This report is the updated version of the report uploaded on 14 December 2023 at 1:07 AM PT

Ormat Technologies, Inc.

ORA Details

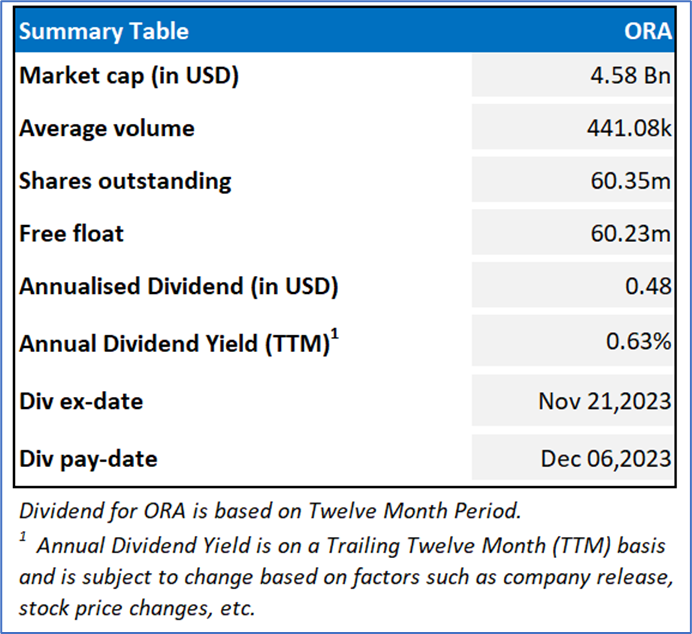

Ormat Technologies, Inc. (NYSE: ORA) is primarily engaged in the geothermal energy power business.

Financial Results for Q3 FY 2023

- The company’s Q3 FY 2023 results demonstrates its strategic success in expanding the portfolio, as witnessed through rise in revenue, adjusted EBITDA as well as net income following the multiple assets ORA added over the previous 12 months.

- ORA witnessed 18.3% growth in total revenues, 15.8% growth in adjusted EBITDA, and growth in adjusted net income attributable to stockholders of 50.4% as compared to the prior year period.

- The gross margin in the electricity segment fell from 36.5% to 31.8%, primarily due to the $5.6 Mn reduction in Puna’s revenues because of lower generation as well as lower energy prices.

Key Update

ORA announced the signing of 15-year Energy Storage Service Agreement (or ESSA) with San Diego Community Power (or SDCP), California’s 2nd largest community choice aggregator, for 20MW/40MWh Pomona 2 Battery Energy Storage System (or BESS) located in Los Angeles County, California.

Outlook

For FY 2023, the company is expecting total revenues of between $825 Mn - $838 Mn and electricity segment revenues is expected between $670 Mn - $675 Mn. Its adjusted EBITDA is expected in the range of $480 Mn - $495 Mn.

Key Risks

The concentration of customers, specific projects as well as regions might expose ORA to heightened financial exposure.

Fundamental Valuation

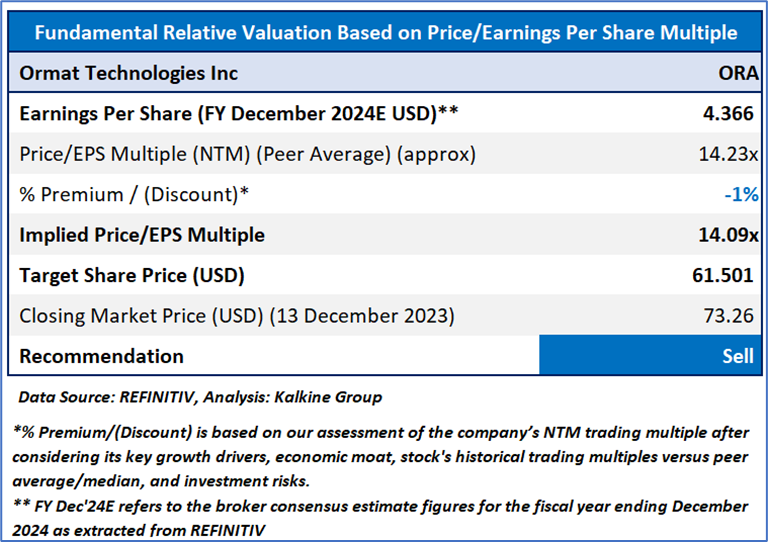

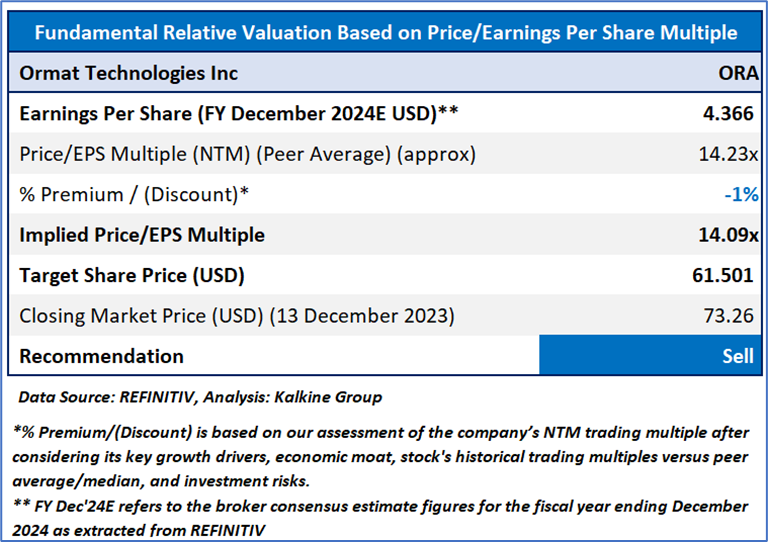

P/E Based Relative Valuation

Stock Recommendation

Considering the risks associated, the company might trade at some discount to its peers’ P/E multiple average. The company’s performance is exposed to the risks related to the global slowdown as well as geopolitical tensions. Therefore, investors should exit the stock.

Hence, a ‘Sell’ rating has been provided on the stock at the closing price of USD 73.26 per share, up by 5.58% as on 13th December 2023.

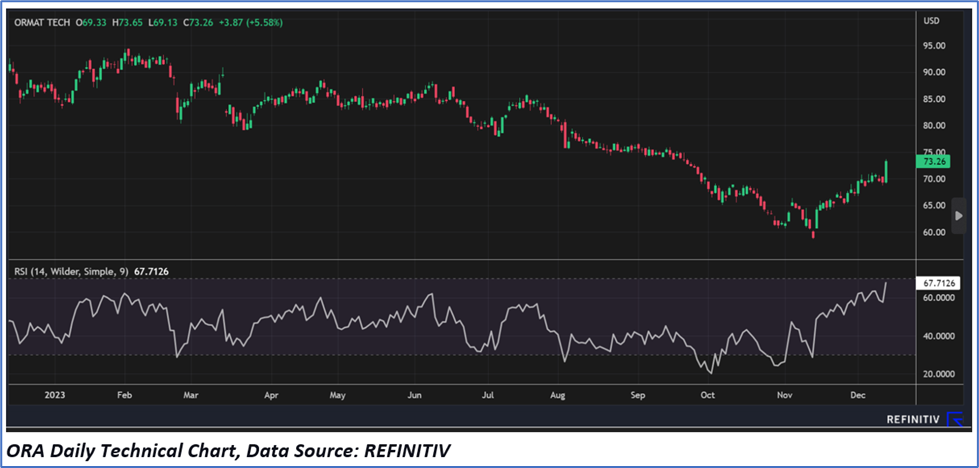

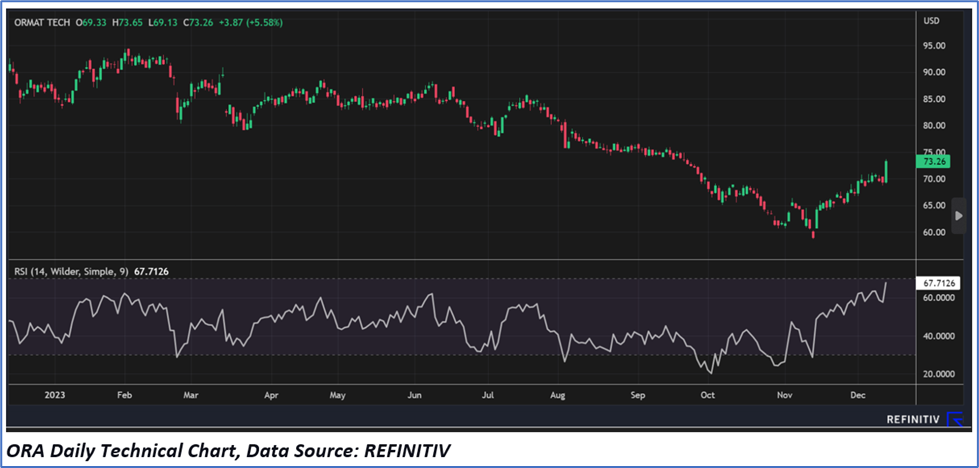

Technical Overview:

Daily Price Chart

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

AU

Please wait processing your request...

Please wait processing your request...