Kalkine has a fully transformed New Avatar.

Bloom Energy Corporation

BE Details

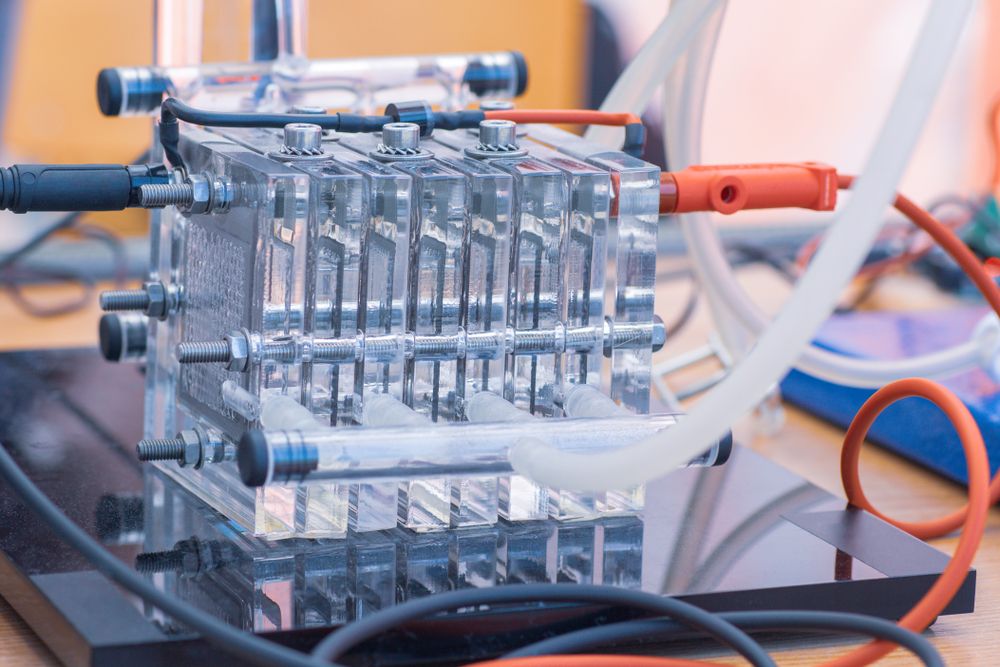

Bloom Energy Corporation (NYSE: BE) deals in the business of providing clean, reliable, and affordable energy and for this, it has developed an energy server platform. It’s Bloom Energy Server provides extremely reliable and resilient power to its customers across industries.

Q1FY21 Results Performance (For the Period Ended 31 March 2021)

The company has reported a 23.8% YoY rise in revenue to $194.0 million as against $156.7 million in Q1FY20 whereby product revenue grew significantly by 38.5% YoY supported by a 40.2% rise in acceptances to 359, or 35.9 MW.

The company witnessed a significant improvement in its gross margin to 28.2% in Q1FY21 from 12.7% in Q1FY20, mainly assisted by an uptick in product gross margin to 36.7% from 27.2% in the same period last year. The company’s operating margin for the quarter improved by 22.2 percentage points to -7.4% from -29.6% in the same period last year.

The company reported an improvement in net loss to $24.9 million as against a net loss of $75.9 million in the same period last year underpinned by an improvement in operating margin.

Preliminary Summary GAAP Profit and Loss Statements (Source: Company Reports)

Agreement with Idaho National Laboratory: The company, on 18 May 2021, declared that it has entered into an agreement with Idaho National Laboratory to produce clean hydrogen through the usage of its solid oxide, high-temperature electrolyzer that is powered by nuclear generation.

Joined Hands with Baker Huges: To fast-track the energy transition, the company, on 5 May 2021, announced that it has joined hands with Baker Hughes, an energy technology company, on the budding commercialization and deployment of integrated, low carbon power generation as well as hydrogen solutions.

Both the companies will focus on three broad areas of integrated power solutions, integrated hydrogen solutions and mutual technical collaborations.

Outlook

The company has reaffirmed its 2021 guidance wherein it expects to achieve revenue in the range of $950 million - $1 billion. It also expects to achieve a non-GAAP gross margin of ~25% in FY21 and a non-GAAP operating margin of around 3% in FY21, without taking into consideration the stock-based compensation. It also expects cash flow to approach positive by 2021.

Key Risks

The company’s operations are exposed to global economic conditions and uncertainties in the geopolitical environment where it operates. Notably, other risks include tremendous upfront costs incurred for its energy servers, manufacturing defects risk, lengthy sales and installation cycle of its products, etc.

Valuation Methodology: EV/Sales Based Relative Valuation (Illustrative)

Technical Overview:

Weekly Chart –

Source: REFINITIV

Note: Purple colour lines are Bollinger Bands® with the upper band suggesting overbought status while the lower band oversold status, and yellow lines are Fibonacci retracement lines which measure price rebound and backtrack. https://www.bollingerbands.com/

The stock fell from its high of $44.67 and took support around 61.8% retracement level of $18.95, and again bounced back to the 38.2% retracement level of $28.77. For the ongoing week, the stock has given a close below 50% retracement level of $23.86. The technical indicator RSI with a reading around 46 and a curve at the end pointing down, suggests softening of bullish momentum.

Going forward, the stock may have resistance around the 38.2% retracement level of $28.77 whereas support could be around the lower Bollinger band of $21.18.

Stock Recommendation

The stock rose by ~12.5% in 9 months. It has made a 52-week low and high of $11.29 and $44.95, respectively.

We have valued the stock using an EV/Sales multiple-based illustrative relative valuation and have arrived at a target price that reflects a rise of low double-digit (in % terms). We have assigned a slight premium to EV/Sales Multiple (NTM) (Peer Average) considering its accelerating revenue as well as margins and record acceptances in Q1FY21.

Considering the aforementioned factors along with its healthy liquidity position, investment in clean energy solutions, and decent outlook, we give a “Speculative Buy” recommendation on the stock at the current market price of $23.21 per share, down by 1.32% on 8th July 2021.

Note 1: The reference data in this report has been partly sourced from REFINITIV.

Note 2: Investment decisions should be made depending on the investors’ appetite on upside potential, risks, holding duration, and any previous holdings. Investors can consider exiting from the stock if the Target Price mentioned as per the analysis has been achieved and subject to the factors discussed above alongside support levels provided.

Technical Indicators Defined:-

Support: A level where-in the stock prices tend to find support if they are falling, and downtrend may take a pause backed by demand or buying interest.

Resistance: A level where-in the stock prices tend to find resistance when they are rising, and uptrend may take a pause due to profit booking or selling interest.

Disclaimer - This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services.

Please also read our Terms & Conditions and Financial Services Guide for further information.

On the date of publishing this report (referred to on the Kalkine website), employees and/or associates of Kalkine do not hold interests in any of the securities or other financial products covered on the Kalkine website.