Ramsay Health Care Limited (ASX: RHC)

RHC is engaged in providing a range of acute and primary healthcare services. The company is the owner and operator of private hospitals, imaging centres, primary care clinics, day surgery facilities, and pharmacies in Australia, the UK, and many other countries.

Recommendation Rationale – SELL at AUD 57.04

- Financial Performance: In 1HFY24, revenue from contracts with customers increased 7.8% in constant currency on a year over basis, driven by mid to high single digit growth in activity in all regions combined with indexation increases. Statutory net profit after tax and non-controlling interests rose by 290.2% YoY in 1HFY24. The result benefited from a weaker Australian dollar against the EUR and the GBP compared to the pcp.

- Outlook: The company expects revenue to grow in mid-single digit, driven by a low to mid-single digit rise in activity and higher reimbursement levels. Digital and data capex for FY24 is expected to be in the range of AUD 12-18mn. RHC plans to invest AUD 210-260mn to tap brownfield and greenfield opportunities in FY24.

- Emerging Risks: Regulatory changes, such as new rules or requirements imposed by financial regulatory bodies, can impact the operations and profitability of SWF. The company is vulnerable to medical malpractice claims due to the nature of its services. Malpractice lawsuits can result in significant financial losses and damage to reputation.

RHC Daily Chart

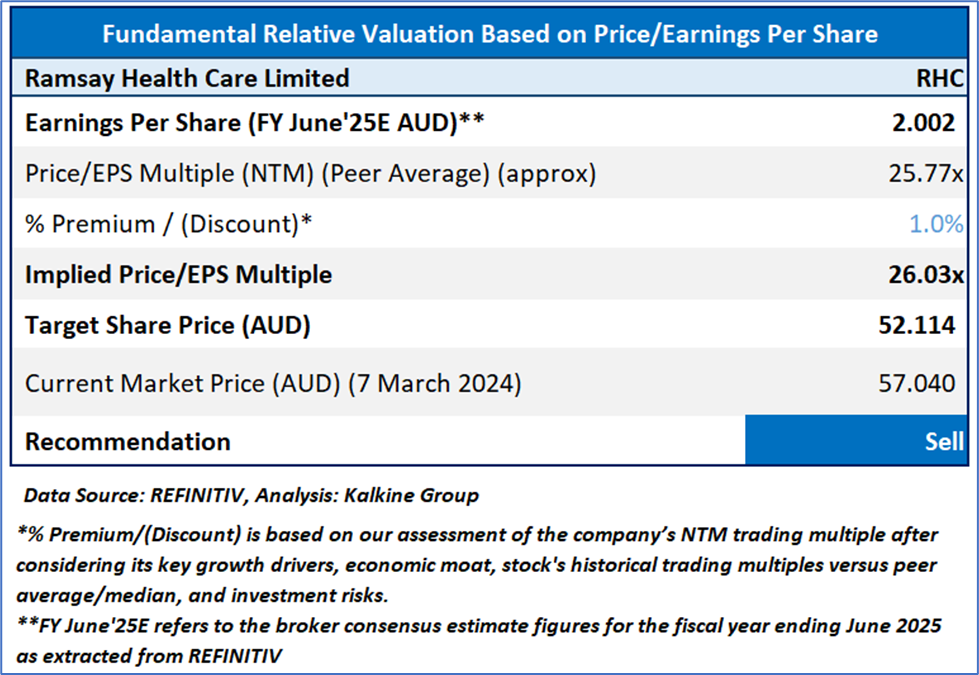

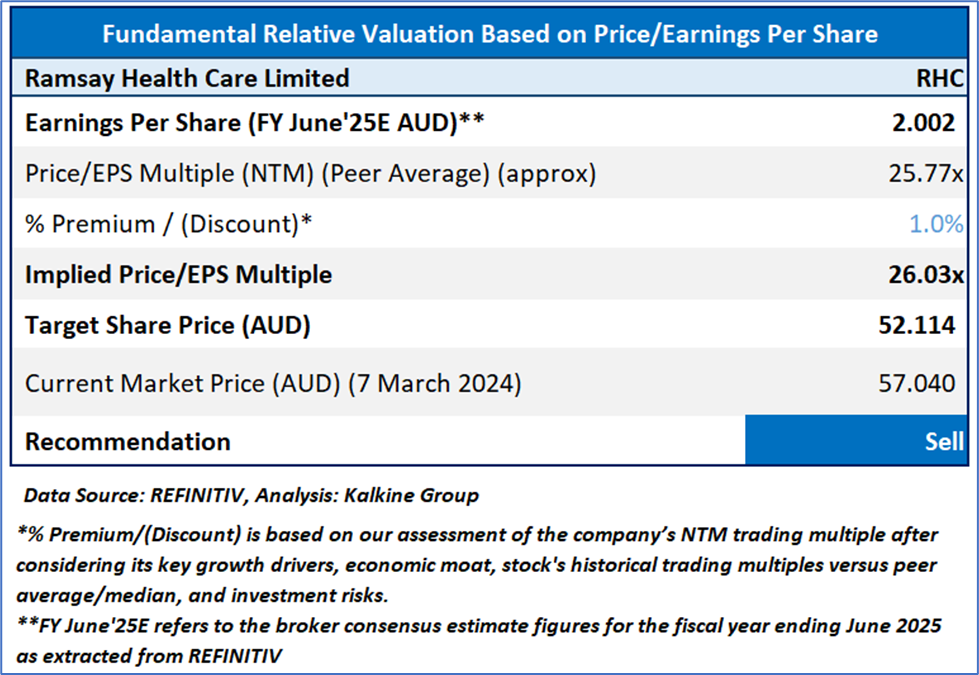

Valuation Methodology: Price/Earnings Approach (FY June'25E) (Illustrative)

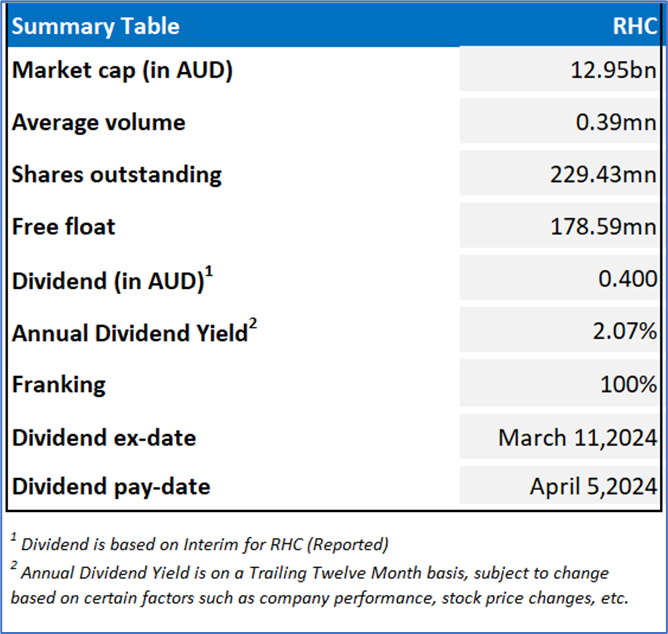

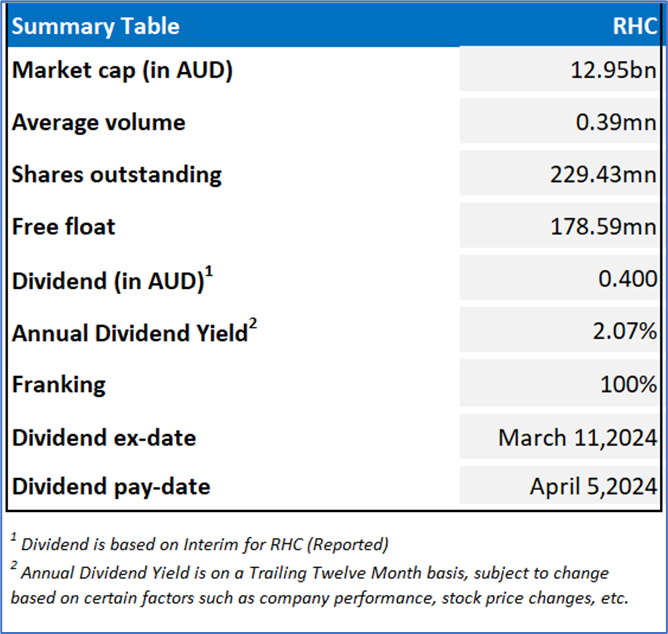

Given the growing revenue from contracts with customers, high single digit growth in activity in all regions combined with indexation increases, expected low to mid-single digit rise in activity and higher reimbursement levels etc, the company might trade at a slight premium to its peers. For valuation, few peers like CSL Ltd (ASX: CSL), Cochlear Ltd (ASX: COH), ResMed Inc (ASX: RMD), and others been considered. Considering that the company has surpassed its R1 level, risks associated, downside indicated by the valuation, and share price movement, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 57.04, as of March 7, 2024, at 12:15 PM AEDT.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 7 March 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

AU

Please wait processing your request...

Please wait processing your request...