Orica Limited (ASX: ORI)

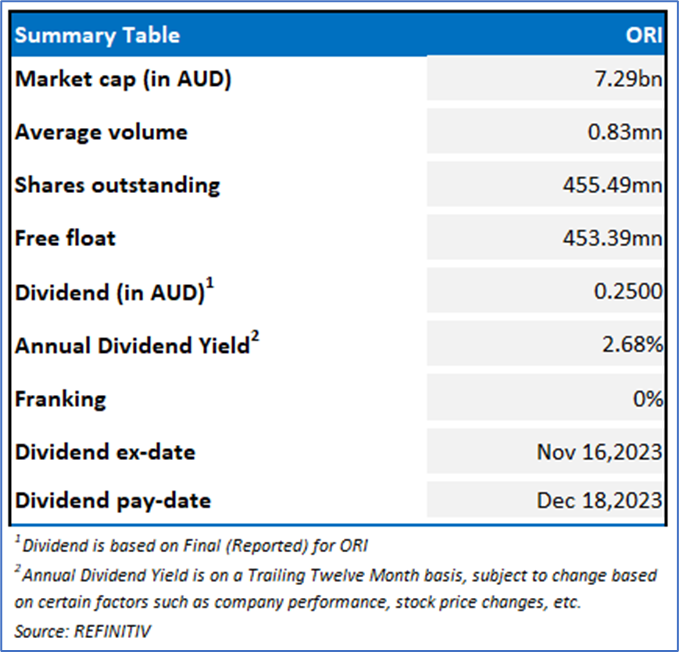

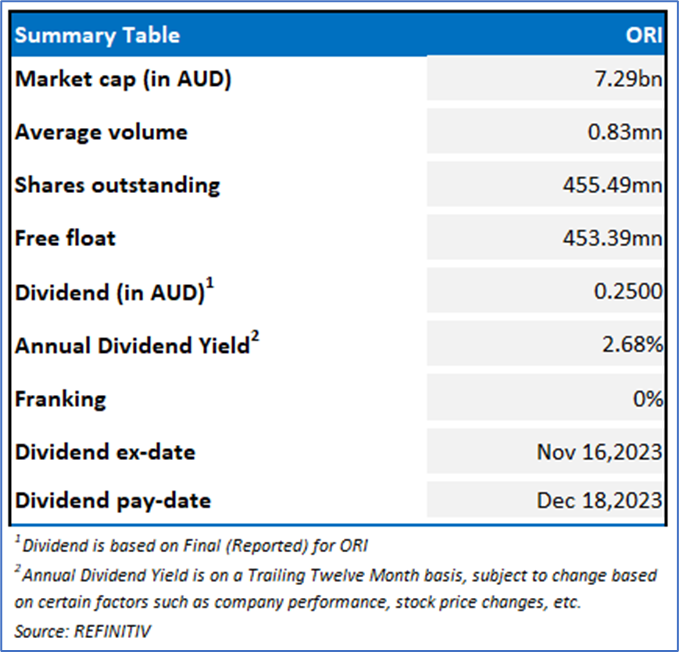

Orica Limited (ASX: ORI) is an ASX listed mining and infrastructure solutions provider. It produces and supplies explosives, blasting systems, geotechnical monitoring, and mining chemicals.

Recommendation Rationale – SELL at AUD 15.70

- Profit Booking: ORI’s stock price has crossed the ‘Resistance 1’ level given in the report on 1 November 2023, and presented a profit booking opportunity.

- Technical Indicator: The momentum oscillator 14-Day RSI (~60.42) is close to the overbought zone; and thus, prices may face correction in the short term.

- Financial Performance: For the financial year ended 30 September 2023, ORI reported a 12% jump in revenue at AUD 7,945.3mn, while its EBIT grew by 21% to AUD 698.1mn. Increased customer demand and earnings from advanced technology offerings supported earnings growth.

- Outlook: The company expects FY24 EBIT to be higher than FY23 EBIT amid increased demand for its products and services and the adoption of digital technology offerings.

- Key Risks: ORI’s earnings are highly sensitive to mining activities in the economy. A decline in commodity demand may result in lower mining activity, hence lower revenue for ORI.

ORI Daily Chart

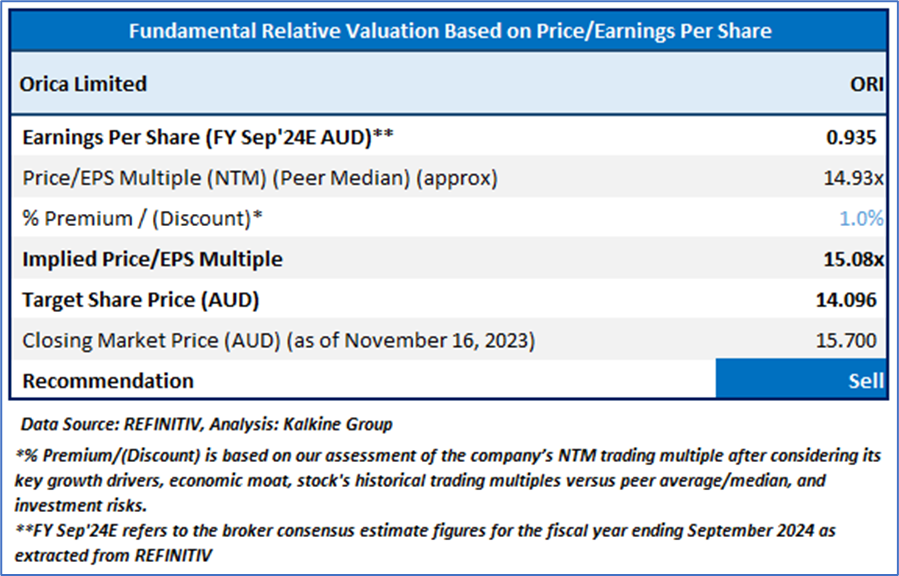

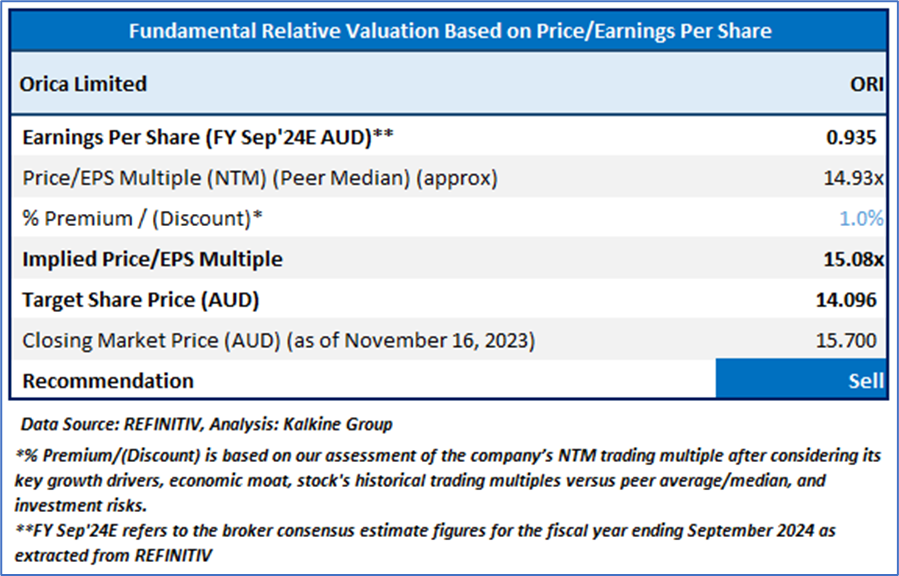

Valuation Methodology: Price/Earnings Approach (FY24E) (Illustrative)

Considering ORI’s growth in FY23 earnings and net return on operating assets, FY24 outlook, the company might trade at a slight premium to its peers. For valuation, few peers like Incitec Pivot Ltd (ASX: IPL), Downer EDI Ltd (ASX: DOW), Nufarm Ltd (ASX: NUF) and others have been considered. Considering the current trading levels, risks associated, downside indicated by the valuation, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the closing market price of AUD 15.700, down ~1.936%, as of November 16, 2023.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 16 November 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

AU

Please wait processing your request...

Please wait processing your request...