This report is an updated version of the report published on 17 January 2025 at 3:55 PM AEDT.

Strike Energy Limited (ASX: STX)

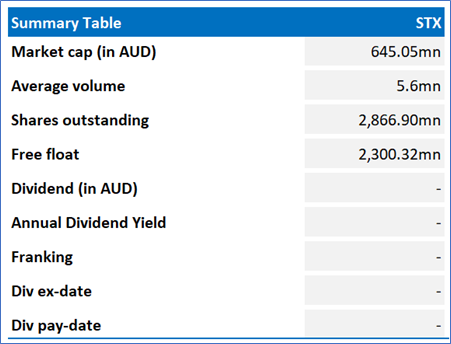

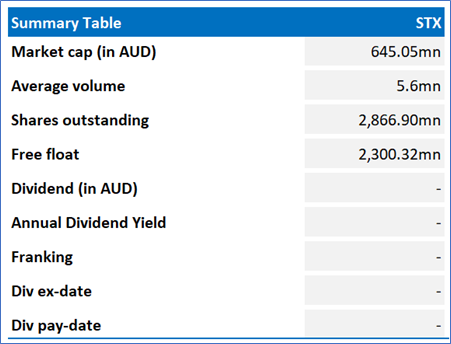

STX is an Australia-based energy and fertilizer company engaged in the exploration and development of oil and gas resources in Australia. Its segments include Producing Assets and Other. Its projects include Perth Basin, Greater Erregulla Gas, West Erregulla, Project Haber, Perth Basin Geothermal, and Walyering.

Recommendation Rationale – SELL at AUD 0.225

- Financial Highlights: Sales revenue (gross) decreased by 8.0% QoQ, from AUD 19.85mn in 4QFY24 to AUD 18.28mn in 1QFY25. Condensate (gross) production fell by 1.0% QoQ, from 17.00 kbbl in 4QFY24 to 16.78 kbbl in 1QFY25. Total liquidity also declined by 28.0% QoQ, dropping to AUD 61.52mn as of 30 September 2024, compared to AUD 85.50mn as of 30 June 2024.

- Trading Near the Resistance: STX’s stock has surpassed its R1 level recommended on 13 December 2024. Therefore, share price can face resistance at the current levels.

- Overvalued Multiples: On a forward 12-month basis – key trading multiples (EV/Sales, EV/EBITDA, Price/Earnings) are higher than the median of Energy sector.

- Market Risk: The energy sector is heavily regulated, and STX must comply with various environmental laws and regulations. Non-compliance can result in fines, legal actions, and reputational damage. The company’s profitability is highly sensitive to fluctuations in oil and gas prices. Market dynamics, geopolitical events, and changes in supply and demand can lead to price volatility.

STX’ Daily Price Chart

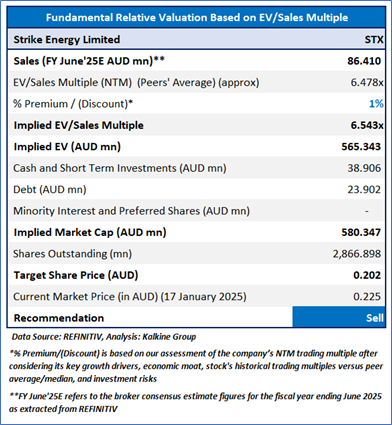

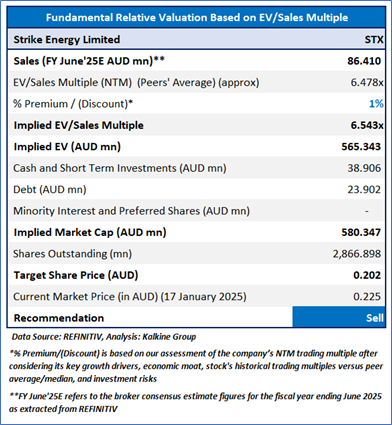

Valuation Methodology: EV/Sales Approach (FY June'25E) (Illustrative)

The stock is expected to trade at premium based on 1QFY25 production growth, high quality gas discovery, and low-cost gas production at Walyering. For conducting the valuation, the following peers have been considered: Santos Ltd (ASX: STO), Amplitude Energy Ltd (ASX: AEL), Woodside Energy Group Ltd (ASX: WDS), and other have been considered.

Considering that the stock has surpassed its R1 level, rally in share price movement, current trading level, and risks associated, the share price can face consolidation at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 0.225 (as of 17 January 2025, at 3:15 PM AEDT).

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 17 January 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Kalkine reports are prepared based on the stock prices captured either from REFINITIV or Trading View. Typically, REFINITIV or Trading View may reflect stock prices with a delay which could be a lag of 25-30 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and downtrend may take a pause backed by demand or buying interest.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and uptrend may take a pause due to profit booking or selling interest.

Stop-loss: In general, it is a level to protect further losses in case of any unfavourable movement in the stock prices.

AU

Please wait processing your request...

Please wait processing your request...