MicroStrategy

MicroStrategy (NASDAQ: MSTR) is a company focused on advancing the Bitcoin network through financial market activities, advocacy efforts, and technological innovation. It creates, markets, and sells its software platform via licensing agreements, cloud-based subscriptions, and associated services.

Positive Growth Prospects

- Strategic Capital Goals and Bitcoin Treasury Expansion: MicroStrategy continues to position itself as a Bitcoin Treasury Company with its ambitious “21/21 Plan,” aiming to raise $42 billion over three years through equal parts equity and fixed income securities. The capital raised will be used to expand bitcoin holdings and optimize BTC Yield, aligning with shareholder interests. The company’s Q3 2024 achievements include raising $2.1 billion in equity and debt, increasing its bitcoin reserves by 11%, and reducing its annualized interest expense by $24 million.

- Record Bitcoin Holdings and Financial Metrics: As of September 30, 2024, MicroStrategy held approximately 252,220 bitcoins, valued at $16.007 billion at market prices. With an average acquisition cost of $39,266 per bitcoin, the strategy reflects the company’s ability to generate significant unrealized gains. The year-to-date BTC Yield of 17.8% demonstrates the company’s effectiveness in leveraging its treasury strategy, with revised long-term targets for sustainable annual yields between 6% and 10% from 2025 to 2027.

- Equity Offering and Convertible Notes Success: The company successfully issued $1.1 billion in equity and introduced a new At-the-Market Equity Offering Program with a $21 billion cap, indicating strong investor confidence. The issuance of $1.01 billion in Convertible Senior Notes with a favorable 0.625% interest rate enabled the redemption of higher-interest secured notes, reducing the overall cost of capital. These steps enhance financial flexibility and liquidity, setting a solid foundation for the 21/21 Plan.

- Stock Split and Investor Accessibility: MicroStrategy completed a 10-for-1 stock split in August 2024, making its shares more accessible to retail investors. This move demonstrates the company’s commitment to increasing shareholder inclusivity and market participation.

Growth Challenges

- Declining Revenues Across Core Business Segments: MicroStrategy’s software business faced significant challenges in Q3 2024, with total revenues decreasing by 10.3% year-over-year to $116.1 million. Product licenses and subscription services revenues fell by 13.6%, and product support revenues declined by 8.7%. The drop in revenues highlights ongoing difficulties in maintaining competitiveness in its traditional software markets.

- Rising Operating Expenses and Impairment Losses: Operating expenses surged by 301.6% year-over-year to $514.3 million, primarily due to impairment losses on digital assets amounting to $412.1 million. These impairments significantly impacted profitability, reflecting the volatile nature of bitcoin investments and exposing the company to potential financial instability in adverse market conditions.

- Widening Net Losses: The company reported a net loss of $340.2 million for Q3 2024, more than doubling the loss from the same period in 2023. This translates to a diluted net loss per share of $1.72, compared to $1.01 per share a year earlier. The growing losses raise concerns about the sustainability of the company’s strategy amidst a high reliance on bitcoin price appreciation.

- Liquidity Concerns Amid Cash Flow Stagnation: MicroStrategy’s cash and cash equivalents stood at $46.3 million as of September 30, 2024, reflecting a marginal decrease from year-end 2023. Despite raising significant capital, the limited increase in liquidity underscores potential inefficiencies in cash management and operational funding gaps.

Technical Observation (on the daily chart):

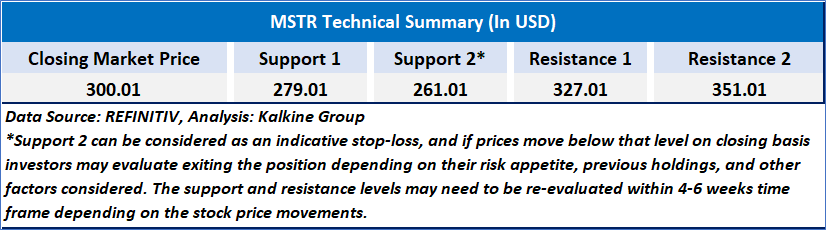

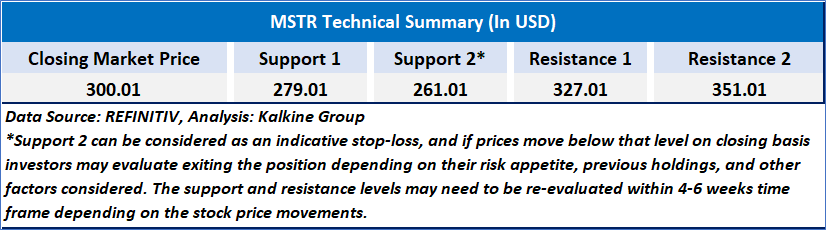

The chart for MicroStrategy (MSTR) shows a potential short-term bearish trend as the price is trading below the 21-day and 50-day moving averages (MAs), which now act as resistance levels at $334.18 and $362.14, respectively. The RSI is at 41.85, indicating weakening momentum but not yet oversold, suggesting the potential for further downside before buyers step in. Volume appears to be declining, signaling reduced market conviction, possibly pointing to a consolidation phase or trend reversal. The $300 price level could serve as psychological support, with stronger support near $290; a breakdown below these levels might lead to further declines. Despite recent weakness, the year-long trend remains bullish, with this pullback possibly forming part of a larger consolidation after significant gains earlier in the year. Bullish traders might look for a breakout above the 21-day MA with rising volume, while bearish traders could focus on a breakdown below $290 for short-selling opportunities. Neutral traders may prefer to wait for clearer signals, such as a decisive breakout or breakdown.

MicroStrategy's Q3 2024 results reflect both the potential and risks of its bold, bitcoin-centric strategy. While the company has made impressive strides in raising capital, expanding bitcoin holdings, and reducing interest expenses, its core software business faces declining revenues, and substantial impairment losses have widened net losses. The ambitious 21/21 Plan and high BTC Yield demonstrate a focus on shareholder value, yet the reliance on bitcoin price appreciation introduces volatility and financial exposure. Balancing growth in digital assets with stabilizing operational performance will be critical to sustaining long-term success.

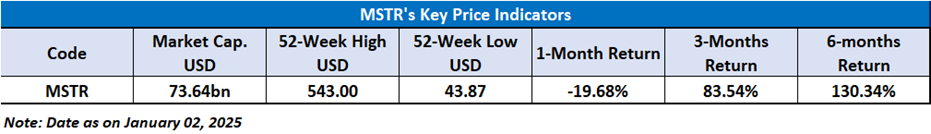

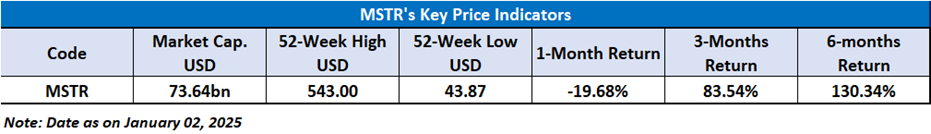

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Watch’ rating has been given to MicroStrategy (NASDAQ: MSTR) at the closing market price of USD 300.01 as of January 02,2025.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 02,2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...