Nickel Industries Limited (ASX: NIC)

Nickel Industries Limited is an ASX listed entity involved in nickel ore NICing, nickel pig iron, and nickel matte production activities.

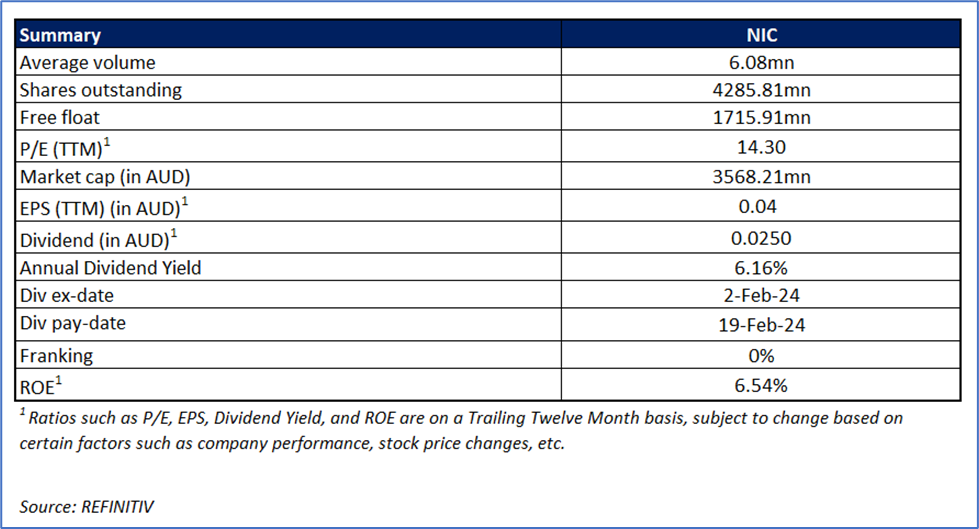

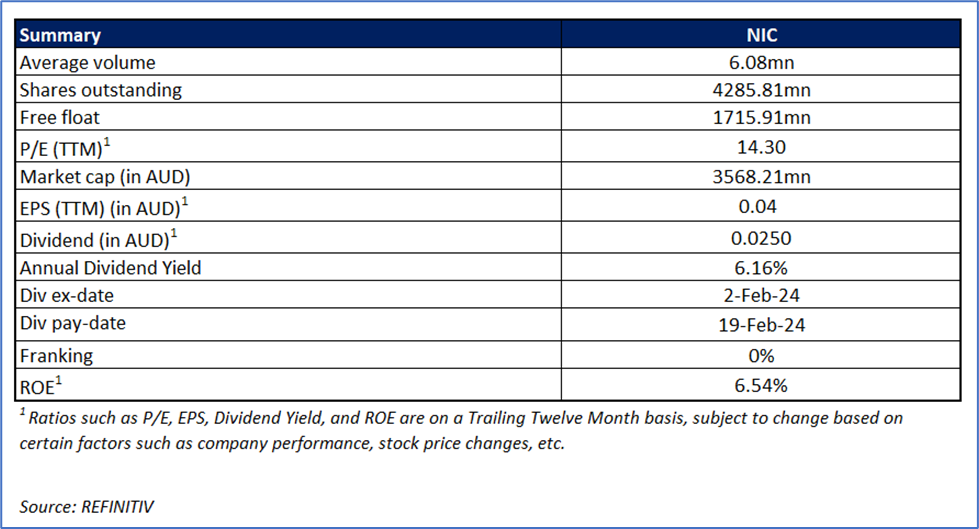

Recommendation Rationale – SELL at AUD 0.870

- Profit Booking: NIC’s share price surpassed Resistance 1 level recommended on 27 March 2024; and thus, offered a profit booking opportunity.

- Overvalued Multiples: On a forward 12-month basis, key trading multiples (EV/EBITDA, Price/Earnings, and Price/Cash Flow) are higher than median of Basic Materials’ sector.

- Key Risks: NIC’s performance is susceptible to commodity price fluctuations, cost inflation, global economic slowdown, among others.

- Profit Decline: During FY23, Profit After Tax declined by 54.5% year-on-year.

- Technical Standpoint: The momentum oscillator, 14-day RSI (~65.96) is approaching the overbought zone; and thus, price can face retracement in the short term.

NIC Daily Chart

Daily Technical Chart; Source: REFINITIV

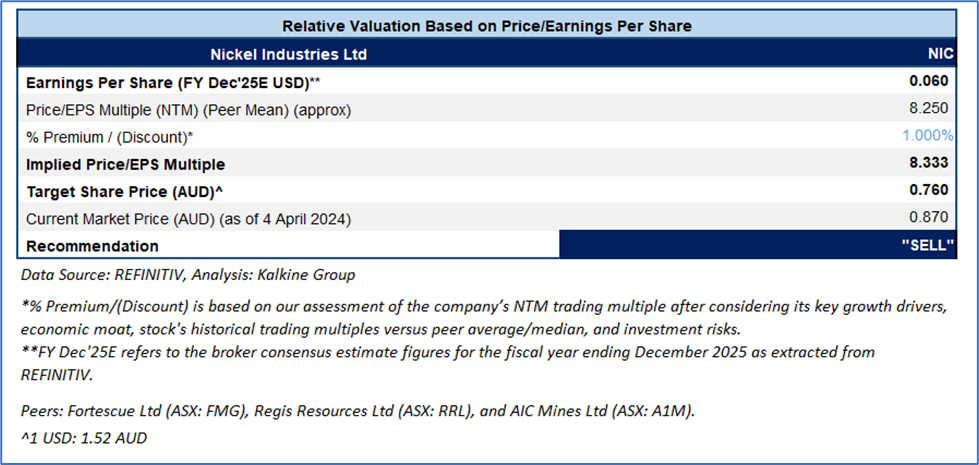

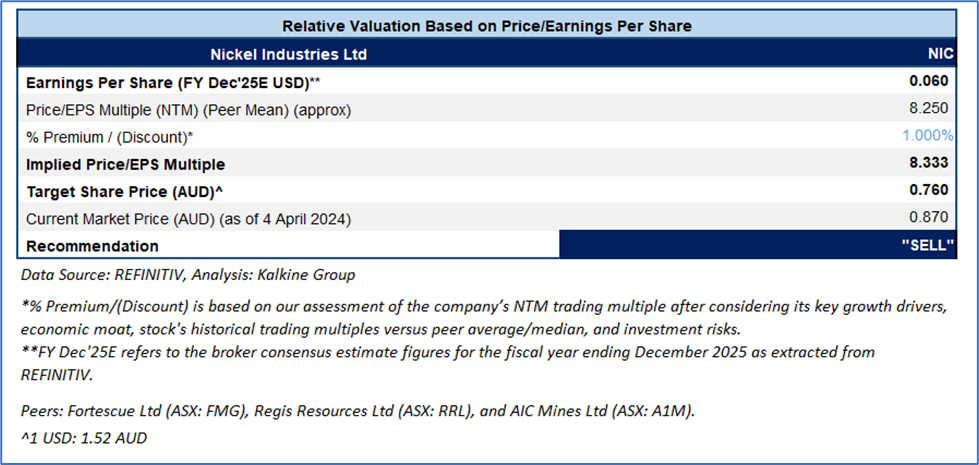

Valuation Methodology: Price/Earnings Approach (FY December'25E) (Illustrative)

Given its current trading levels, recent rally in the share price, and risks associated, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current market price of AUD 0.870, at 3:59 PM AEDT, as of 4 April 2024.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 4 April 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and downtrend may take a pause backed by demand or buying interest.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and uptrend may take a pause due to profit booking or selling interest.

Stop-loss: In general, it is a level to protect further losses in case of any unfavourable movement in the stock prices.

AU

Please wait processing your request...

Please wait processing your request...