Bitfarms Ltd

Bitfarms Ltd. (NASDAQ: BITF) is a Canada-based global vertically integrated bitcoin mining company. The Company develops, owns, and operates vertically integrated mining farms with in-house management and Company-owned electrical engineering, installation service, and multiple onsite technical repair centers. The Company’s proprietary data analytics system delivers operational performance and uptime. The Company operates through the cryptocurrency mining segment.

Recent Business and Financial Updates

- Strategic Acquisition and Expansion: Bitfarms has successfully assumed control of its first mega-site located in Sharon, Pennsylvania, which provides access to up to 120 megawatts (MW) of power. As part of this strategic acquisition, the company has secured 110 MW, with 30 MW anticipated to become operational by the end of 2024. In addition, Bitfarms has signed a Letter of Intent for an additional 10 MW site, expected to bring the total capacity to 120 MW by 2025. These developments underscore Bitfarms’ ongoing commitment to expanding its operational footprint and optimizing its energy strategy, positioning the company as a leader in the cryptocurrency mining industry.

- Mining Performance Review: In August 2024, Bitcoin mining operations were impacted by a 1.3% decrease in Bitcoin network difficulty, resulting in 233 BTC being generated compared to 253 BTC in July. This decrease was partially offset by an increase in corporate hashrate, owing to the arrival of 2,744 T21 miners from Bitmain, which replaced underperforming machines. The installation of these new miners is currently underway, which is expected to boost the company's future operational efficiency.

- Key Performance Metrics: In August 2024, Bitfarms’ mining operations exhibited the following key metrics:

- Total BTC earned decreased to 233 BTC, compared to 253 BTC in July 2024 and 383 BTC in August 2023.

- Operational hashrate stood at 11.3 EH/s at the end of August 2024, reflecting a 102% year-on-year increase and a 2% month-on-month growth.

- BTC earned per average EH/s was 22, a 9% decline from July 2024 due to the increase in network difficulty.

- The company's operational capacity remained constant at 310 MW, with 256 MW derived from hydropower.

- August 2024 Operational Highlights:

- Bitfarms continued to expand its operational capacity in August 2024, achieving several key milestones:

- The company maintained an average operational hashrate of 10.4 EH/s, up 104% year-on-year and 1% month-on-month.

- Despite the higher network difficulty, Bitfarms earned 233 BTC, representing an 8% month-on-month decline and a 39% year-on-year decrease.

- On average, 7.5 BTC were earned daily, generating approximately USD 443,000 per day, based on a Bitcoin price of USD 59,000 at the end of August 2024.

- Progress in Global Operations: Bitfarms is actively expanding its operations across multiple locations. In August, 5,040 T21 miners were in transit, with 3,060 destined for Canada, 648 for Washington, and 1,332 for Argentina. Construction at the Yguazu site in Paraguay is progressing swiftly and remains on schedule, further demonstrating Bitfarms' commitment to scaling its global mining operations.

- Financial Performance and Treasury Update: In August 2024, Bitfarms sold 147 of the 233 BTC earned as part of its treasury management strategy, generating total proceeds of USD 8.8 million. The company added 86 BTC to its treasury, bringing the total to 1,103 BTC, valued at USD 65.1 million, based on a BTC price of USD 59,000 at the end of the month. Furthermore, Bitfarms held 647 long-dated BTC call options as part of its Synthetic HODL™ strategy, further enhancing its financial positioning.

- Year-to-Date Bitcoin Production: Bitfarms’ year-to-date Bitcoin production totaled 2,043 BTC as of August 2024, a notable decline from 3,281 BTC during the same period in 2023. The decline in production reflects the increasing complexity of the Bitcoin network, along with fluctuating market conditions, which have impacted overall mining output. Despite this, the company continues to prioritize operational efficiency and strategic investments in new technology to enhance future productivity.

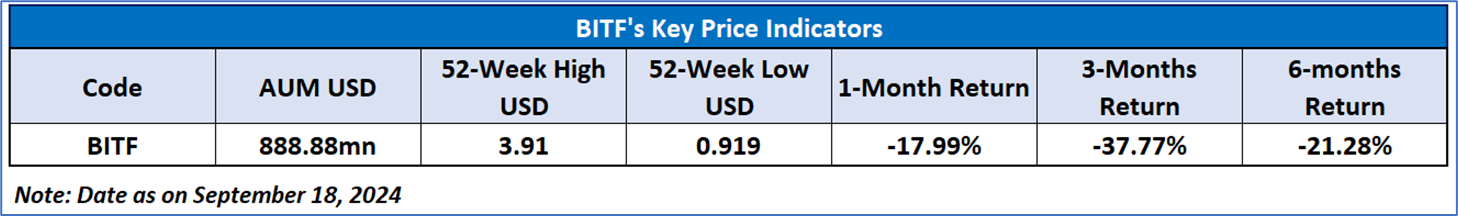

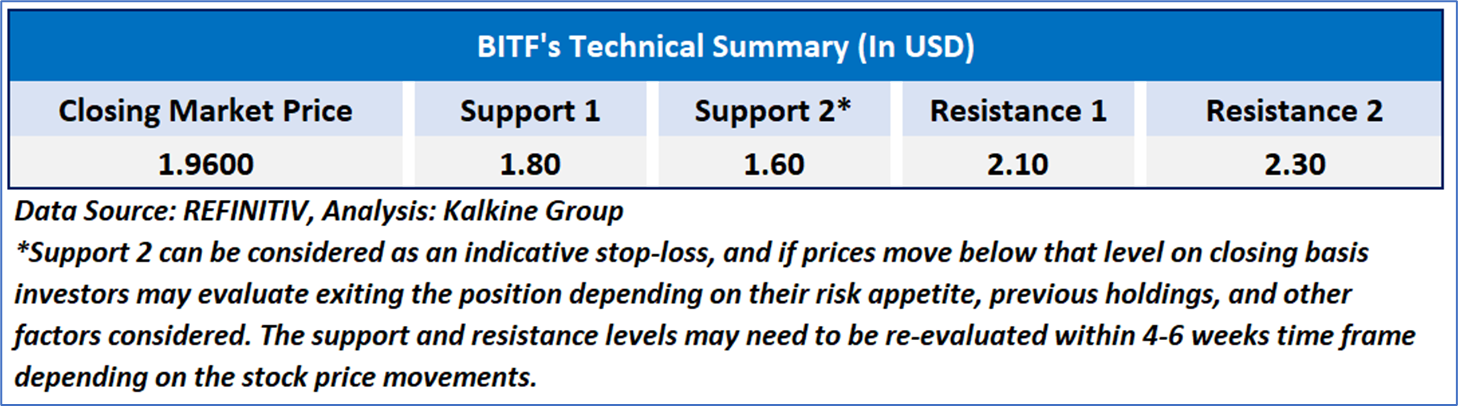

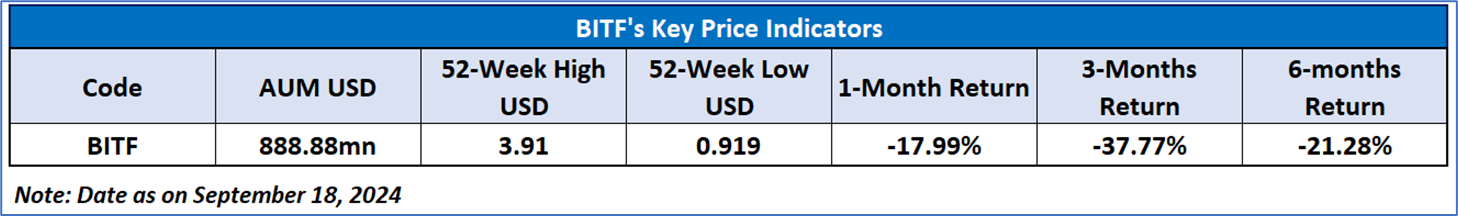

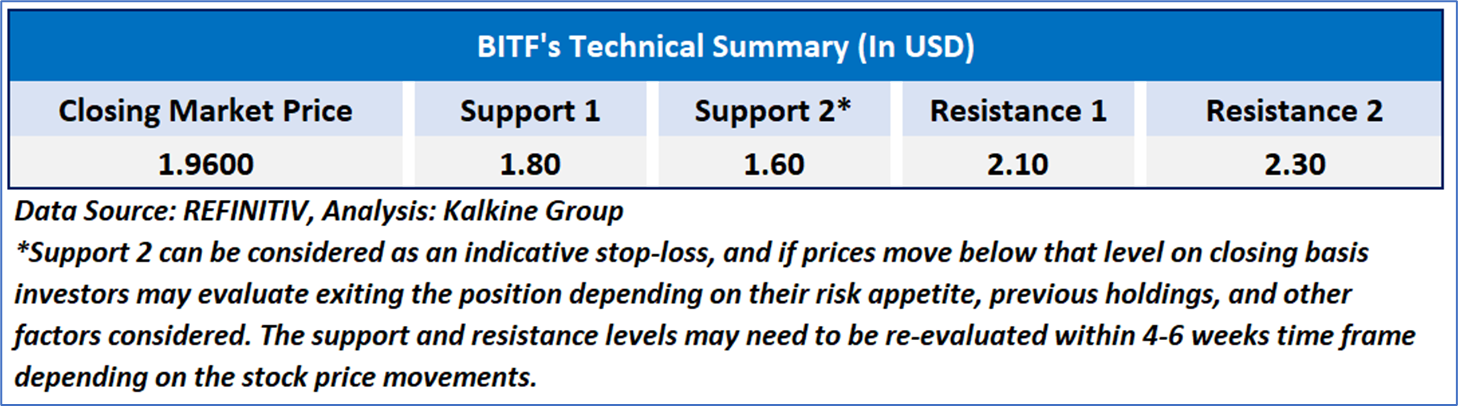

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 41.75, currently upward trending, with expectations of a consolidation or an upward momentum if the current important support levels of USD 1.80- USD2.00 holds. Additionally, the stock's current positioning is below both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term resistance levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Speculative Buy’ rating has been given to Bitfarms Ltd. (NASDAQ: BITF) at the closing market price of USD 1.96 as of September 18, 2024.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is September 18, 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...