Novavax Inc

Novavax, Inc. (NASDAQ: NVAX) is a biotechnology company, which discovers, develops and commercializes vaccines to prevent serious infectious diseases. The Company offers a differentiated vaccine platform that combines a recombinant protein approach, advanced nanoparticle technology and its patented Matrix-M adjuvant to enhance the immune response. It has one commercial program, for vaccines to prevent COVID-19, which includes Nuvaxovid prototype COVID-19 vaccine (NVX-CoV2373 or prototype vaccine) and Nuvaxovid updated COVID-19 vaccine (NVX-CoV2601 or updated vaccine) (collectively, COVID-19 Vaccine).

Recent Business and Financial Updates

- Regulatory and Operational Milestones: In November 2024, Novavax, Inc. announced significant regulatory advancements, including the U.S. FDA's removal of the clinical hold on its Investigational New Drug (IND) application for the COVID-19-Influenza Combination (CIC) and stand-alone influenza vaccine candidates. This development enables the company to proceed with Phase 3 immunogenicity clinical trials for these candidates. Additionally, the U.S. FDA and the European Commission authorized Novavax's updated 2024-2025 formula COVID-19 vaccine for individuals aged 12 and older.

- Financial Performance: For the third quarter of 2024, Novavax reported total revenue of USD 85 million, reflecting a decline from USD 187 million in the same period of 2023. Product sales, primarily from the U.S. market, amounted to USD 38 million, while licensing, royalties, and other revenue contributed USD 46 million, largely driven by the Sanofi agreement and adjuvant sales. Despite a reduction in the cost of sales to USD 61 million, the company incurred a net loss of USD 121 million for the quarter, slightly less than the USD 131 million loss reported in the third quarter of 2023.

- Research and Development Strategy: Novavax outlined a strategic focus on leveraging its proven technology platform to expand beyond COVID-19 and influenza vaccines. The appointment of Dr. Ruxandra Draghia-Akli as Executive Vice President and Head of R&D signals a renewed emphasis on developing a disciplined early-stage pipeline targeting public health improvements. Ongoing efforts include advancing pandemic influenza and respiratory syncytial virus (RSV) pre-clinical programs toward IND readiness.

- Cost Management and Financial Guidance: The company reported significant progress in cost management, achieving a 26% reduction in combined R&D and SG&A expenses in the third quarter of 2024 compared to the same period in 2023. Novavax aims to reduce these expenses further, targeting USD 500 million for 2025 and USD 350 million for 2026, representing substantial reductions from 2022 levels. Updated financial guidance for 2024 projects total revenue between USD 650 million and USD 700 million, with product sales expected to range from USD 175 million to USD 225 million.

- Market and Product Developments: Novavax successfully launched an improved product presentation of its COVID-19 vaccine, Nuvaxovid™, in pre-filled syringes, now available across major U.S. pharmacy retailers and regional grocers. The company also anticipates a milestone payment of USD 175 million upon the anticipated Biologics License Application (BLA) approval in April 2025, which will include the JN.1 variant and pre-filled syringe presentation.

Technical Observation (on the daily chart):

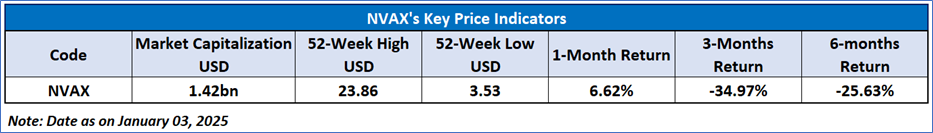

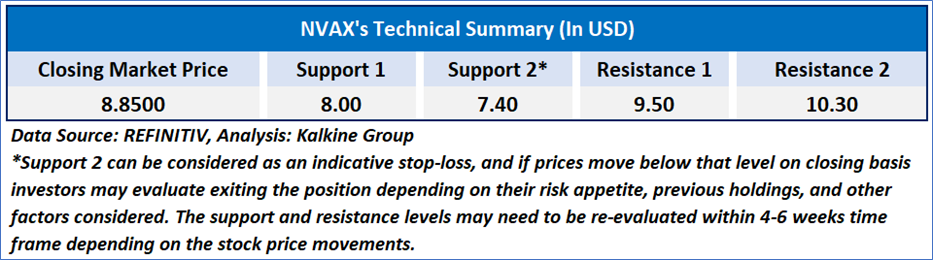

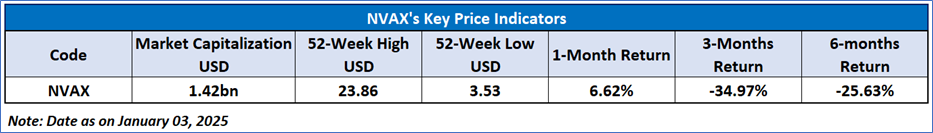

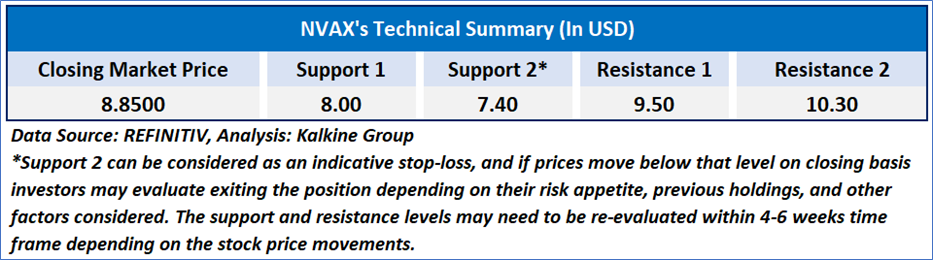

The Relative Strength Index (RSI) over a 14-day period stands at a value of 52.81, upward trending, with expectations of a consolidation or an upward momentum if the current support levels of USD 8.00-USD 8.50. Additionally, the stock's current positioning is between both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support and resistance levels respectively.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Speculative Buy’ rating has been given for Novavax, Inc. (NASDAQ: NVAX) at the closing market price of USD 8.85, as of January 03, 2025.z

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 03, 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...