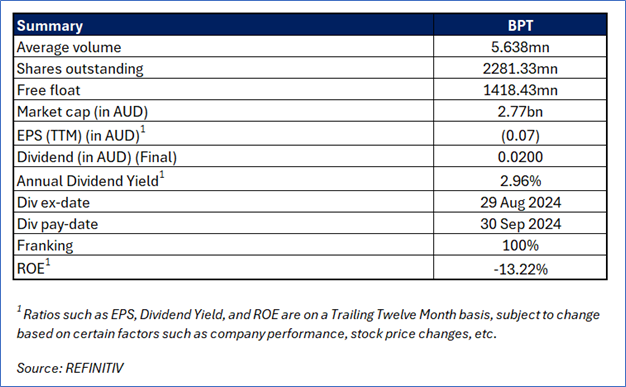

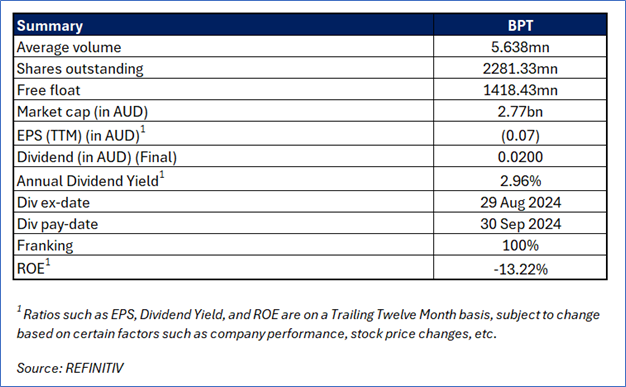

Beach Energy Limited (ASX: BPT)

Company Overview: Beach Energy Limited is an Australian-based oil and gas exploration and production

company with a diverse portfolio of assets across Australia and New Zealand. Beach Energy's core business involves both operated and non-operated assets, producing natural gas, LPG, condensate, and crude oil.

Recommendation Rationale - SELL at AUD 1.35

- Earnings Decline: During FY24, underlying EBITDA and NPAT declined by 3% and 11% YoY, respectively, due to 7% YoY decline in production.

- Oil Price Decline: During Q1 FY25, realised oil prices decreased by 11% QoQ. Subsequently, BPT reduced capital expenditure by 21% QoQ.

- Lower Gross Margin: BPT reported 28% of Gross Margin in FY24, while industry median is 44.1%.

- Cost Pressure: The significant increase in the cost of sales by 23% YoY in FY24, driven by higher third-party purchases, tariffs, and unavoidable processing costs, could pressure profit margins. If costs continue to rise without corresponding increases in revenue, it may impact overall profitability.

BPT’s Daily Chart

(Source: REFINITIV; Analysis by Kalkine Group)

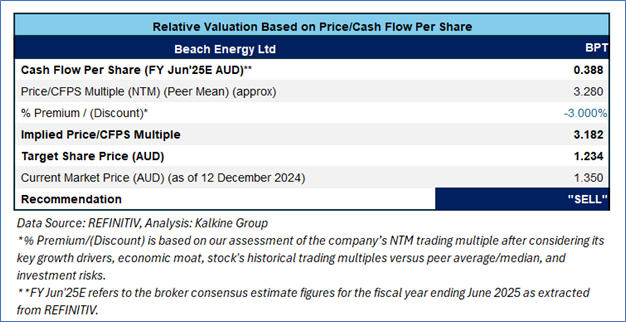

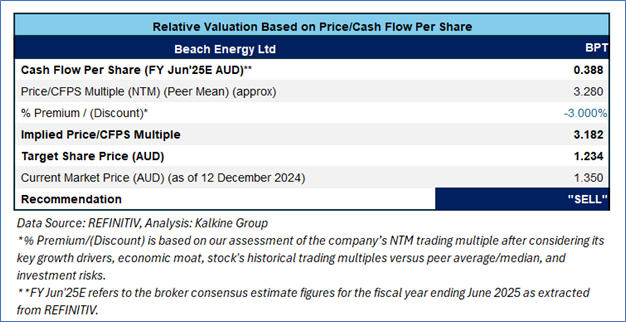

Valuation Methodology: Price/Cash Flow Approach (FY Jun'25E) (Illustrative)

BPT is expected to trade at a discount compared to its peers considering its profit decline in FY24, and lower profitability margins than industry median. For conducting the valuation, the following peers have been considered: Amplitude Energy Ltd (ASX: AEL), Strike Energy Ltd (ASX: STX), and Whitehaven Coal Ltd (ASX: WHC).

Considering the volatile market condition, risks associated, and the share price can face consolidation at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current market price of AUD 1.350, as of 12 December 2024 at 1:20 PM AEDT.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is 12 December 2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Dividend Yield may vary as per the stock price movement.

Note 5: Kalkine reports are prepared based on the stock prices captured either from REFINITIV or Trading View. Typically, REFINITIV or Trading View may reflect stock prices with a delay which could be a lag of 25-30 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

Technical Indicators Defined: -

Support: A level at which the stock prices tend to find support if they are falling, and a downtrend may take a pause backed by demand or buying interest. Support 1 refers to the nearby support level for the stock and if the price breaches the level, then Support 2 may act as the crucial support level for the stock.

Resistance: A level at which the stock prices tend to find resistance when they are rising, and an uptrend may take a pause due to profit booking or selling interest. Resistance 1 refers to the nearby resistance level for the stock and if the price surpasses the level, then Resistance 2 may act as the crucial resistance level for the stock.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

AU

Please wait processing your request...

Please wait processing your request...