Fisher & Paykel Healthcare Corporation Limited (ASX: FPH)

FPH is a provider of medical devices and technologies. The company designs, manufactures and markets products and systems for use in surgery, acute and chronic respiratory care, and the treatment of obstructive sleep apnoea.

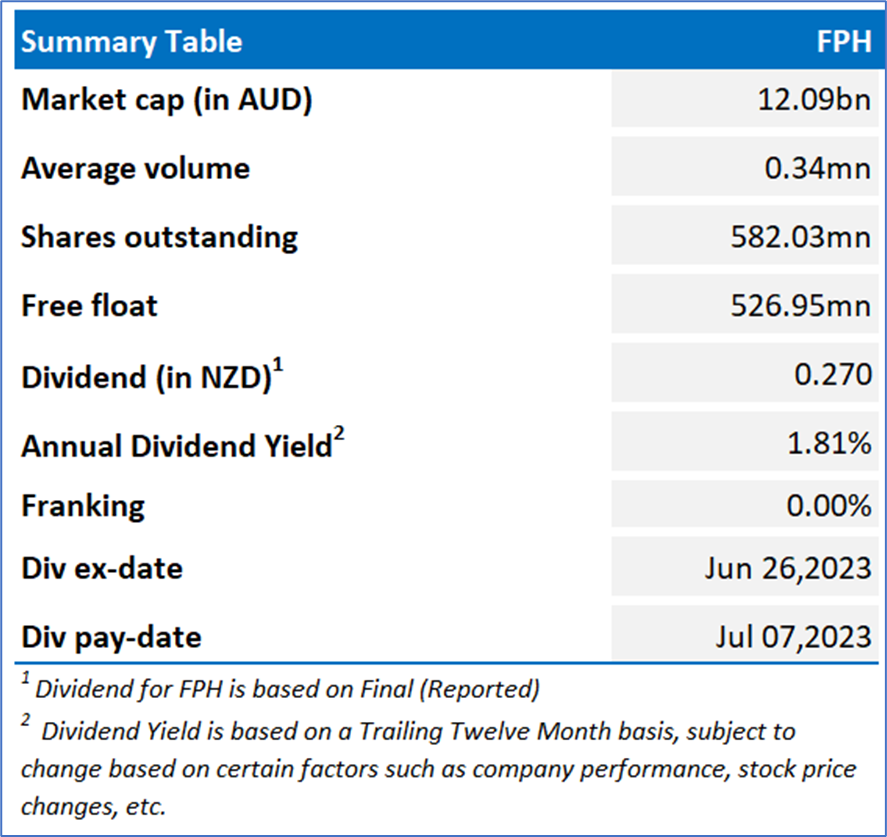

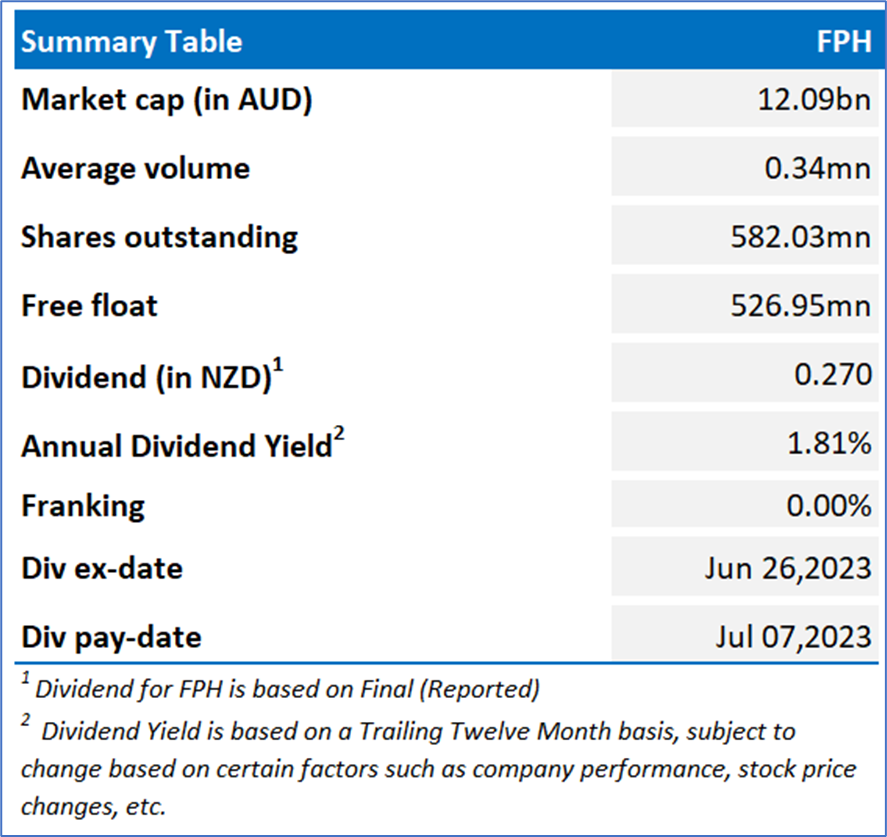

Recommendation Rationale – SELL at AUD 21.025

- Financial Performance: In FY23, the company’s total operating revenue went down by 6% year over year, whereas NPAT was down 33.6% on a YoY basis. FY23 saw significant COVID-19-related impact on sales. Nevertheless, for 2HFY23, operating revenue grew 14% YoY, and grew 12% on a constant currency basis, driven by growth in Hospital new applications consumables and OSA masks revenue.

- Outlook: FPH expects to report approximately NZD 1.70bn in revenue for FY24. Owing to its land and building programs, the company anticipates capital expenditure of NZD 450mn during the current financial year.

- Emerging Risks: FPH is at risk of product recall and liability litigation, if use of any of its products harm patients. There might be disruptions to the company’s operations and data breach, in the event of cyber-attacks.

- Overvalued Multiples: On a forward 12-month basis, key valuation multiples (EV/EBITDA, EV/Sales, Price/Earnings, Price/Book Value and Price/Cash Flow) are higher than the median of Healthcare Industry.

FPH Daily Chart

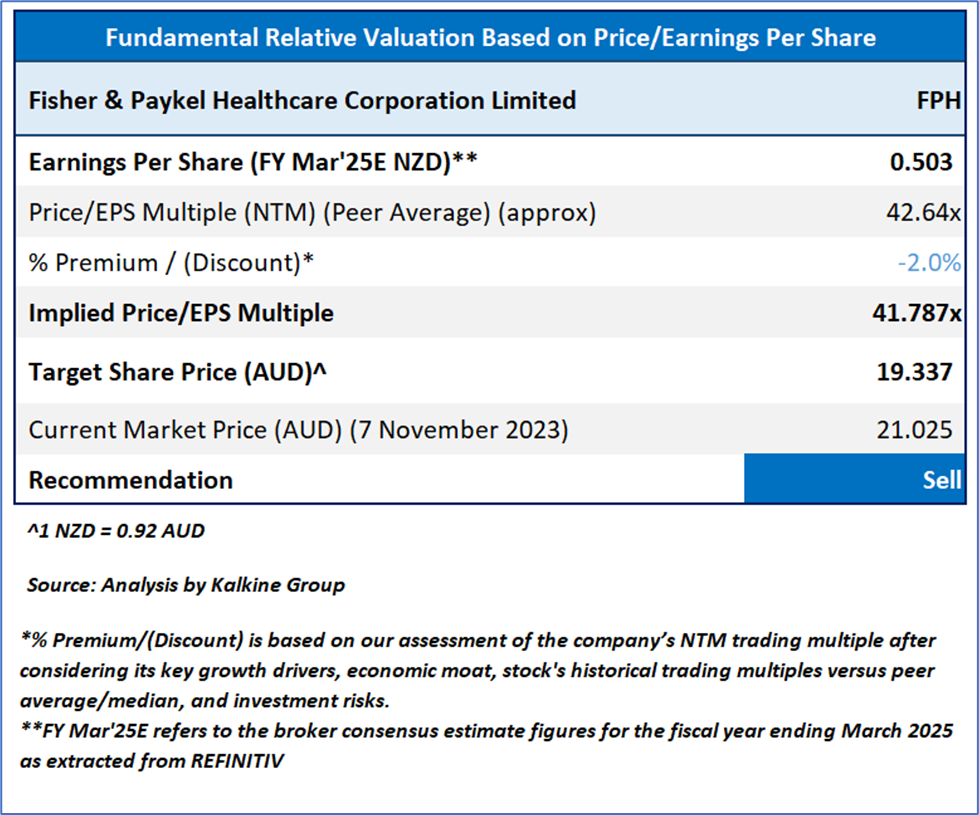

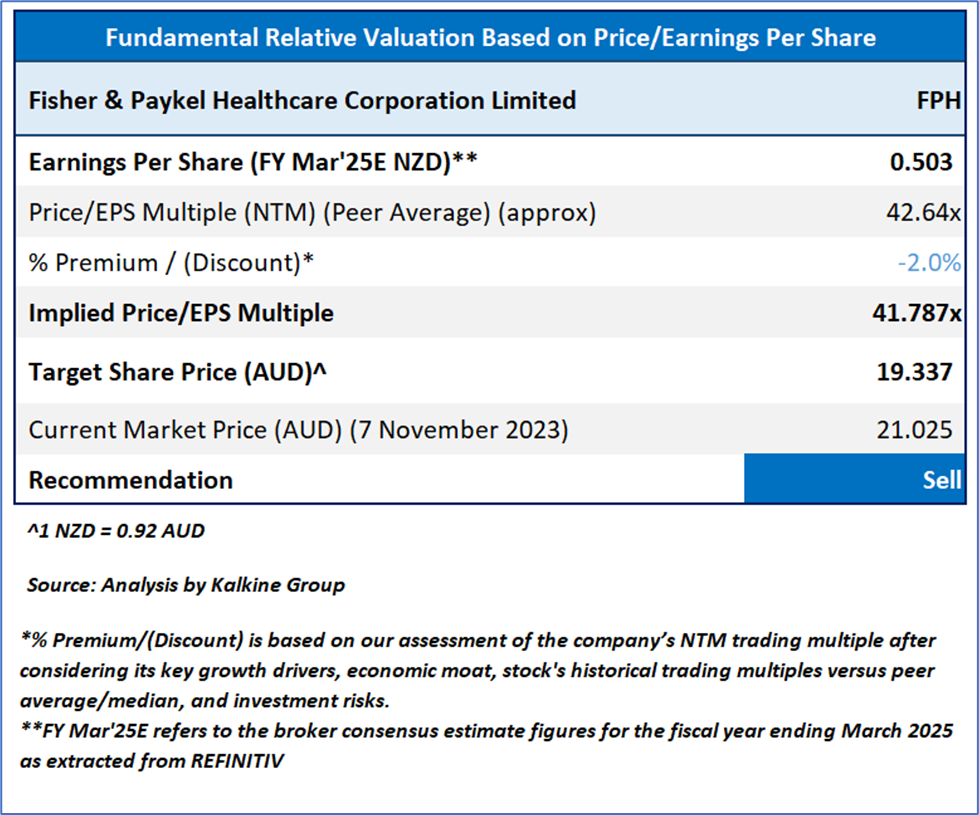

Valuation Methodology: Price/Earnings Approach (FY March'25E) (Illustrative)

Given the decline in top and bottom line, owing to significant COVID-19-related impact on sales, risks from data breach, etc, the company might trade at a slight discount to its peers. For valuation, few peers like Cochlear Ltd (ASX: COH), Nanosonics Ltd (ASX: NAN), Ramsay Health Care Ltd (ASX: RHC), and others have been considered. Considering the current trading levels and risks associated, downside indicated by the valuation, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 21.025, as of November 7, 2023, at 12:52 PM AEDT.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is November 7, 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

AU

Please wait processing your request...

Please wait processing your request...