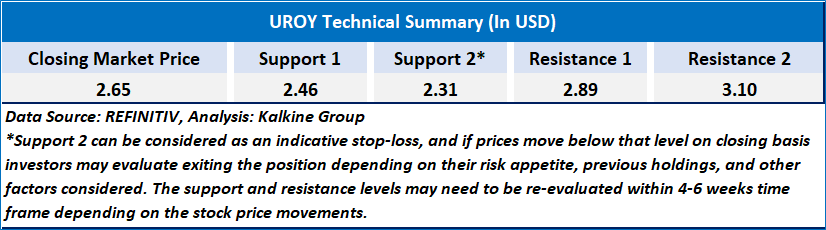

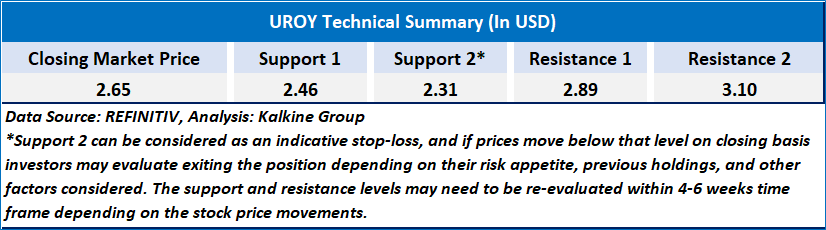

Technical Observation (on the daily chart):

On the daily charts, UROY is holding above a critical horizontal support level, with a bullish candlestick pattern suggesting potential for further upward movement. The positive momentum is reinforced by increased trading volumes, indicating strong buying interest. The Relative Strength Index (RSI) at 54.76 signals continued bullish momentum without reaching overbought conditions. The 21-period and 50-period Simple Moving Averages (SMAs) lie below the current price, offering dynamic support. Key support levels are USD 2.38 and USD 2.54, while resistance levels are USD 2.98 and USD 3.19.

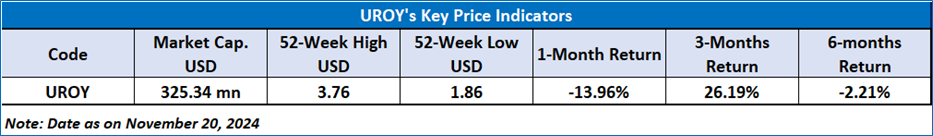

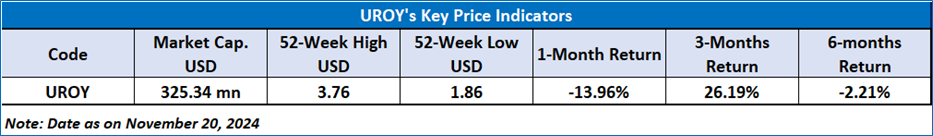

As per the above-mentioned price action, recent key business and financial updates, price momentum over one month and technical indicators analysis, a ‘Speculative Buy’ rating has been given to Uranium Royalty Corp (NASDAQ: UROY) at the closing market price of USD 2.65 as of November 20,2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is November 20,2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...