Richtech Robotics Inc

Richtech Robotics Inc. (NASDAQ: RR) is a developer of advanced robotic technologies focused on transforming labor-intensive services in hospitality and other sectors. The Company designs, manufactures and sells robots to restaurants, hotels, senior living centers, casinos, factories, movie theaters and other businesses. Its robots perform a range of services, including restaurant running and bussing, hotel room service delivery, floor scrubbing and vacuuming, and beverage and food preparation.

Recent Business and Financial Updates

- Revenue Performance:

- For the nine months ended June 30, 2024, total revenue reached approximately USD 3,715 thousand, reflecting an 11% increase from USD 3,364 thousand in the same period of 2023. This USD 351 thousand rise was driven by an expanded customer base and a shift in sales strategies. Robotics revenue accounted for USD 3,366 thousand in 2024, up 7% from USD 3,171 thousand in 2023. Key contributors to this growth were service revenue, which surged by 485% to USD 1,252 thousand, and leasing revenue, which rose by 314% to USD 458 thousand, offset by a 55% decrease in product revenue. The company is transitioning to a Robotics as a Service (RaaS) model, prioritizing recurring revenue and higher margins, though this shift has temporarily impacted product sales.

- In the three months ended June 30, 2024, gross revenue was USD 1,443 thousand, up from USD 1,310 thousand in 2023, due to increased service and ClouTea revenue, despite a decline in product revenue. Notable advancements include deploying the ADAM robot in U.S. Ghost Kitchens and launching Medbot for medical delivery in healthcare, demonstrating strategic innovation in hospitality and healthcare sectors.

- Cost of Revenue and Gross Profit: The cost of revenue, net, decreased by 7% to approximately USD 1,411 thousand for the nine months ended June 30, 2024, primarily due to the rise in higher-margin robotics service revenue. For the three months ended June 30, 2024, the cost of revenue was USD 429 thousand, a 30% decline compared to the same period in 2023. Gross profit as a percentage of total revenue improved significantly, reaching 62% for the nine months ended June 30, 2024, compared to 55% in 2023. The gross profit margin for the three months ended June 30, 2024, was 70%, up from 53% in the same period of the previous year, driven by an increase in higher-margin service offerings.

- Operating Expenses: Research and development (R&D) expenses increased slightly to USD 1,633 thousand for the nine months ended June 30, 2024, reflecting ongoing investments in product innovation. Sales and marketing expenses surged by 375% to USD 1,024 thousand for the same period, driven by intensified advertising and promotional efforts. General and administrative expenses rose by 48% to USD 3,750 thousand, primarily due to higher professional service fees and costs associated with maintaining public company status. These investments underscore the company’s focus on scaling operations and enhancing market presence.

- Liquidity and Financing Activities: The company reported a net operating cash outflow of USD 2,121 thousand for the nine months ended June 30, 2024, compared to USD 2,265 thousand in 2023. The working capital position improved significantly to USD 8,835 thousand as of June 30, 2024, from USD 4,092 thousand as of September 30, 2023. Financing activities generated USD 10,754 thousand in cash during this period, primarily from the issuance of Class B common stock and convertible notes. In comparison, the prior year’s financing activities yielded USD 2,517 thousand, mainly through ordinary share issuance and third-party loans.

- Strategic Investments and Income Tax Impact: Investing activities resulted in net cash outflows of USD 135 thousand for the nine months ended June 30, 2024, primarily due to lending to related parties. The income tax expense of USD 317 thousand in 2024 reflects tax liabilities and a partial reversal of the Deferred Tax Asset (DTA), driven by changes in forecasted taxable income. These financial adjustments align with the company’s efforts to optimize fiscal strategies amid evolving operational needs.

- Outlook and Future Prospects: The company remains confident in its ability to fund operations for the next twelve months, supported by cash reserves, financing activities, and strategic investments. The transition to the RaaS model and the upcoming launch of new products are expected to drive long-term growth. Leveraging its innovative solutions in hospitality and healthcare, the company aims to strengthen its market position and deliver sustained revenue expansion.

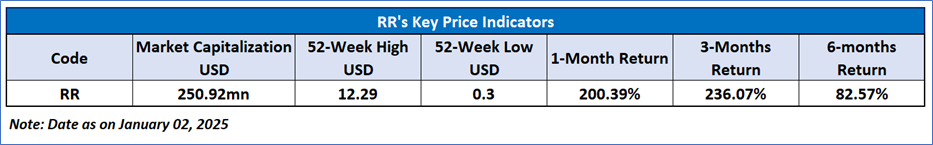

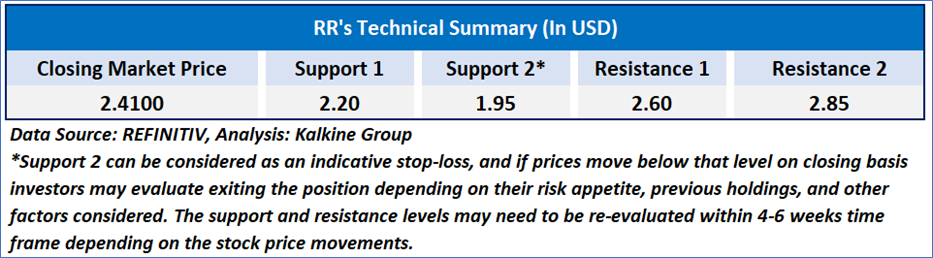

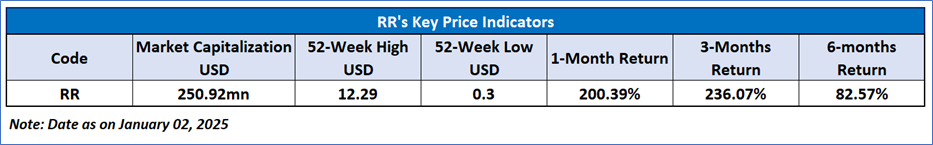

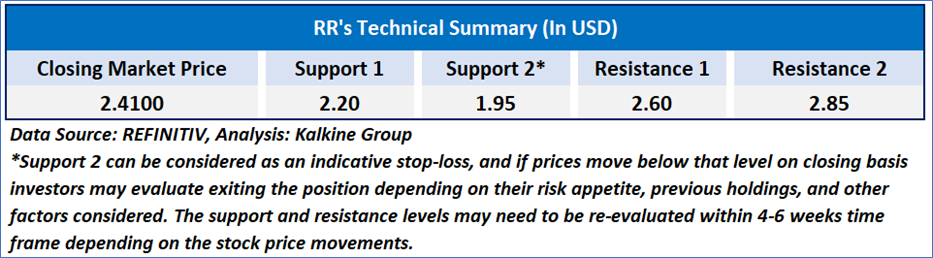

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 63.44, currently recovering from overbought zone, with expectations of a consolidation or upward momentum from the current important support levels of USD 2.20-USD 2.40. Additionally, the stock's current positioning is above both the 21-period SMA and 50-period SMA, which may serve as dynamic short to medium-term support levels.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Speculative Buy’ rating has been given for Richtech Robotics Inc. (NASDAQ: RR) at the closing market price of USD 2.41, as of January 02, 2025.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 02, 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...