Clearway Energy Inc

CWEN Details

Clearway Energy Inc (NYSE: CWEN) is an electric utility company which owns, operates, and acquires contracted renewable as well as conventional energy generation and thermal infrastructure assets across the U.S.

Financial Results for Q3 FY 2023

- For Q3 FY 2023, CWEN reported net income of $15 Mn, adjusted EBITDA of $323 Mn, cash from operating activities of $287 Mn as well as CAFD of $156 Mn. Net income decreased versus 2022 primarily because of non-cash tax expenses from allocations of taxable earnings as well as losses from HLBV method accounting.

- Total liquidity as of September 30, 2023 stood at $1,645 Mn, which was $279 Mn higher than as of December 31, 2022. As of September 30, 2023, the company's liquidity included $590 Mn of restricted cash.

- In the third quarter of 2023, availability at the Conventional segment was higher than the Q3 FY 2022 primarily because of forced outages in 2022.

Outlook

The Company has reiterated its 2023 full year CAFD guidance range of $330 Mn - $360 Mn.

Key Risks

CWEN's business is subject to restrictions because of the environmental, health and safety laws as well as regulations.

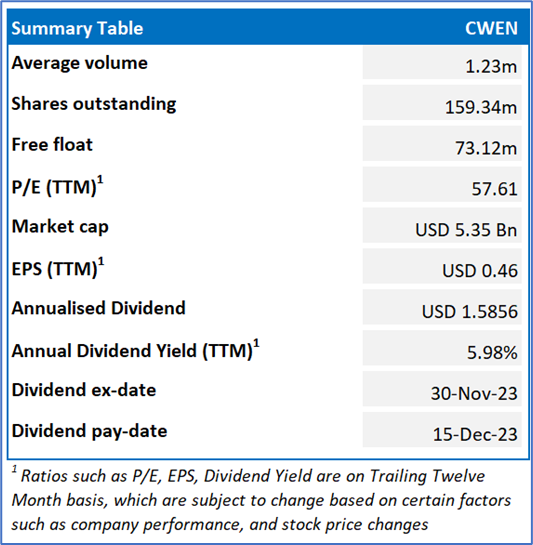

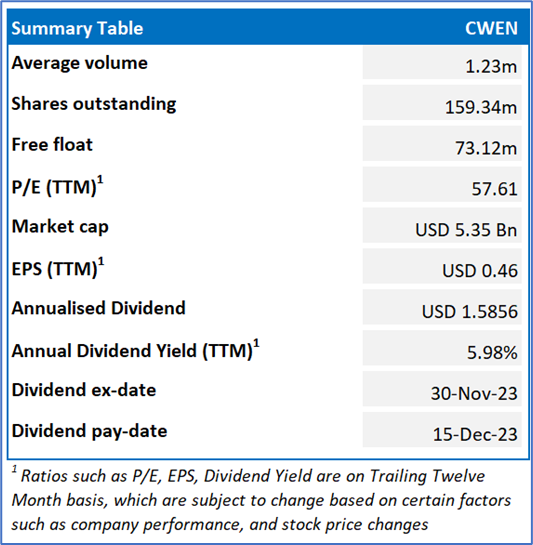

Fundamental Valuation

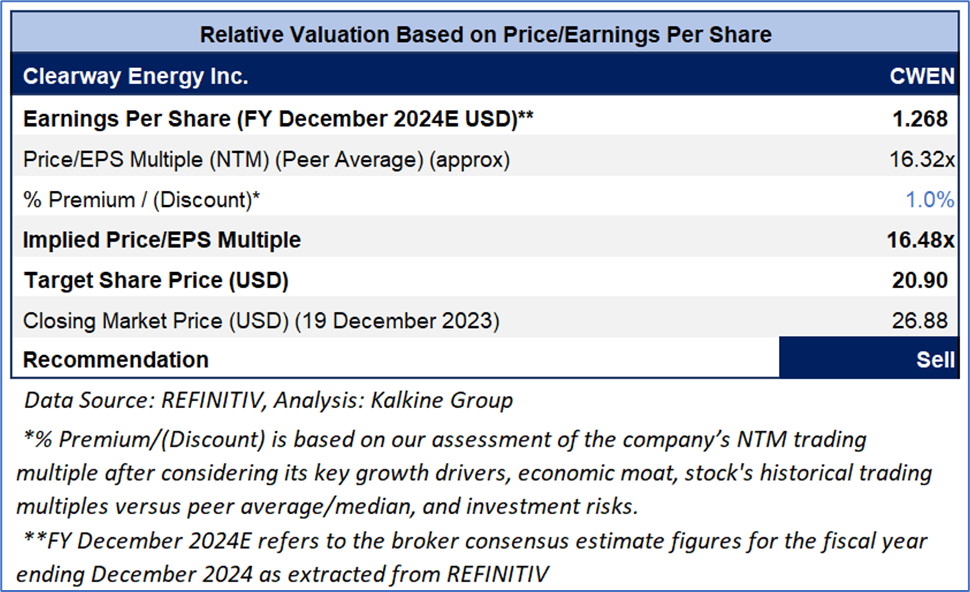

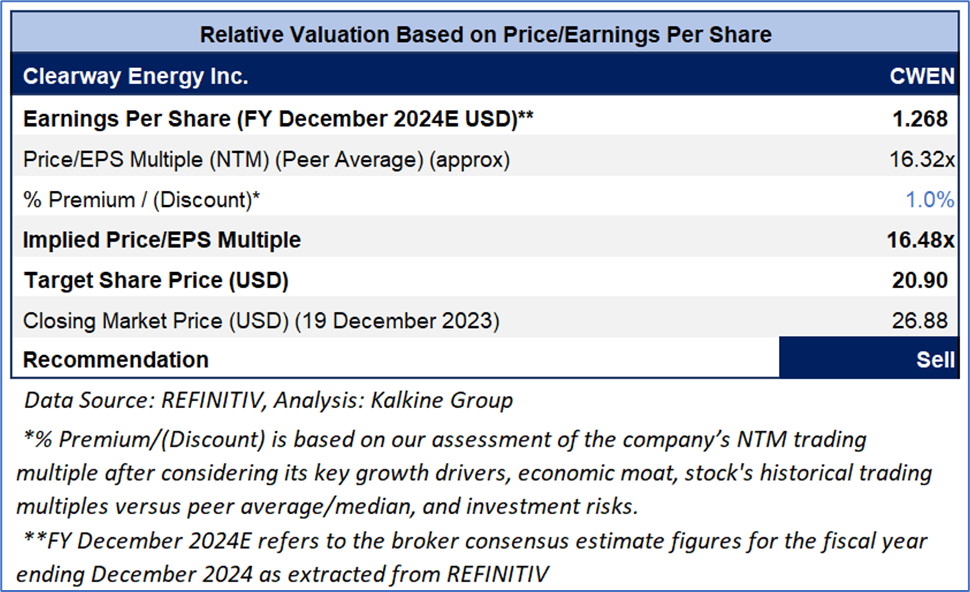

P/E Based Relative Valuation

Stock Recommendation

The stock has made a 52-week low and high of USD 18.59 and USD 35.14, respectively. The company’s performance is exposed to the risks related to the global slowdown as well as geopolitical tensions. Therefore, investors should exit the stock.

Hence, a ‘Sell’ rating has been provided on the stock at the closing price of USD 26.88 per share, up by 3.07% as on 19th December 2023.

Technical Overview:

Daily Price Chart

Markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

AU

Please wait processing your request...

Please wait processing your request...