This report is an updated version of the report published on 6 December 2023 at 3:31 PM AEDT.

Block Inc. (ASX: SQ2)

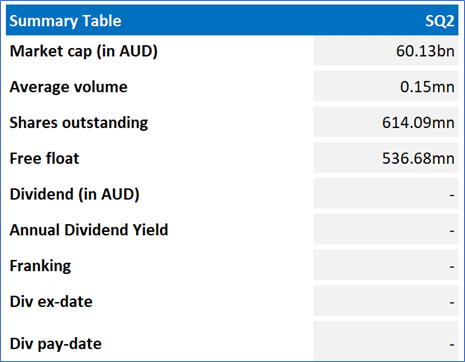

US-based financial services and digital payments company with offices across the globe. Founded in 2009, the ASX-listed company has two reportable segments, Square and Cash.

Recommendation Rationale – SELL at AUD 99.92

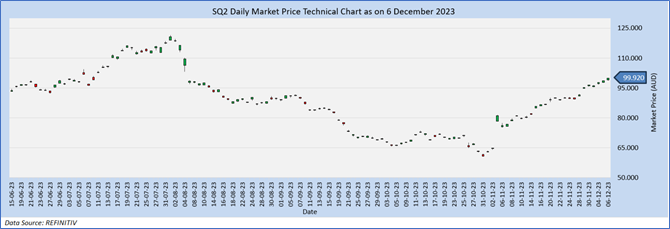

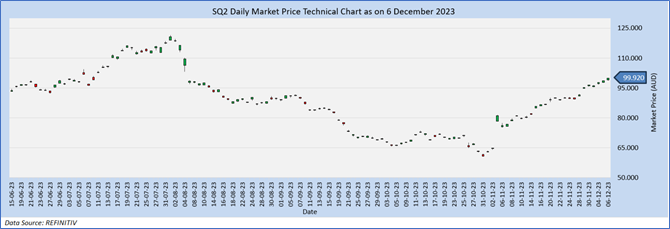

- Profit Booking: SQ2 has surpassed the R2 level recommended on 10 November 2023; and thus, it is giving a profit booking opportunity.

- Financial Performance: In Q3FY23, the company’s revenue stood at USD 5,617.5mn, up from USD 4,515.5mn reported in Q3FY22. Top-line was driven by increase in subscription and service-based revenue and bitcoin revenue. Meanwhile, adjusted EBITDA increased YoY and stood at USD 477mn during the quarter, owing to higher gross profit across CashApp and square ecosystem.

- Outlook: The company projects adjusted EBITDA for FY24 to reach up to USD 2,400mn. Additionally, adjusted operating income is expected to be roughly USD 875mn in FY24.

- Emerging Risks: The macroeconomic headwinds, unfavorable opinions about the bitcoin market, intense competition, and regulatory barriers could impact the company’s financials.

SQ2 Daily Chart

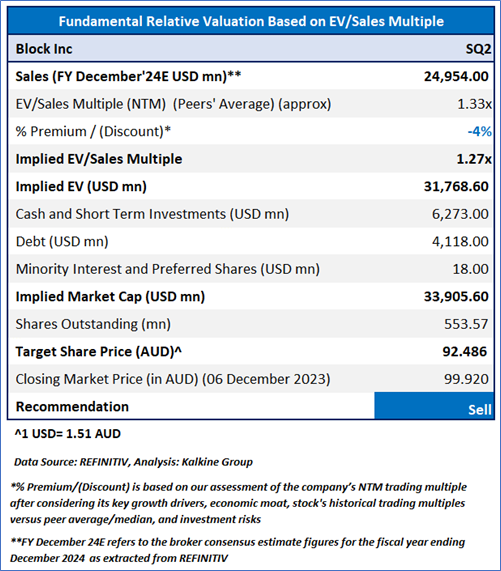

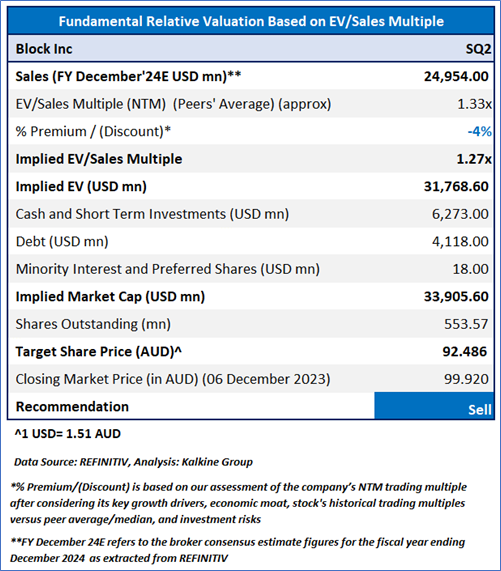

Valuation Methodology: EV/Sales Approach (FY24E) (Illustrative)

Considering the net loss in 3QFY23, stiff competition and regulatory barriers, etc. the company might trade at some discount to its peers. For valuation, few peers like Splitit Ltd (ASX: SPT), Sezzle Inc (ASX: SZL), and Tyro Payments Ltd (ASX: TYR) have been considered. Considering that the company has breached its R2 level, current trading levels and risks associated, downside indicated by the valuation, it is prudent to book profit at the current levels. Hence, a ‘Sell’ recommendation is given on the stock at the current price of AUD 99.92, as of 6 December 2023, at 10:15 AM AEDT.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and geopolitical issues prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is neither an indicator nor a guarantee of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance levels is December 6, 2023. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

AU

Please wait processing your request...

Please wait processing your request...