iCAD Inc

iCAD, Inc. (NASDAQ: ICAD) provides artificial intelligence-powered cancer detection. Its ProFound Breast Health Suite enables medical providers and professionals to accurately and reliably identify where cancer may be hiding. Its Cancer Detection segment solutions include advanced artificial intelligence and image analysis workflow solutions that enable healthcare professionals to better serve patients by identifying pathologies and pinpointing the prevalent cancers earlier, a range of upgradeable computer-aided detection systems and workflow solutions for digital breast tomosynthesis, full-field digital mammography, magnetic resonance imaging and computed tomography.

Recent Business and Financial Updates

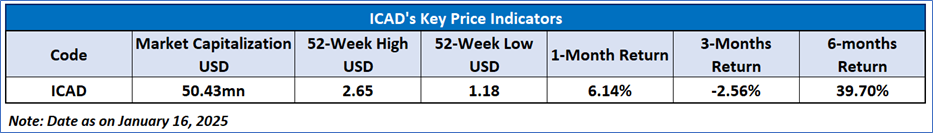

- Third Quarter 2024 Performance Overview: The third quarter of 2024 demonstrated significant growth in key financial metrics for iCAD. Total Annual Recurring Revenue (ARR) reached USD 9.3 million, reflecting a 10% increase year-over-year. Total revenue for the quarter amounted to USD 4.2 million, marking a 4% rise compared to the previous year. The gross profit margin remained robust at 86%, consistent with the prior year.

- Strategic Cloud Deals and Key Wins: During the quarter, iCAD successfully closed 13 cloud deals, underscoring the growing demand for its cloud-based solutions. Notable agreements included a three-year contract with the University of California San Diego (UCSD) and a similar deal with Charlotte Radiology, a leading provider in the US Radiology network. These strategic partnerships highlight iCAD's expanding footprint in the cloud services market.

- Advancements in AI-Powered Detection: iCAD achieved a significant milestone with the FDA clearance of ProFound Detection Version 4.0 for Digital Breast Tomosynthesis (DBT). This fourth-generation AI solution offers a 22% improvement in detecting challenging and aggressive cancer subtypes, including dense breast tissue, compared to the previous version. Additionally, it achieves an 18% reduction in lesion markings, enhancing accuracy and streamlining clinical workflows.

- Geographic Expansion and Regulatory Developments: The third quarter also saw iCAD extending its global reach through new regulatory clearances in South Africa and strategic partnerships in the Dominican Republic, France, Spain, Turkey, and the United Arab Emirates. The implementation of new FDA regulations on breast density reporting in the U.S. is expected to boost demand for iCAD's Density and Detection solutions, further solidifying its market leadership in AI-powered breast cancer detection.

- Financial Results and Operational Highlights: For the three months ended September 30, 2024, total revenue was USD 4.2 million, a 3.5% increase from USD 4.1 million in the same period of 2023. Product revenue rose by 14.1%, while services revenue saw an 8.9% decline. Operating expenses increased by 19% to USD 5.6 million, resulting in a GAAP net loss of USD 1.8 million, or USD 0.07 per diluted share, compared to a net loss of USD 1.0 million in the previous year.

- Nine-Month Financial Performance: For the nine months ended September 30, 2024, total revenue was approximately USD 14.2 million, a 13% increase compared to USD 12.6 million for the same period in 2023. Product revenue surged by 27.3%, while services revenue declined by 5.0%. Gross profit for this period was USD 12.0 million, or 84% of revenue, compared to USD 10.5 million, or 83% of revenue, in the prior year. Operating expenses remained stable at USD 17.4 million.

- Cash Position and Outlook: As of September 30, 2024, iCAD reported cash and cash equivalents totaling USD 18.8 million. The company believes it possesses sufficient cash resources to support its planned operations without the need for additional funding. This financial stability enables iCAD to continue its strategic initiatives and growth trajectory in the AI-powered breast cancer detection market.

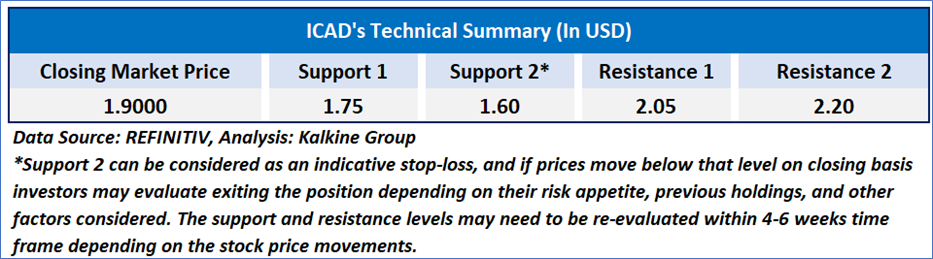

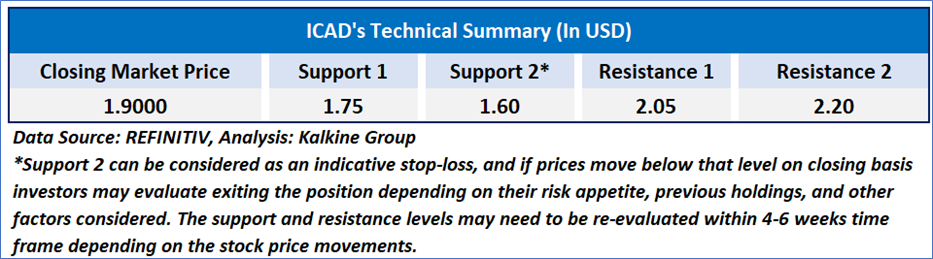

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 50.90, currently recovered near mid-levels, with expectations of a consolidation or an upward momentum from the near important support zone of USD 1.70-USD 1.80. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

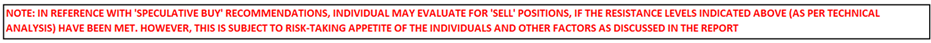

iCAD's third-quarter 2024 results highlighted notable growth, with a 10% year-over-year increase in Annual Recurring Revenue, reaching USD 9.3 million, and a 4% rise in total revenue to USD 4.2 million. The company secured significant cloud deals, including partnerships with the University of California San Diego and Charlotte Radiology, underscoring its expanding market presence. Additionally, iCAD achieved FDA clearance for its ProFound Detection Version 4.0, enhancing AI-powered cancer detection accuracy. Geographic expansion and regulatory developments, particularly in breast density reporting, further strengthen its market position. Despite a GAAP net loss of USD 1.8 million, iCAD’s financial stability, with USD 18.8 million in cash, supports its strategic growth initiatives. As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Speculative Buy’ rating has been given for iCAD, Inc. (NASDAQ: ICAD) at the closing market price of USD 1.90, as on January 16, 2025.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 16, 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...