Coinbase Global, Inc

Coinbase Global, Inc (NASDAQ: COIN) is a holding company that operates Coinbase, Inc. and other subsidiaries. It provides a platform for users to engage in various crypto activities such as trading, staking, storing, and spending crypto assets. The company serves three customer groups: consumers (retail users), institutions (businesses and financial organizations), and developers (builders of decentralized applications and products).

Recent Business and Financial Updates

- Revenue Performance: For the three months ended September 30, 2024, total revenue surged by 79% to $1.2 billion, compared to $674.1 million in the same period of 2023. Similarly, revenue for the nine months increased by 99%, reaching $4.3 billion, up from $2.15 billion in 2023. The impressive growth was primarily driven by a substantial rise in transaction revenue, subscription and services revenue, and other revenue, all of which contributed to the overall revenue expansion.

- Transaction Revenue Growth: Transaction revenue experienced remarkable growth, increasing by 98% to $572.5 million for the three months ended September 30, 2024, compared to $288.6 million in 2023. For the nine months, transaction revenue soared by 145%, reaching $2.43 billion, up from $990.4 million in 2023. This growth was largely attributed to a 209% and 176% rise in consumer trading volume for the respective periods, although offset somewhat by a lower blended fee rate. Institutional transaction revenue also saw significant gains, reflecting a 132% and 123% increase in trading volume, as well as higher fees due to the increased usage of the Prime Brokerage product.

- Subscription and Services Revenue Expansion: Subscription and services revenue saw an impressive 66% increase for the three months ended September 30, 2024, amounting to $556.1 million, up from $334.4 million in 2023. Over the nine-month period, subscription and services revenue grew by 62%, reaching $1.67 billion, compared to $1.03 billion in 2023. The growth was driven by higher stablecoin revenue, blockchain rewards, and interest and finance fee income. Additionally, the launch of new products and the growth of Coinbase One paid subscribers played a significant role in the revenue uplift.

- Revenue Growth and Profitability: Coinbase reported significant revenue growth for Q3 2024, driven by diverse streams such as transaction fees, subscriptions, and services. Total revenue reached $1.1 billion for the quarter, reflecting a 81% increase compared to the previous year. This was complemented by a substantial improvement in net income, climbing to $75.5 million from a loss in Q3 2023, showcasing a robust rebound in financial performance.

- Diversification of Revenue Streams: The company continues to diversify its revenue sources, including gains from stablecoin-related activities, blockchain rewards, and institutional services. Subscription and services revenue grew to $556.1 million, reflecting increased adoption of blockchain rewards programs and USDC-related transactions. This strategic expansion into multiple revenue streams has reinforced Coinbase's financial stability.

- Active User Base and Trading Volumes: Coinbase's active user base, measured by Monthly Transacting Users (MTUs), expanded to 7.8 million, an increase influenced by higher crypto market activity and user engagement with USDC rewards programs. Trading volumes surged to $185 billion, underscoring heightened customer engagement amidst favorable market conditions.

- Operational Efficiency and Cost Management: Operating expenses exhibited effective management, with restructuring efforts from prior periods contributing to streamlined operations. Although marketing expenses rose due to enhanced digital advertising efforts, the company leveraged its growing revenue to maintain overall financial health. These actions highlight Coinbase's commitment to balancing growth and cost control.

- Strategic Acquisitions: Coinbase's acquisition of One River Digital Asset Management (ORDAM) for $96.8 million marked a strategic move to enhance its institutional offerings. The deal was financed through a mix of cash and equity, with goodwill attributed to synergies, market presence, and assembled workforce benefits.

- Cash Flow and Liquidity: Net cash provided by operating activities reached $1.59 billion, reflecting robust liquidity. While significant investments were made to enhance infrastructure and crypto-related assets, the company maintained strong financial flexibility to support ongoing operations and growth initiatives.

- Outlook and Challenges: Looking ahead, Coinbase remains focused on driving revenue growth and advocating for regulatory clarity. Despite ongoing legal and regulatory challenges, including disputes with the SEC over its staking programs, the company has demonstrated resilience. Continued investment in compliance and innovation will likely be pivotal in navigating the evolving crypto landscape

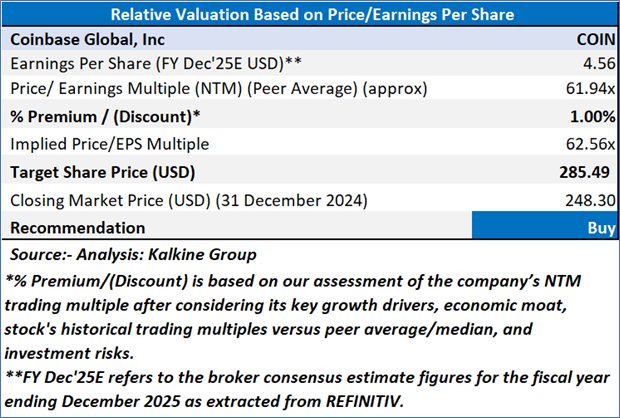

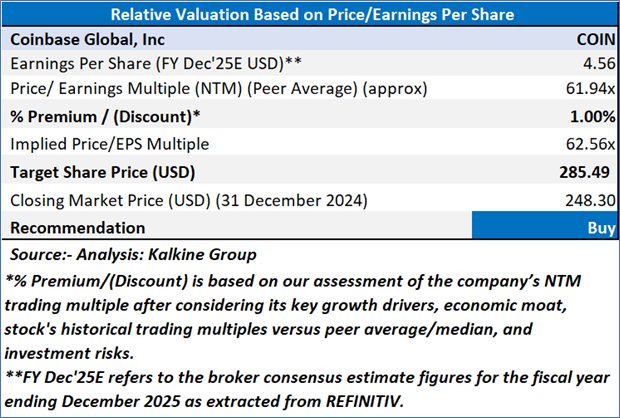

Valuation Methodology (using P/E Approach)

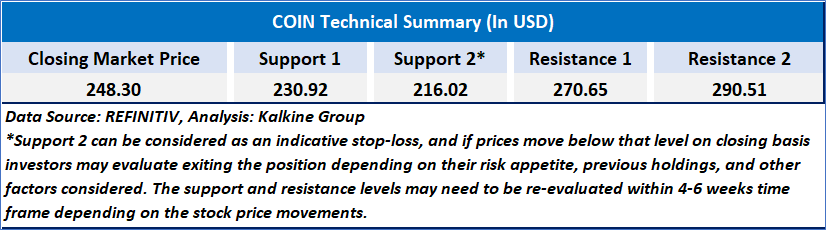

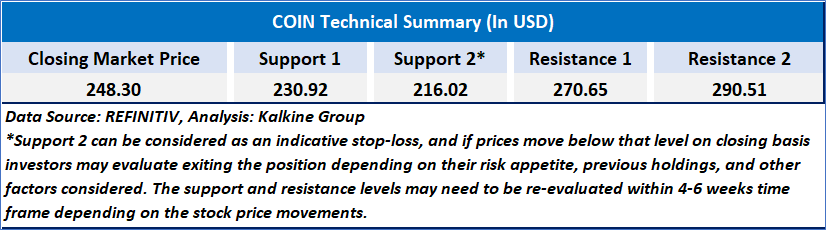

Technical Observation (on the daily chart):

COIN's stock price is currently situated near critical support levels, which could indicate a potential reversal and an opportunity for upward movement. The 14-day Relative Strength Index (RSI) is below the midpoint, suggesting a possible pullback that might set the stage for a rally. Additionally, the 50-day Simple Moving Average (SMA) is above the stock price, implying that a retracement to this level could occur in the near term.

Coinbase demonstrated strong financial performance in Q3 2024, with an 81% revenue increase to $1.1 billion and a significant rebound to $75.5 million in net income. The company showcased its resilience by diversifying revenue streams, achieving growth in subscription services, and expanding its active user base to 7.8 million. Strategic initiatives, including the acquisition of ORDAM, bolstered institutional offerings, while effective cost management and robust operating cash flow of $1.59 billion highlighted financial stability and liquidity. These positive developments position Coinbase for sustained growth in the dynamic crypto economy.

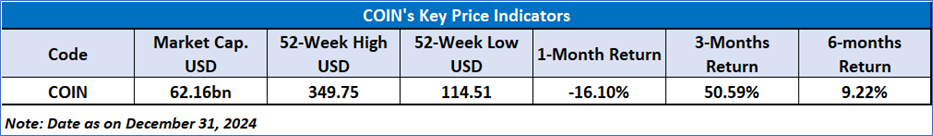

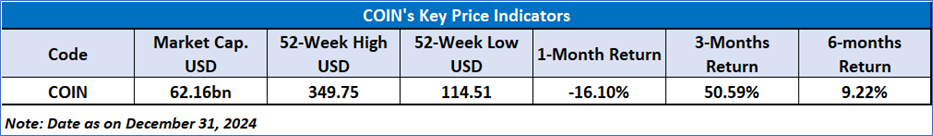

As per the above-mentioned price action, recent key business and financial updates, and technical indicators analysis, a ‘Buy’ rating has been given to Coinbase Global, Inc (NASDAQ: COIN) at the closing market price of USD 248.30 as of December 31,2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 31,2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...