This report is the updated version of the report uploaded on 25 March 2024 at closing price.

APA Corporation

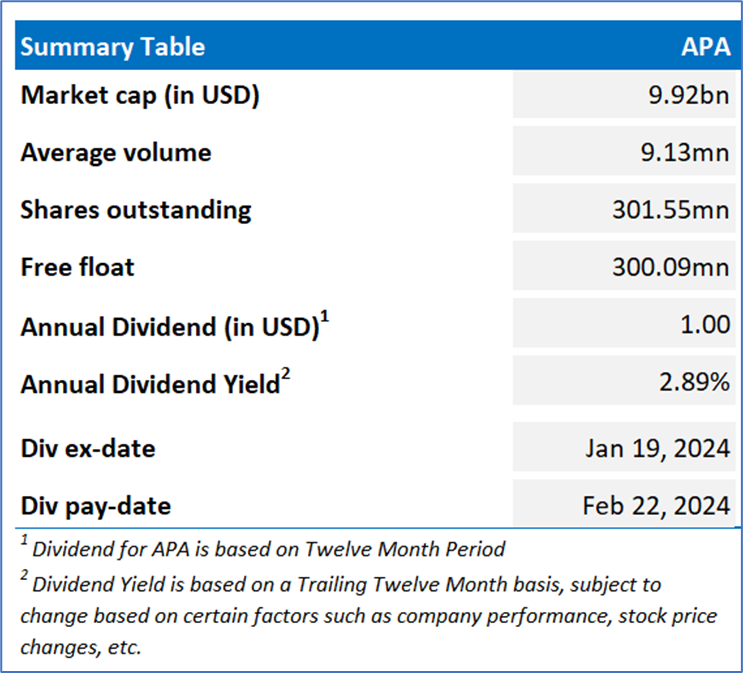

APA Details

APA Corporation (NASDAQ: APA) is independent energy company which explores for, develops as well as produces natural gas, crude oil, and natural gas liquids (or NGLs).

Financial Results

- APA released its fourth-quarter and full-year 2023. Its reported net income attributable to shareholders of USD 1.8bn in 4Q FY23. Reported earnings stood at USD 352mn on a diluted share basis.

- During the quarter, total production stood at 414,000 BOE per day; whereas, when adjusted for Egypt noncontrolling interest and tax barrels, production came at 341,000 BOE per day. Net cash provided by operating activities in 4Q FY23 came in at USD 1.0bn, and adjusted EBITDAX stood at USD 1.4bn

Key Updates

The company informed the market that the statutory waiting interval under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 ended on February 22, 2024.

Outlook

In 2024, the company anticipates investing in the ambit of USD 1.9 to USD 2.0bn in upstream oil and gas capital.

Key Risks

The company is exposed to risks arising from delays in the development of new pipeline capacity, highly regulated environment, etc. The crude oil, natural gas, and NGL prices as well as their volatility could adversely impact APA's operating results and the price of APA’s common stock.

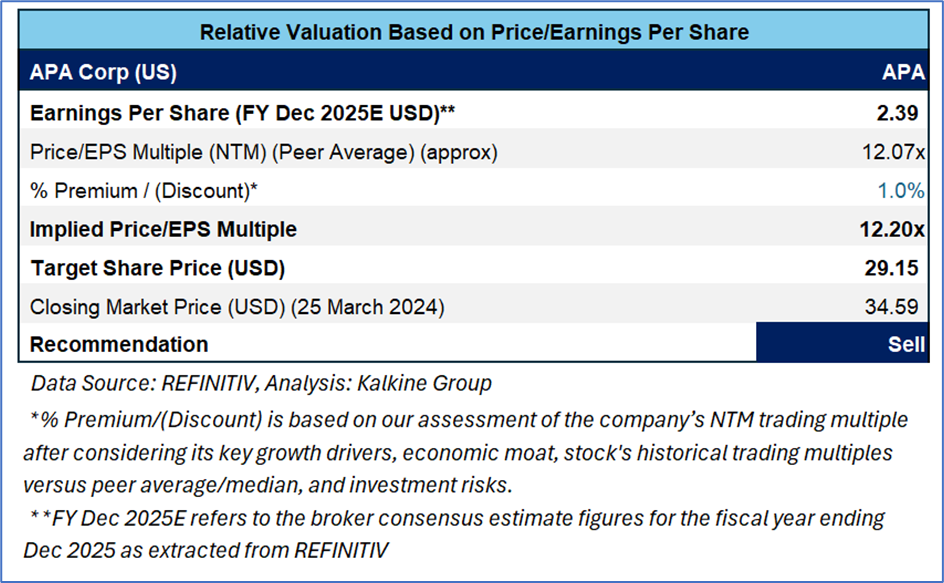

Fundamental Valuation

P/E Based Relative Valuation

Stock Recommendation

Over the last one month, the stock has given a return of 9.5%. The stock has made a 52-week low and high of USD 29.47and USD 46.15, respectively. The company’s performance is exposed to the risks related to the global slowdown as well as geopolitical tensions.

The political conditions and events in oil and gas producing regions, increased competitiveness, technological advances affecting energy supply and energy consumption, etc. are some other risks.

Hence, a ‘Sell’ rating has been provided on the stock at the closing price of USD 34.59 per share as on 25th March 2024.

Technical Overview:

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

AU

Please wait processing your request...

Please wait processing your request...